- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:4013

Here's Why We Think Dr. Sulaiman Al Habib Medical Services Group (TADAWUL:4013) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Dr. Sulaiman Al Habib Medical Services Group (TADAWUL:4013). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Dr. Sulaiman Al Habib Medical Services Group with the means to add long-term value to shareholders.

Check out our latest analysis for Dr. Sulaiman Al Habib Medical Services Group

How Fast Is Dr. Sulaiman Al Habib Medical Services Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Dr. Sulaiman Al Habib Medical Services Group has managed to grow EPS by 24% per year over three years. This has no doubt fuelled the optimism that sees the stock trading on a high multiple of earnings.

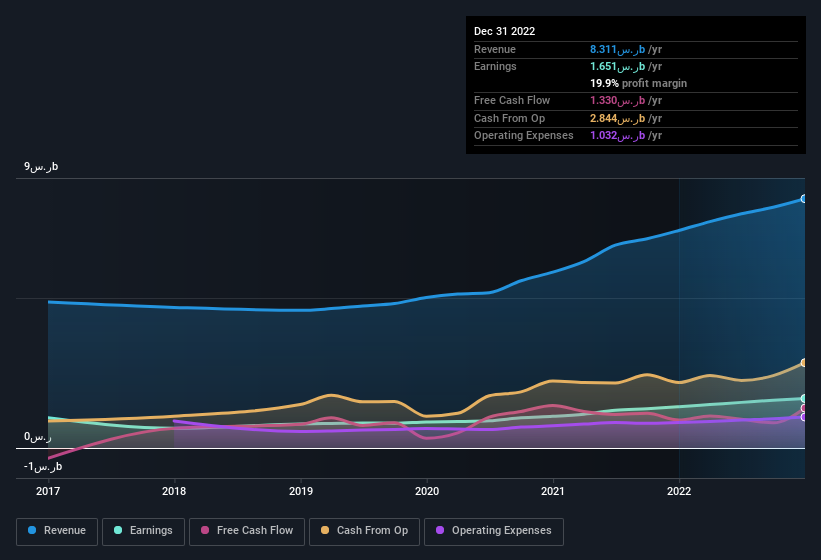

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Dr. Sulaiman Al Habib Medical Services Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to ر.س8.3b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Dr. Sulaiman Al Habib Medical Services Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Dr. Sulaiman Al Habib Medical Services Group Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Dr. Sulaiman Al Habib Medical Services Group insiders own a meaningful share of the business. Actually, with 42% of the company to their names, insiders are profoundly invested in the business. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. At the current share price, that insider holding is worth a staggering ر.س37b. This is an incredible endorsement from them.

Does Dr. Sulaiman Al Habib Medical Services Group Deserve A Spot On Your Watchlist?

For growth investors, Dr. Sulaiman Al Habib Medical Services Group's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. One of Buffett's considerations when discussing businesses is if they are capital light or capital intensive. Generally, a company with a high return on equity is capital light, and can thus fund growth more easily. So you might want to check this graph comparing Dr. Sulaiman Al Habib Medical Services Group's ROE with industry peers (and the market at large).

Although Dr. Sulaiman Al Habib Medical Services Group certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4013

Dr. Sulaiman Al Habib Medical Services Group

Provides private health and ancillary services.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives