- Romania

- /

- Electric Utilities

- /

- BVB:TEL

Undiscovered Gems CNTEE Transelectrica And 2 Other Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the de-escalation of trade tensions between the U.S. and China, small-cap stocks are gaining attention for their potential to outperform in this revitalized economic landscape. In such an environment, stocks with strong fundamentals—such as robust financial health, competitive positioning, and growth potential—are particularly appealing to investors seeking undiscovered opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Evergent Investments | 5.59% | 5.88% | 16.36% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Value Rating: ★★★★★★

Overview: CNTEE Transelectrica SA operates as the transmission and system operator of the national power system, with a market capitalization of RON3.45 billion.

Operations: Transelectrica generates revenue primarily from its role as a transmission and system operator within the national power system.

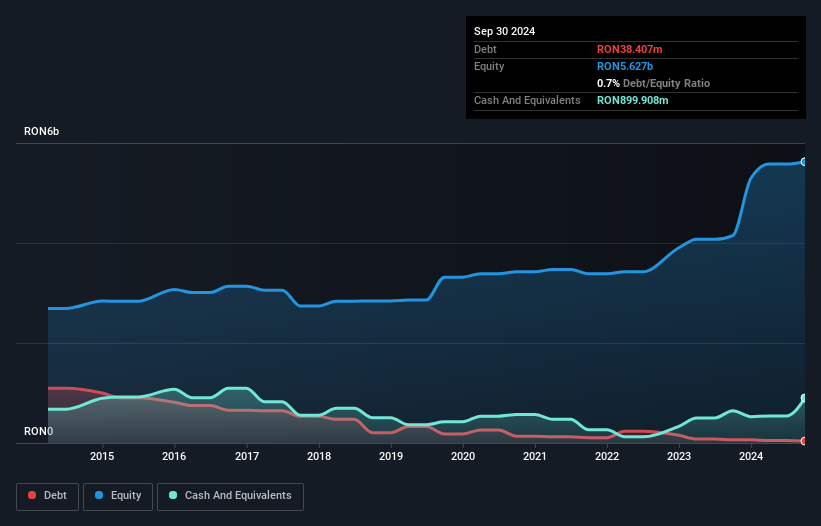

CNTEE Transelectrica, a notable player in the European utilities sector, has shown impressive financial resilience. Over the past year, its earnings surged by 134%, outpacing industry averages. The company's debt-to-equity ratio impressively decreased from 7.7 to 0.6 over five years, highlighting effective debt management. With net income rising to RON 153 million in Q1 2025 from RON 104 million a year ago and basic earnings per share increasing to RON 2.09 from RON 1.42, Transelectrica demonstrates robust growth potential while trading at a value estimated to be about one-third below its fair market price estimate.

- Unlock comprehensive insights into our analysis of CNTEE Transelectrica stock in this health report.

Explore historical data to track CNTEE Transelectrica's performance over time in our Past section.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★★

Overview: APG|SGA SA is a company that specializes in providing advertising services primarily in Switzerland and Serbia, with a market capitalization of CHF716.29 million.

Operations: APG|SGA generates revenue of CHF328.94 million from the acquisition, sale, and management of advertising spaces.

