- Saudi Arabia

- /

- Food

- /

- SASE:2050

Benign Growth For Savola Group Company (TADAWUL:2050) Underpins Stock's 45% Plummet

Savola Group Company (TADAWUL:2050) shareholders that were waiting for something to happen have been dealt a blow with a 45% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

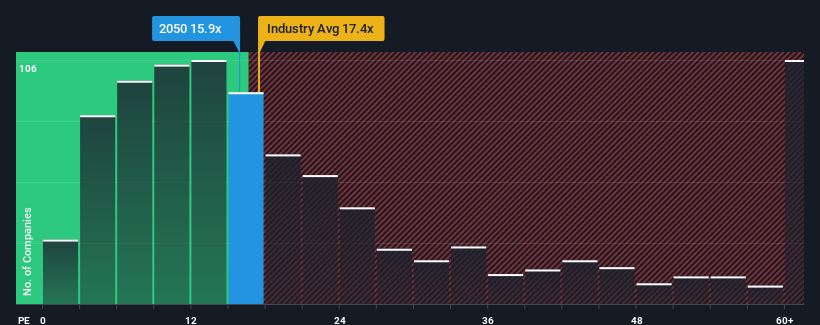

Following the heavy fall in price, Savola Group may be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.9x, since almost half of all companies in Saudi Arabia have P/E ratios greater than 27x and even P/E's higher than 44x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Savola Group's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Savola Group

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Savola Group's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 10% gain to the company's bottom line. The latest three year period has also seen a 26% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Looking ahead now, EPS is anticipated to climb by 8.8% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 16% per year growth forecast for the broader market.

In light of this, it's understandable that Savola Group's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The softening of Savola Group's shares means its P/E is now sitting at a pretty low level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Savola Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Savola Group (2 don't sit too well with us!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Savola Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2050

Solid track record with adequate balance sheet.

Market Insights

Community Narratives