- Saudi Arabia

- /

- Food

- /

- SASE:9536

Arabian Food and Dairy Factories Company's (TADAWUL:9536) Share Price Is Matching Sentiment Around Its Earnings

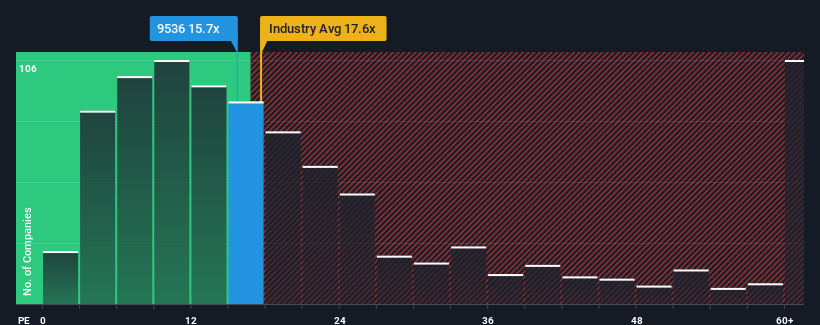

Arabian Food and Dairy Factories Company's (TADAWUL:9536) price-to-earnings (or "P/E") ratio of 15.7x might make it look like a buy right now compared to the market in Saudi Arabia, where around half of the companies have P/E ratios above 26x and even P/E's above 44x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Earnings have risen firmly for Arabian Food and Dairy Factories recently, which is pleasing to see. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Arabian Food and Dairy Factories

How Is Arabian Food and Dairy Factories' Growth Trending?

Arabian Food and Dairy Factories' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. Still, lamentably EPS has fallen 15% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's an unpleasant look.

With this information, we are not surprised that Arabian Food and Dairy Factories is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Arabian Food and Dairy Factories' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Arabian Food and Dairy Factories maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Arabian Food and Dairy Factories (1 is significant!) that you should be aware of before investing here.

If you're unsure about the strength of Arabian Food and Dairy Factories' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9536

Arabian Food and Dairy Factories

Produces, trades, and sells a range of ice cream products in the Kingdom of Saudi Arabia.

Excellent balance sheet slight.

Market Insights

Community Narratives