- Saudi Arabia

- /

- Consumer Finance

- /

- SASE:4081

Nayifat Finance Company's (TADAWUL:4081) Shares Leap 25% Yet They're Still Not Telling The Full Story

Nayifat Finance Company (TADAWUL:4081) shareholders have had their patience rewarded with a 25% share price jump in the last month. Looking further back, the 12% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

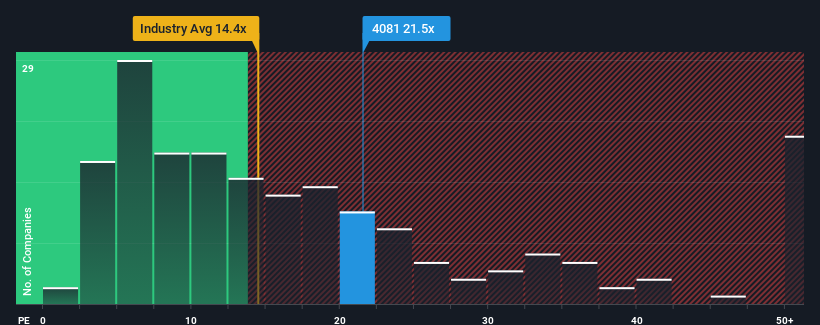

In spite of the firm bounce in price, given about half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") above 26x, you may still consider Nayifat Finance as an attractive investment with its 21.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

While the market has experienced earnings growth lately, Nayifat Finance's earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Nayifat Finance

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Nayifat Finance's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 31%. As a result, earnings from three years ago have also fallen 60% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 16% per annum over the next three years. With the market predicted to deliver 16% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it odd that Nayifat Finance is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Nayifat Finance's P/E?

Nayifat Finance's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Nayifat Finance's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Nayifat Finance that you need to be mindful of.

If these risks are making you reconsider your opinion on Nayifat Finance, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nayifat Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4081

Nayifat Finance

Provides personal financing solutions in the Kingdom of Saudi Arabia.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives