- Saudi Arabia

- /

- Oil and Gas

- /

- SASE:2380

Investors Don't See Light At End Of Rabigh Refining and Petrochemical Company's (TADAWUL:2380) Tunnel

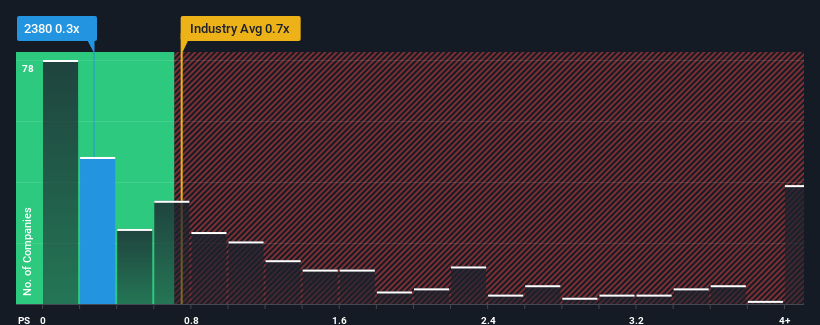

When you see that almost half of the companies in the Oil and Gas industry in Saudi Arabia have price-to-sales ratios (or "P/S") above 2.3x, Rabigh Refining and Petrochemical Company (TADAWUL:2380) looks to be giving off very strong buy signals with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Rabigh Refining and Petrochemical

What Does Rabigh Refining and Petrochemical's Recent Performance Look Like?

Recent times haven't been great for Rabigh Refining and Petrochemical as its revenue has been falling quicker than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rabigh Refining and Petrochemical.How Is Rabigh Refining and Petrochemical's Revenue Growth Trending?

In order to justify its P/S ratio, Rabigh Refining and Petrochemical would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. Still, the latest three year period has seen an excellent 49% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 0.4% over the next year. With the industry predicted to deliver 0.007% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Rabigh Refining and Petrochemical's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Rabigh Refining and Petrochemical's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Rabigh Refining and Petrochemical that you need to be mindful of.

If these risks are making you reconsider your opinion on Rabigh Refining and Petrochemical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2380

Rabigh Refining and Petrochemical

Engages in the development, construction, and operation of an integrated refining and petrochemical complex in the Middle East, the Asia Pacific, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives