- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4200

Aldrees Petroleum and Transport Services (TADAWUL:4200) jumps 10% this week, though earnings growth is still tracking behind five-year shareholder returns

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. Just think about the savvy investors who held Aldrees Petroleum and Transport Services Company (TADAWUL:4200) shares for the last five years, while they gained 511%. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 32% over the last quarter. It really delights us to see such great share price performance for investors.

Since it's been a strong week for Aldrees Petroleum and Transport Services shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Aldrees Petroleum and Transport Services

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

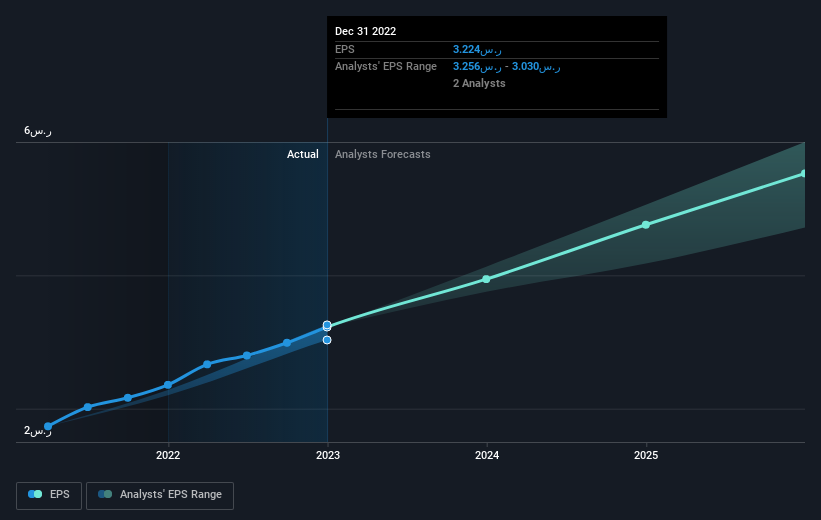

During five years of share price growth, Aldrees Petroleum and Transport Services achieved compound earnings per share (EPS) growth of 30% per year. This EPS growth is lower than the 44% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Aldrees Petroleum and Transport Services has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Aldrees Petroleum and Transport Services will grow revenue in the future.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Aldrees Petroleum and Transport Services the TSR over the last 5 years was 581%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Aldrees Petroleum and Transport Services shareholders have received a total shareholder return of 56% over the last year. And that does include the dividend. That's better than the annualised return of 47% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Is Aldrees Petroleum and Transport Services cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4200

Aldrees Petroleum and Transport Services

Engages in the wholesale and retail of fuel, gasoline, oil, and lubricants in the Kingdom of Saudi Arabia.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives