- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:4013

Those who invested in Dr. Sulaiman Al Habib Medical Services Group (TADAWUL:4013) a year ago are up 22%

We believe investing is smart because history shows that stock markets go higher in the long term. But if when you choose to buy stocks, some of them will be below average performers. Over the last year the Dr. Sulaiman Al Habib Medical Services Group Company (TADAWUL:4013) share price is up 20%, but that's less than the broader market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Dr. Sulaiman Al Habib Medical Services Group

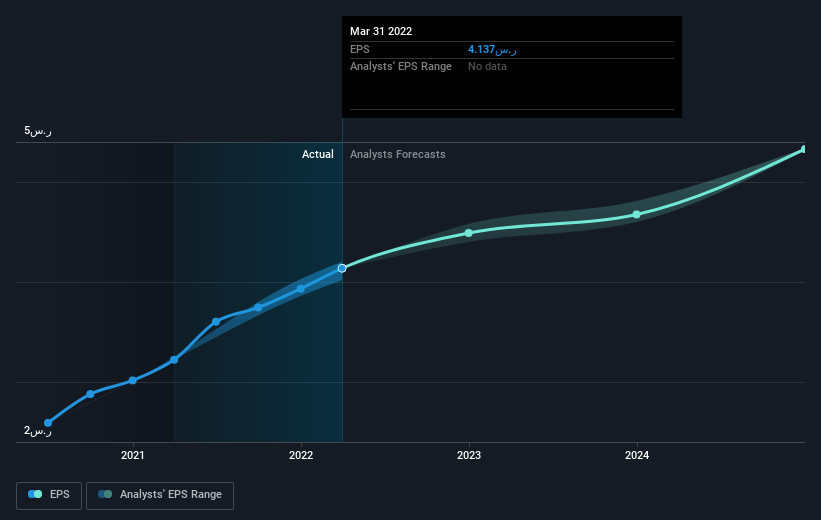

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Dr. Sulaiman Al Habib Medical Services Group was able to grow EPS by 28% in the last twelve months. It's fair to say that the share price gain of 20% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Dr. Sulaiman Al Habib Medical Services Group as it was before. This could be an opportunity.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Dr. Sulaiman Al Habib Medical Services Group's earnings, revenue and cash flow.

A Different Perspective

Dr. Sulaiman Al Habib Medical Services Group shareholders have gained 22% for the year (even including dividends). Unfortunately this falls short of the market return of around 24%. Before forming an opinion on Dr. Sulaiman Al Habib Medical Services Group you might want to consider these 3 valuation metrics.

We will like Dr. Sulaiman Al Habib Medical Services Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4013

Dr. Sulaiman Al Habib Medical Services Group

Provides private health and ancillary services.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives