- Saudi Arabia

- /

- Commercial Services

- /

- SASE:9540

With EPS Growth And More, National Environmental Recycling (TADAWUL:9540) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like National Environmental Recycling (TADAWUL:9540), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide National Environmental Recycling with the means to add long-term value to shareholders.

See our latest analysis for National Environmental Recycling

National Environmental Recycling's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. National Environmental Recycling's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 44%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

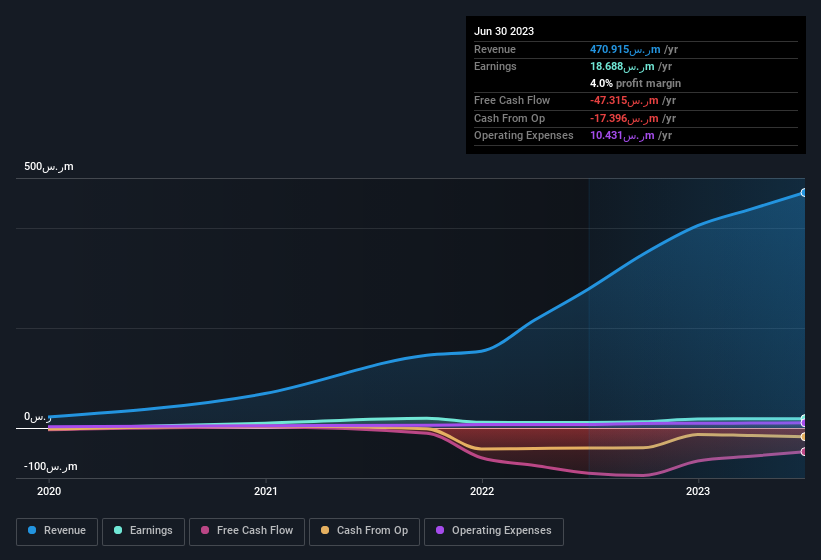

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for National Environmental Recycling remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 69% to ر.س471m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since National Environmental Recycling is no giant, with a market capitalisation of ر.س532m, you should definitely check its cash and debt before getting too excited about its prospects.

Are National Environmental Recycling Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that National Environmental Recycling insiders own a meaningful share of the business. To be exact, company insiders hold 53% of the company, so their decisions have a significant impact on their investments. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. With that sort of holding, insiders have about ر.س282m riding on the stock, at current prices. That should be more than enough to keep them focussed on creating shareholder value!

Is National Environmental Recycling Worth Keeping An Eye On?

National Environmental Recycling's earnings have taken off in quite an impressive fashion. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, National Environmental Recycling is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Even so, be aware that National Environmental Recycling is showing 2 warning signs in our investment analysis , and 1 of those is a bit concerning...

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in SA with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if National Environmental Recycling might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9540

National Environmental Recycling

National Environmental Recycling Company recycles electronic and electrical equipment in the Kingdom of Saudi Arabia and the United Arab Emirates.

Adequate balance sheet low.

Market Insights

Community Narratives