- Saudi Arabia

- /

- Consumer Durables

- /

- SASE:1213

Investors push Naseej International Trading (TADAWUL:1213) 13% lower this week, company's increasing losses might be to blame

Naseej International Trading Company (TADAWUL:1213) shareholders might be concerned after seeing the share price drop 24% in the last quarter. But that doesn't change the fact that the returns over the last three years have been pleasing. In fact, the company's share price bested the return of its market index in that time, posting a gain of 51%.

In light of the stock dropping 13% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

Because Naseej International Trading made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Naseej International Trading actually saw its revenue drop by 17% per year over three years. Despite the lack of revenue growth, the stock has returned 15%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

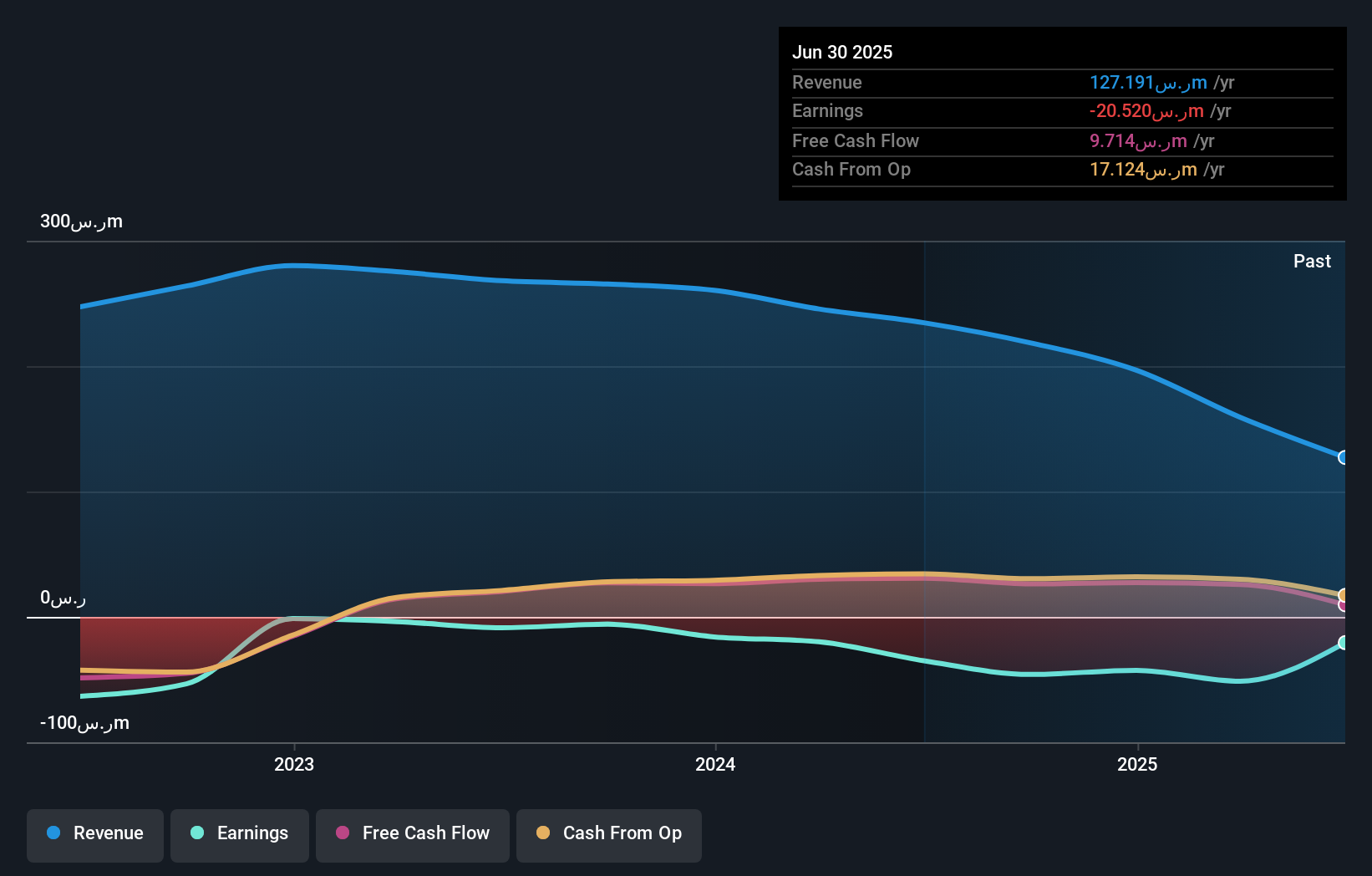

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Naseej International Trading's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Naseej International Trading has rewarded shareholders with a total shareholder return of 7.9% in the last twelve months. Having said that, the five-year TSR of 14% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Naseej International Trading might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1213

Naseej International Trading

Together with subsidiaries, engages in the manufacture, import, export, wholesale, and retailing of carpets and rugs in the Kingdom of Saudi Arabia.

Excellent balance sheet with weak fundamentals.

Market Insights

Community Narratives