- South Korea

- /

- IT

- /

- KOSDAQ:A042000

3 Promising Growth Companies With Insider Ownership Up To 23%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices showing both gains and declines amid economic uncertainties, investors are increasingly focused on identifying resilient growth opportunities. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market capitalization of approximately €1.56 billion.

Operations: The company's revenue is derived from its operations in the Benelux region, which generated €505.17 million, and from France, Spain, and Germany, contributing €626.41 million.

Insider Ownership: 12%

Basic-Fit demonstrates strong growth potential with significant insider buying over the past three months, indicating confidence in its future prospects. Earnings are projected to grow 78.44% annually, outpacing the Dutch market's 15%. Despite a decline in profit margins to 0.7%, revenue is expected to increase by 14.7% per year, surpassing the local market's growth rate of 8.4%. However, interest payments remain poorly covered by earnings, suggesting financial caution is warranted.

- Click here to discover the nuances of Basic-Fit with our detailed analytical future growth report.

- Our valuation report unveils the possibility Basic-Fit's shares may be trading at a premium.

Cafe24 (KOSDAQ:A042000)

Simply Wall St Growth Rating: ★★★★☆☆

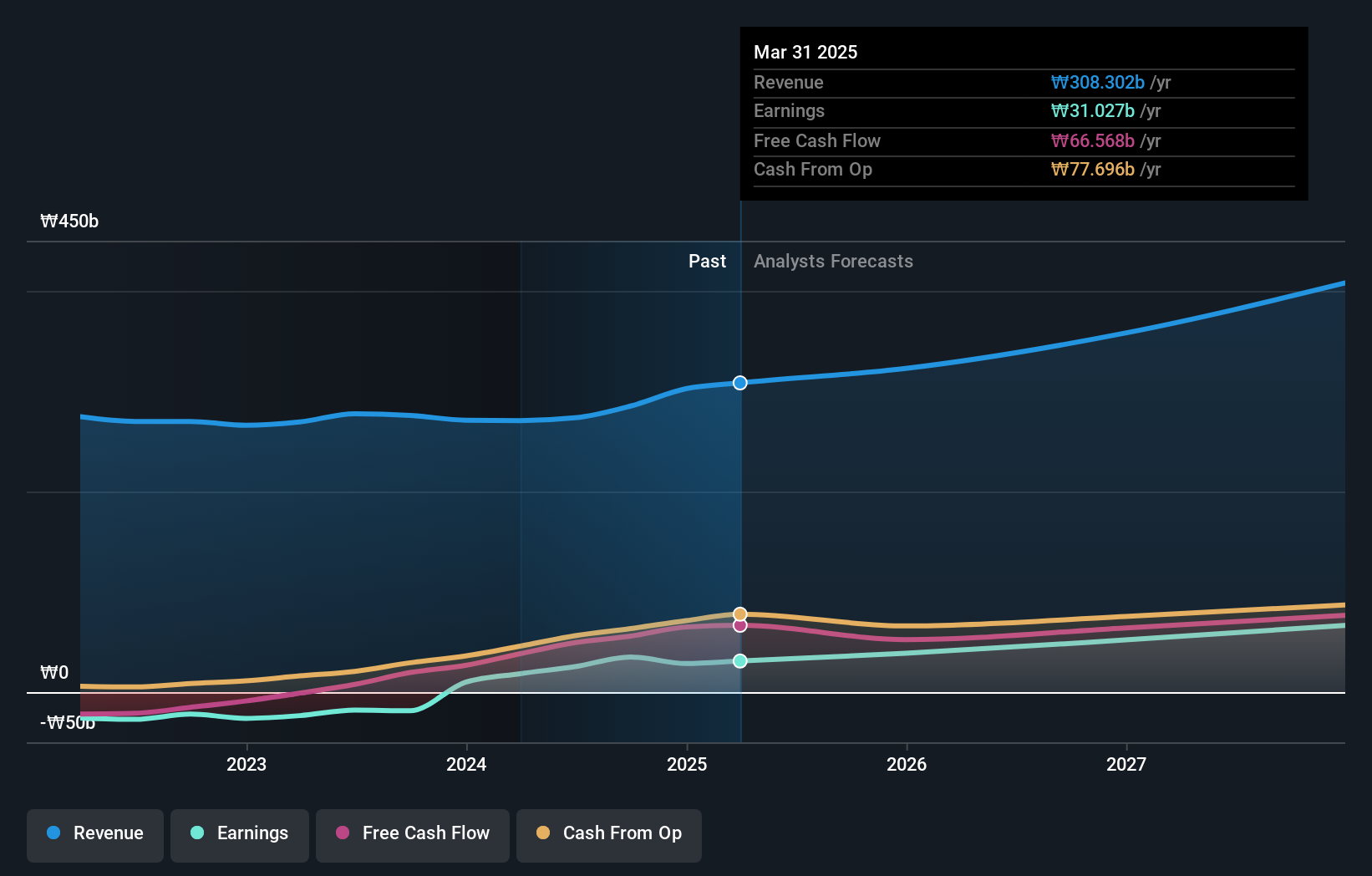

Overview: Cafe24 Corp. operates a global e-commerce platform and has a market cap of ₩904.26 billion.

