- Saudi Arabia

- /

- Building

- /

- SASE:2040

Saudi Ceramic (TADAWUL:2040) delivers shareholders favorable 12% CAGR over 5 years, surging 7.1% in the last week alone

While Saudi Ceramic Company (TADAWUL:2040) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 20% in the last quarter. Looking further back, the stock has generated good profits over five years. After all, the share price is up a market-beating 70% in that time. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 31% decline over the last three years: that's a long time to wait for profits.

Since it's been a strong week for Saudi Ceramic shareholders, let's have a look at trend of the longer term fundamentals.

Our free stock report includes 1 warning sign investors should be aware of before investing in Saudi Ceramic. Read for free now.Given that Saudi Ceramic didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Saudi Ceramic saw its revenue shrink by 1.6% per year. Even though revenue hasn't increased, the stock actually gained 11%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

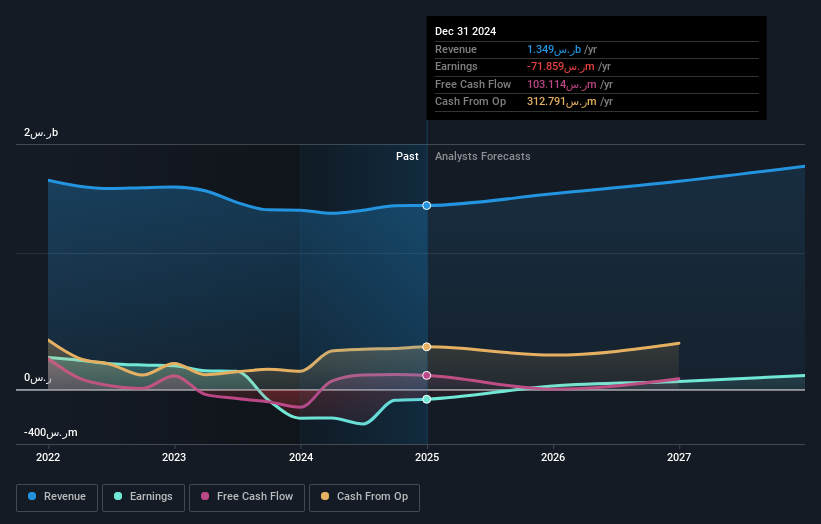

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We've already covered Saudi Ceramic's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Saudi Ceramic shareholders, and that cash payout contributed to why its TSR of 80%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that Saudi Ceramic shareholders have received a total shareholder return of 1.8% over the last year. However, the TSR over five years, coming in at 12% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Saudi Ceramic has 1 warning sign we think you should be aware of.

We will like Saudi Ceramic better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2040

Saudi Ceramic

Manufactures and sells ceramic products, water heaters, and other products in Saudi Arabia and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives