- Russia

- /

- Aerospace & Defense

- /

- MISX:UNAC

How Much Did United Aircraft's(MCX:UNAC) Shareholders Earn From Share Price Movements Over The Last Three Years?

As an investor its worth striving to ensure your overall portfolio beats the market average. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Public Joint Stock Company United Aircraft Corporation (MCX:UNAC) shareholders have had that experience, with the share price dropping 49% in three years, versus a market return of about 50%. And more recent buyers are having a tough time too, with a drop of 40% in the last year. It's down 3.9% in the last seven days.

View our latest analysis for United Aircraft

Given that United Aircraft didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, United Aircraft's revenue dropped 12% per year. That's not what investors generally want to see. The annual decline of 14% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

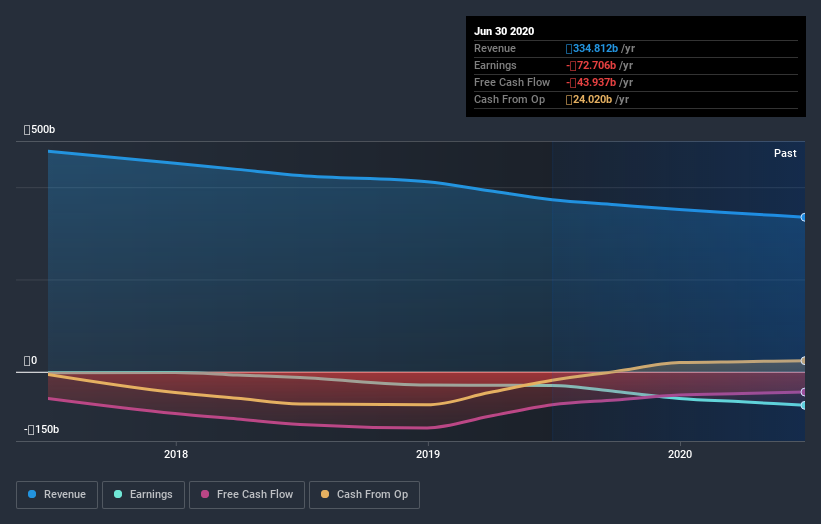

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on United Aircraft's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

United Aircraft shareholders are down 40% for the year, but the market itself is up 3.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand United Aircraft better, we need to consider many other factors. Even so, be aware that United Aircraft is showing 2 warning signs in our investment analysis , you should know about...

Of course United Aircraft may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

If you’re looking to trade United Aircraft, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About MISX:UNAC

United Aircraft

Public Joint Stock Company United Aircraft Corporation, together with its subsidiaries, engages in the development, manufacture, sale, and aftersales maintenance of civil, military, transport, and special-purpose aircraft in Russia.

Slightly overvalued with weak fundamentals.