- Saudi Arabia

- /

- Oil and Gas

- /

- SASE:2380

Investors Holding Back On Rabigh Refining and Petrochemical Company (TADAWUL:2380)

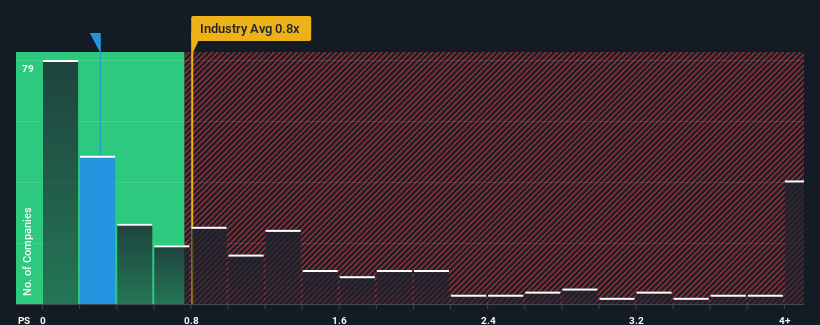

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Rabigh Refining and Petrochemical Company (TADAWUL:2380) is a stock worth checking out, seeing as almost half of all the Oil and Gas companies in Saudi Arabia have P/S ratios greater than 2.1x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Rabigh Refining and Petrochemical

What Does Rabigh Refining and Petrochemical's Recent Performance Look Like?

Rabigh Refining and Petrochemical has been struggling lately as its revenue has declined faster than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think Rabigh Refining and Petrochemical's future stacks up against the industry? In that case, our free report is a great place to start.How Is Rabigh Refining and Petrochemical's Revenue Growth Trending?

Rabigh Refining and Petrochemical's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's top line. Still, the latest three year period has seen an excellent 108% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth will be highly resilient over the next year growing by 7.3%. Meanwhile, the broader industry is forecast to contract by 2.1%, which would indicate the company is doing very well.

With this in mind, we find it intriguing that Rabigh Refining and Petrochemical's P/S falls short of its industry peers. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Rabigh Refining and Petrochemical's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Rabigh Refining and Petrochemical, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Rabigh Refining and Petrochemical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2380

Rabigh Refining and Petrochemical

Engages in the development, construction, and operation of an integrated refining and petrochemical complex in the Middle East, the Asia Pacific, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives