- Saudi Arabia

- /

- Capital Markets

- /

- SASE:4084

Undiscovered Gems in the Middle East to Explore This December 2025

Reviewed by Simply Wall St

As Gulf markets remain muted with investors cautiously awaiting key U.S. economic data, the Middle East's stock landscape presents a unique opportunity for those looking to explore under-the-radar investments. In this environment, identifying stocks that demonstrate resilience and potential growth amid global economic shifts can be particularly rewarding for investors seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.26% | 17.17% | 23.30% | ★★★★★★ |

| Najran Cement | 14.49% | -4.20% | -30.16% | ★★★★★★ |

| Etihad GO Telecom | 0.85% | 38.36% | 57.78% | ★★★★★☆ |

| Amir Marketing and Investments in Agriculture | 32.43% | 3.87% | 6.98% | ★★★★☆☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Sumer Varlik Yonetim (IBSE:SMRVA)

Simply Wall St Value Rating: ★★★★☆☆

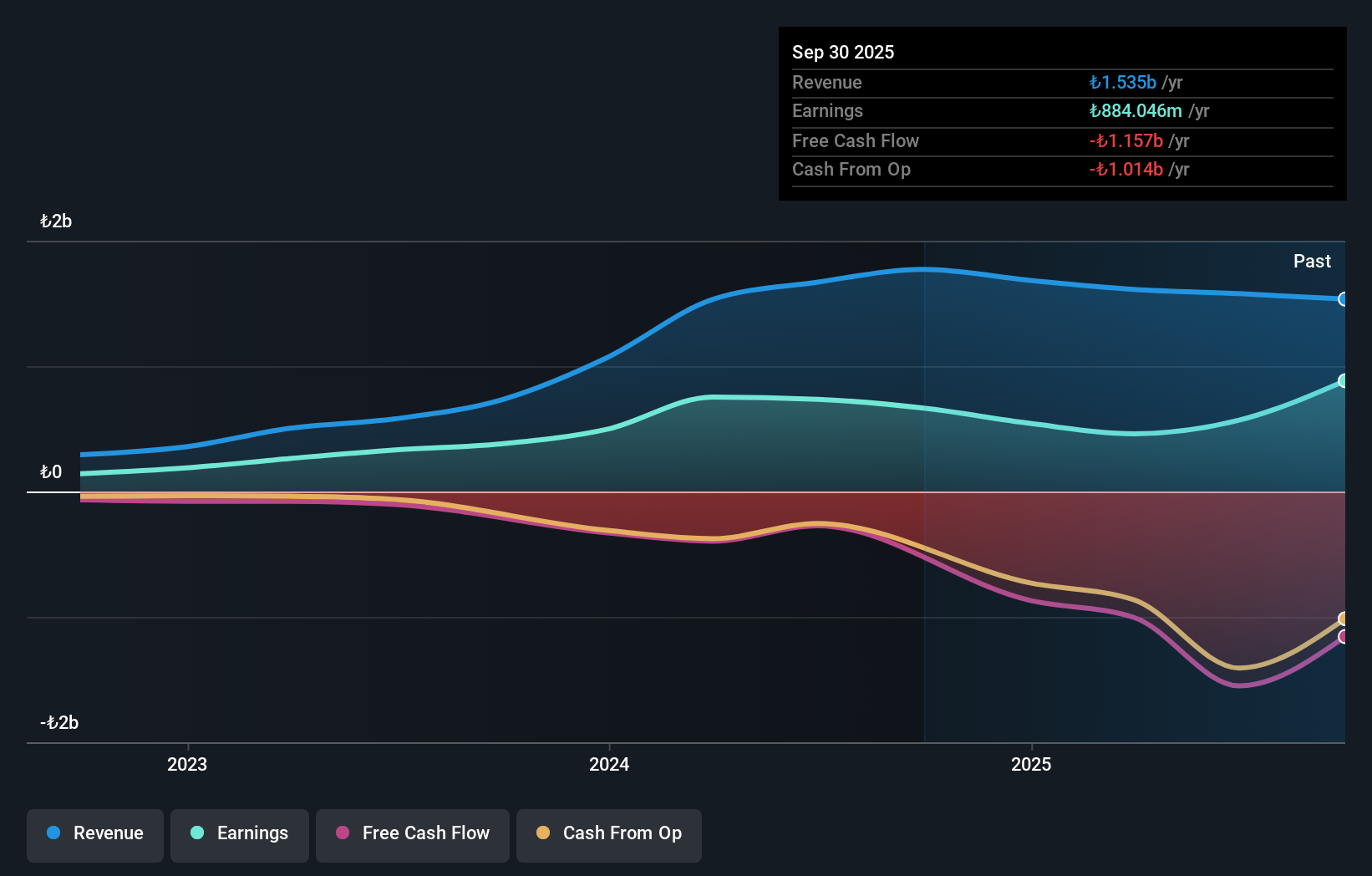

Overview: Sumer Varlik Yonetim A.S. operates as an asset management company with a market capitalization of TRY30.71 billion.

Operations: Sumer Varlik Yonetim generates revenue primarily from its services, amounting to TRY1.53 billion.

Sumer Varlik Yonetim, a small-cap player in the financial sector, has shown impressive earnings growth of 33.1% over the past year, outpacing the industry's -5.2%. Despite a highly volatile share price recently, its net debt to equity ratio stands at a satisfactory 9.1%, indicating solid financial management as it reduced from 185.3% to 83.8% over five years. However, free cash flow remains negative and interest payments are not well covered by EBIT (1x coverage). Recent earnings reveal net income of TRY 369.58 million for Q3 2025 compared to TRY 77.32 million in Q3 last year, reflecting robust profitability despite revenue fluctuations.

Fourth Milling (SASE:2286)

