- Russia

- /

- Marine and Shipping

- /

- MISX:FESH

Introducing Far-Eastern Shipping (MCX:FESH), The Stock That Soared 351% In The Last Five Years

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held Far-Eastern Shipping Company PLC. (MCX:FESH) shares for the last five years, while they gained 351%. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 14% over the last quarter. But this could be related to the strong market, which is up 21% in the last three months.

View our latest analysis for Far-Eastern Shipping

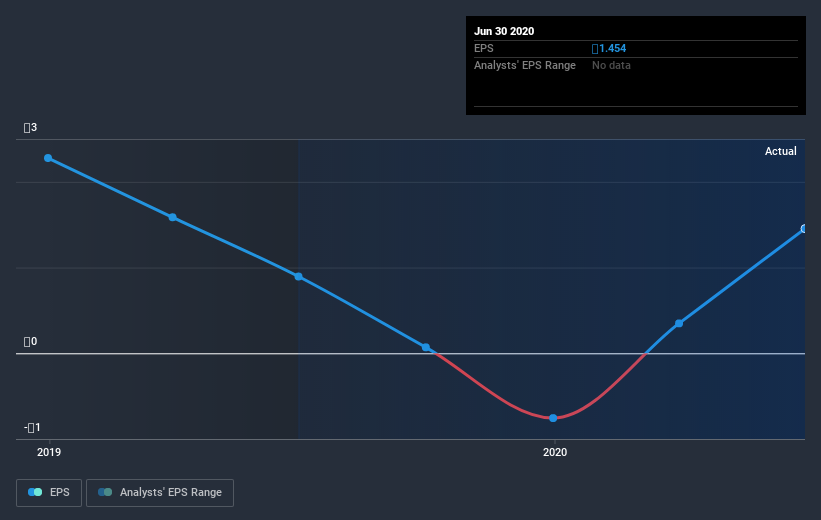

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the five years of share price growth, Far-Eastern Shipping moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Far-Eastern Shipping's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Far-Eastern Shipping has rewarded shareholders with a total shareholder return of 38% in the last twelve months. That gain is better than the annual TSR over five years, which is 35%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Far-Eastern Shipping you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you’re looking to trade Far-Eastern Shipping, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:FESH

Far-Eastern Shipping

Far-Eastern Shipping Company PLC. provides logistics services in Russia and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives