- Norway

- /

- Marine and Shipping

- /

- OB:BELCO

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As global markets navigate the complexities of rising U.S. Treasury yields and tepid economic growth, investors are closely watching how these factors influence stock performance. In this environment, growth companies with high insider ownership can be particularly intriguing as insiders may have a deeper understanding of their company's potential and confidence in its future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Pharma Mar (BME:PHM) | 11.8% | 55.1% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's review some notable picks from our screened stocks.

Belships (OB:BELCO)

Simply Wall St Growth Rating: ★★★★☆☆

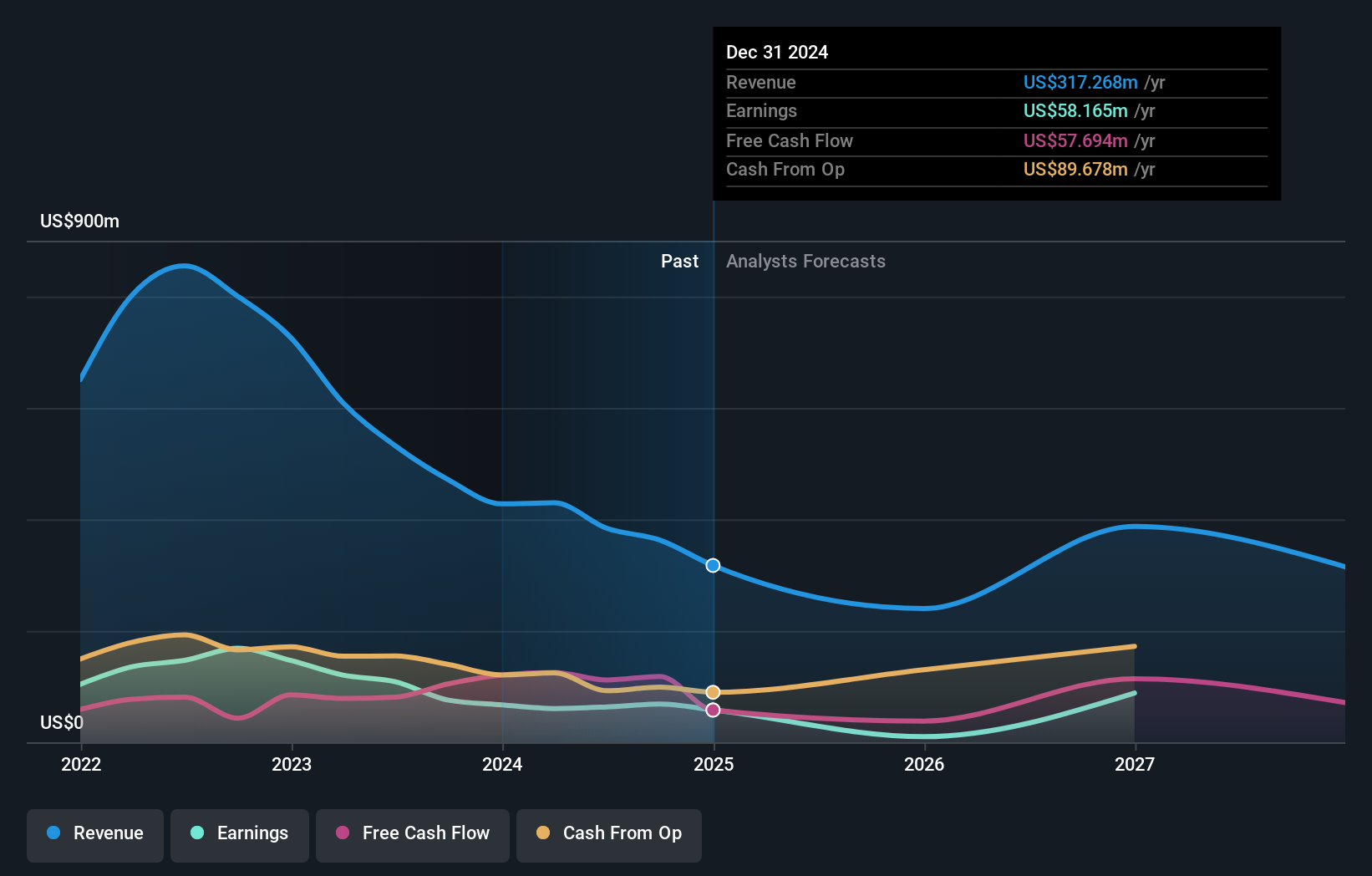

Overview: Belships ASA owns and operates dry bulk ships worldwide, with a market capitalization of NOK4.62 billion.

Operations: The company's revenue segments include $178.57 million from Belships and $204.33 million from its Operating Business.

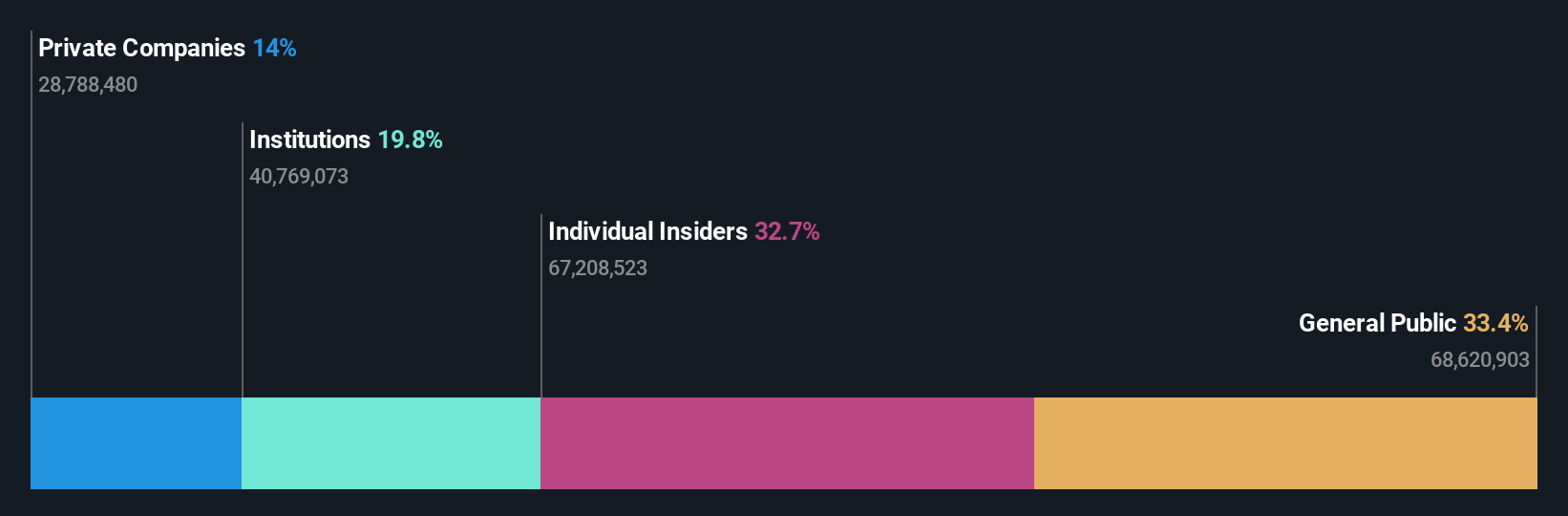

Insider Ownership: 13.6%

Earnings Growth Forecast: 18.2% p.a.

Belships demonstrates characteristics of a growth company with high insider ownership, as insiders have been net buyers recently. The stock trades at 70.4% below its estimated fair value and is expected to grow earnings at 18.2% annually, outpacing the Norwegian market's average. Despite recent earnings declines and an unstable dividend track record, analysts agree on potential price appreciation of 68.7%, reflecting confidence in its future prospects despite some challenges.

- Get an in-depth perspective on Belships' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Belships is priced lower than what may be justified by its financials.

Herfy Food Services (SASE:6002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Herfy Food Services Company operates and franchises restaurants in Saudi Arabia and internationally, with a market cap of SAR1.62 billion.

Operations: The company's revenue segments include SAR923.62 million from restaurants and catering, SAR199.46 million from the meat factory, and SAR198.45 million from bakeries and other operations.

Insider Ownership: 15.3%

Earnings Growth Forecast: 81.3% p.a.

Herfy Food Services shows potential for growth despite recent financial challenges, with revenue forecasted to grow at 5.9% annually, surpassing the Saudi Arabian market average. The company reported significant net losses in recent quarters but is expected to become profitable within three years, outperforming average market growth rates. Trading at a good value relative to peers and industry, Herfy's share price remains volatile without significant insider trading activity over the past three months.

- Dive into the specifics of Herfy Food Services here with our thorough growth forecast report.

- Our valuation report unveils the possibility Herfy Food Services' shares may be trading at a discount.

Fujian Apex SoftwareLTD (SHSE:603383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fujian Apex Software Co., LTD is a professional platform software and information service provider in China, with a market cap of CN¥7.88 billion.

Operations: The company generates revenue primarily from its Application Software Service Industry segment, amounting to CN¥730.07 million.

Insider Ownership: 32.7%

Earnings Growth Forecast: 22.4% p.a.

Fujian Apex SoftwareLTD demonstrates potential as a growth company with high insider ownership, despite recent declines in sales and net income. While earnings grew by 14.4% over the past year, forecasts suggest slower profit growth compared to the broader CN market. The company's return on equity is expected to be strong at 20.4%, and it trades at good value relative to peers. However, its dividend coverage is weak, and share price volatility remains high without recent insider trading activity.

- Take a closer look at Fujian Apex SoftwareLTD's potential here in our earnings growth report.

- According our valuation report, there's an indication that Fujian Apex SoftwareLTD's share price might be on the cheaper side.

Summing It All Up

- Explore the 1514 names from our Fast Growing Companies With High Insider Ownership screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Belships might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BELCO

High growth potential with adequate balance sheet.

Market Insights

Community Narratives