Operations: The company's revenue segments consist of Transit at ₩44.06 billion, Clothing at ₩22.16 billion, and Internet Business Solution at ₩237.10 billion.

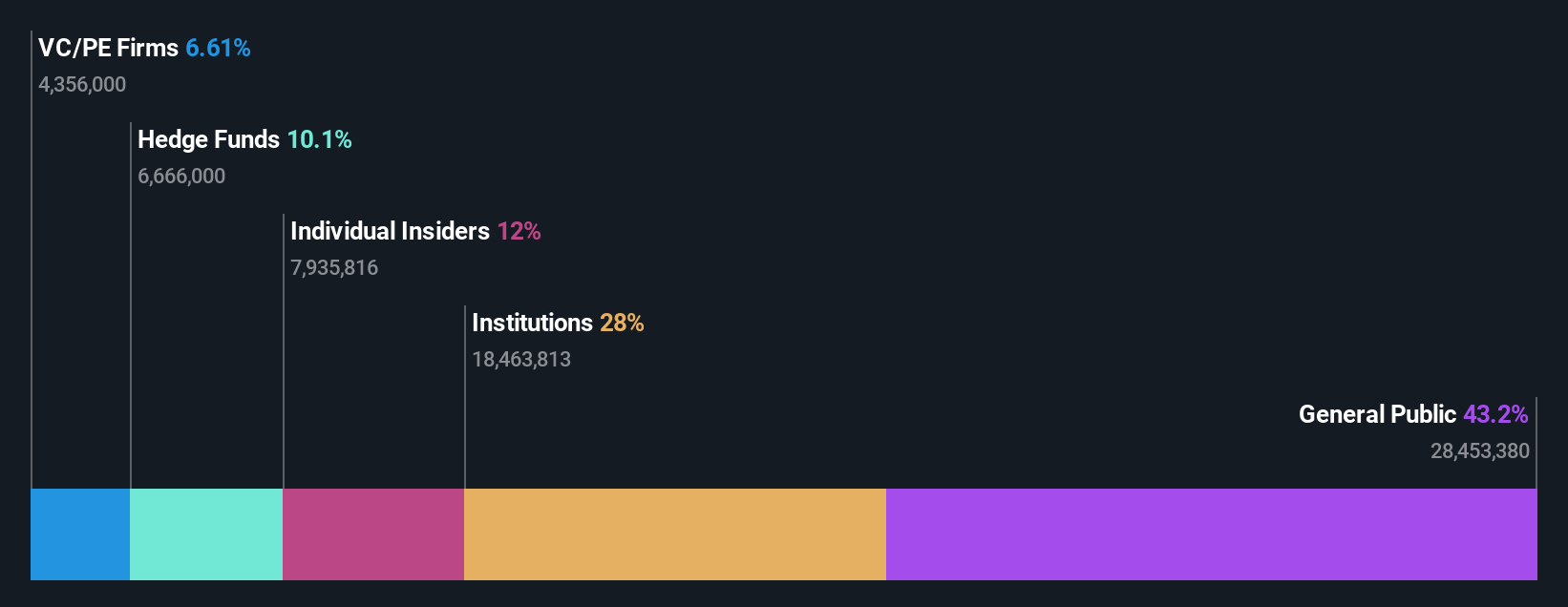

Insider Ownership: 23.4%

Cafe24's earnings are forecast to grow significantly at 35.47% annually, surpassing the Korean market's average growth rate of 29%. Revenue is also expected to increase by 11.3% per year, outpacing the market's 9.1% growth. Trading slightly below its fair value, Cafe24 has not diluted shareholders over the past year but experiences high share price volatility and faces low return on equity forecasts in three years at 15.3%.

- Take a closer look at Cafe24's potential here in our earnings growth report.

- According our valuation report, there's an indication that Cafe24's share price might be on the expensive side.

Herfy Food Services (SASE:6002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Herfy Food Services Company operates and franchises restaurants in Saudi Arabia and internationally, with a market cap of SAR1.64 billion.

Operations: The company's revenue segments include SAR897.66 million from Restaurants and Catering, SAR202.06 million from the Meat Factory, and SAR188.63 million from Bakeries and Other.

Insider Ownership: 15.3%

Herfy Food Services is forecast to achieve profitability within three years, with earnings expected to grow at 75.08% annually, outperforming the market. However, revenue growth is projected at a modest 6.6% per year, which surpasses the Saudi Arabian market's negative trend but remains below high-growth benchmarks. Despite trading at good value compared to peers, Herfy faces challenges with low return on equity forecasts of 4.2% and an unsustainable dividend yield of 1.98%.

- Navigate through the intricacies of Herfy Food Services with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Herfy Food Services is trading behind its estimated value.

Seize The Opportunity

- Investigate our full lineup of 1494 Fast Growing Companies With High Insider Ownership right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A042000

Flawless balance sheet with reasonable growth potential.