Simply Wall St Value Rating: ★★★★★☆

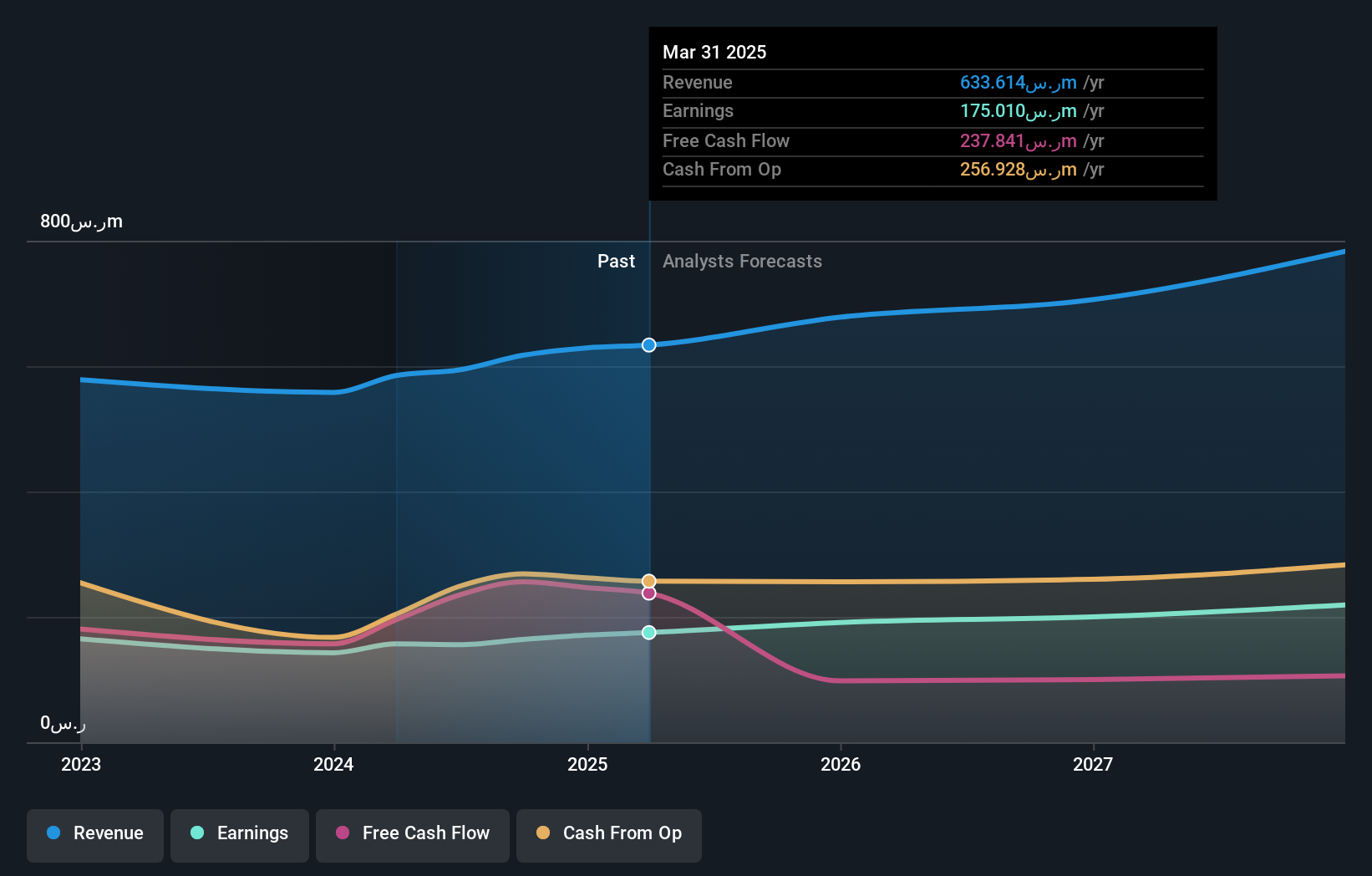

Overview: Fourth Milling Company operates in the Kingdom of Saudi Arabia, producing flour, feed, bran, and wheat derivatives with a market capitalization of SAR1.97 billion.

Operations: The company's primary revenue stream is derived from its food processing segment, generating SAR646.51 million.

Fourth Milling shines as a promising player in the Middle East's food sector. Recently, it posted a net income of SAR 52 million for Q3 2025, up from SAR 47 million the previous year, reflecting solid growth. The company also reported nine-month sales of SAR 479.78 million and continues to operate debt-free, ensuring strong financial health with no interest coverage worries. Its earnings have outpaced industry averages by growing 10.4% over the past year compared to the food industry's 7.5%. With an expansion underway at Al-Kharj and trading at nearly 37% below fair value estimates, Fourth Milling seems poised for further growth.

- Dive into the specifics of Fourth Milling here with our thorough health report.

Evaluate Fourth Milling's historical performance by accessing our past performance report.

Derayah Financial (SASE:4084)

Simply Wall St Value Rating: ★★★★★★

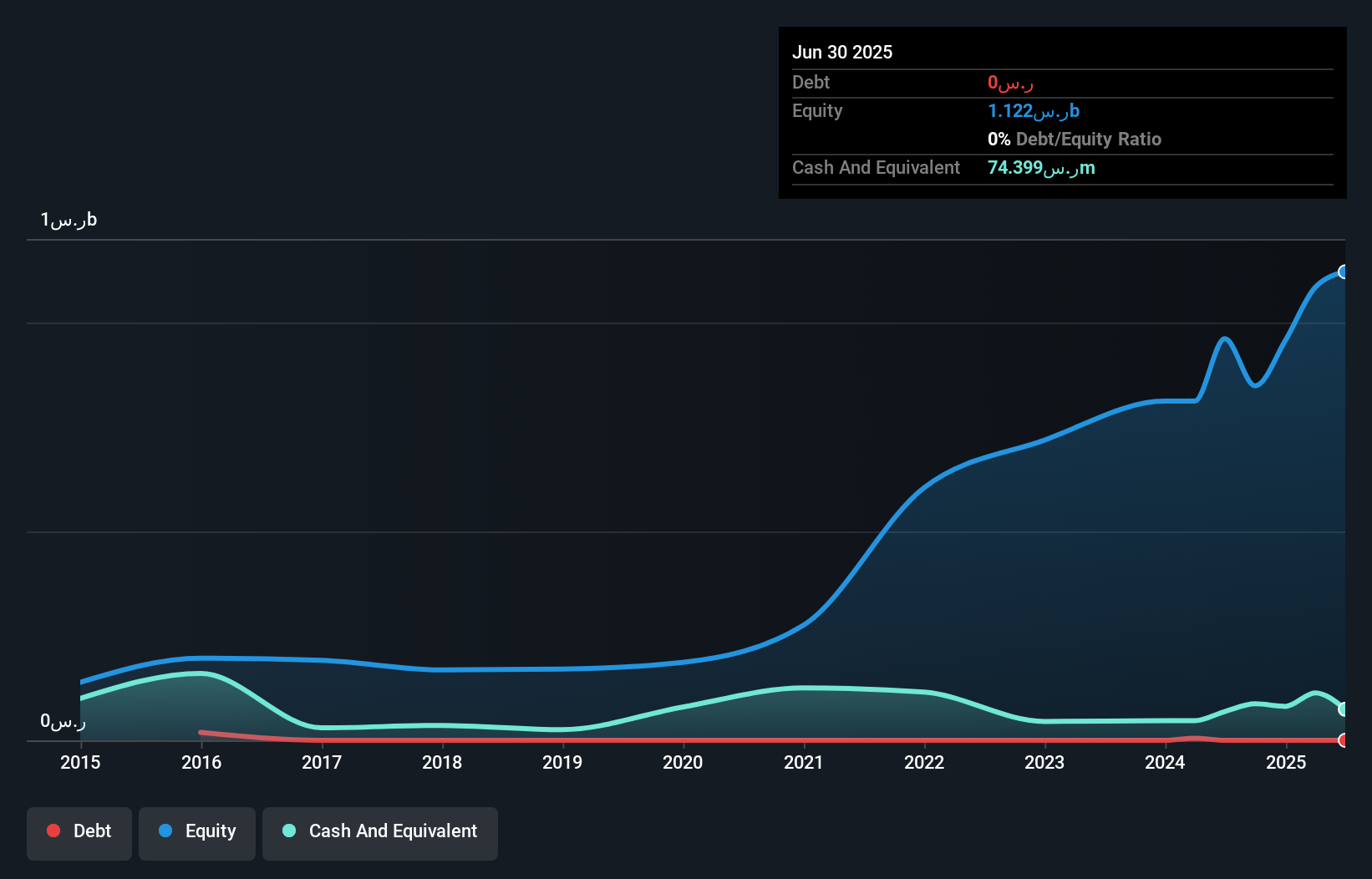

Overview: Derayah Financial Company offers financial and investment services in Saudi Arabia with a market capitalization of SAR6.89 billion.

Operations: The primary revenue streams for Derayah Financial are brokerage services, generating SAR713.92 million, and asset management, contributing SAR137.13 million. Investment activities add another SAR59.11 million to the total revenue.

Derayah Financial, a financial services entity in the Middle East, showcases a unique blend of strengths and challenges. With no debt on its books, it avoids interest coverage concerns. However, earnings growth has been negative at -6.8% over the past year, mirroring industry trends. The firm is valued attractively with a P/E ratio of 16.4x compared to the SA market's 17.9x and maintains high-quality earnings alongside positive free cash flow of SAR 360 million as of September 2024. Recent revenue figures for Q3 stood at SAR 238 million with net income slightly down to SAR 100 million from last year's SAR 108 million, reflecting mixed performance dynamics amidst consistent dividend payouts of SAR 0.33 per share quarterly.

Key Takeaways

- Navigate through the entire inventory of 186 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4084

Derayah Financial

Provides financial and investment services in Saudi Arabia.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)