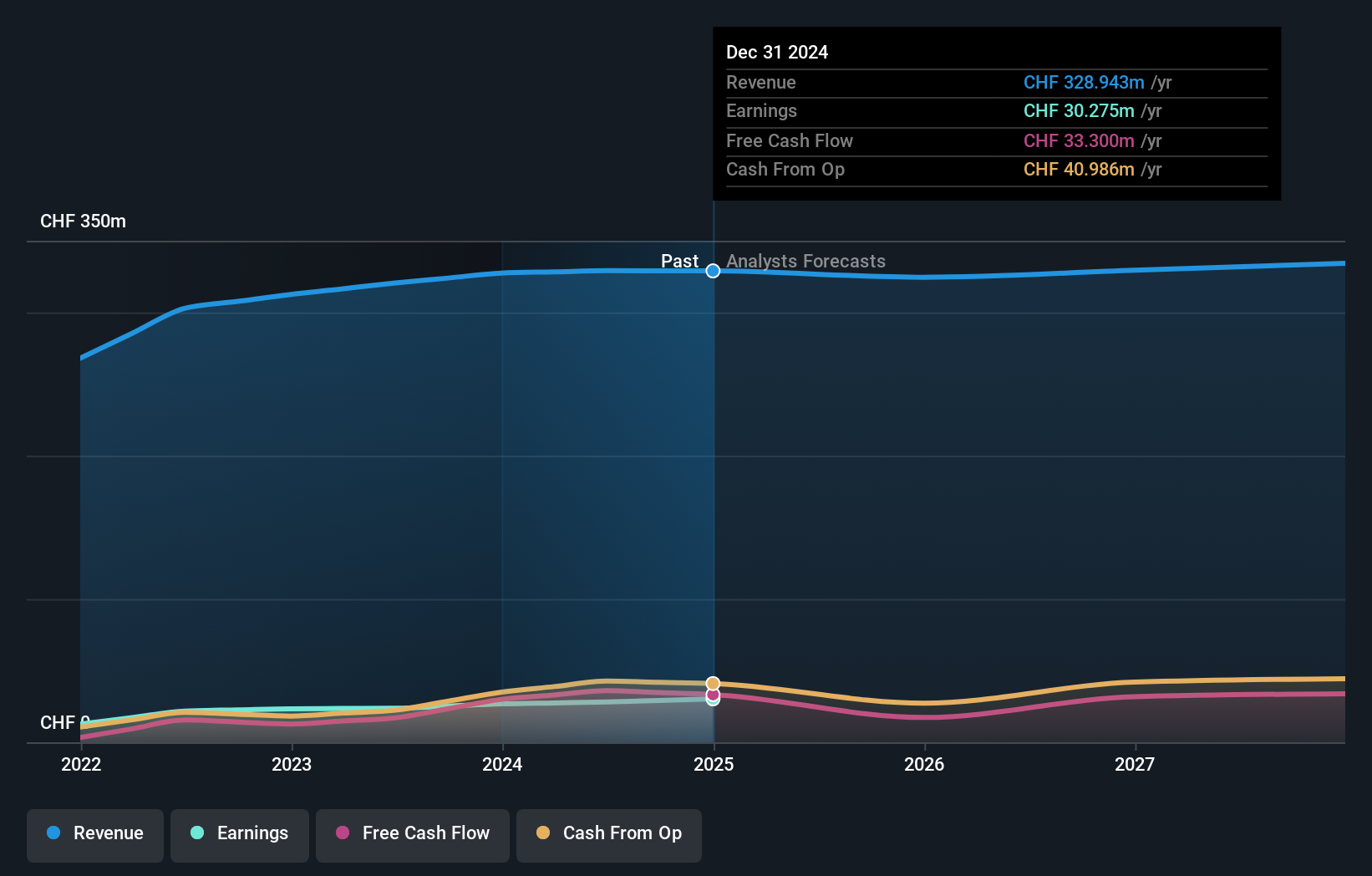

APG|SGA stands out with a notable earnings growth of 12.9% over the past year, surpassing the media industry's -3.7%. Trading at 31.9% below its estimated fair value, it offers potential upside for investors. The company reported a net income of CHF 30.28 million for the full year ending December 2024, up from CHF 26.82 million previously, reflecting high-quality earnings and robust financial health without any debt concerns for five years running. Furthermore, APG|SGA announced an annual dividend of CHF 12 per share, showcasing its commitment to shareholder returns while maintaining positive free cash flow throughout this period.

Newag (WSE:NWG)

Simply Wall St Value Rating: ★★★★★★

Overview: Newag S.A. is a Polish company involved in the production and sale of railway locomotives and rolling stock, with a market capitalization of PLN3.60 billion.

Operations: Newag generates revenue primarily from the production and sale of railway locomotives and rolling stock. The company's financial performance is reflected in its net profit margin, which has shown variability over recent periods.

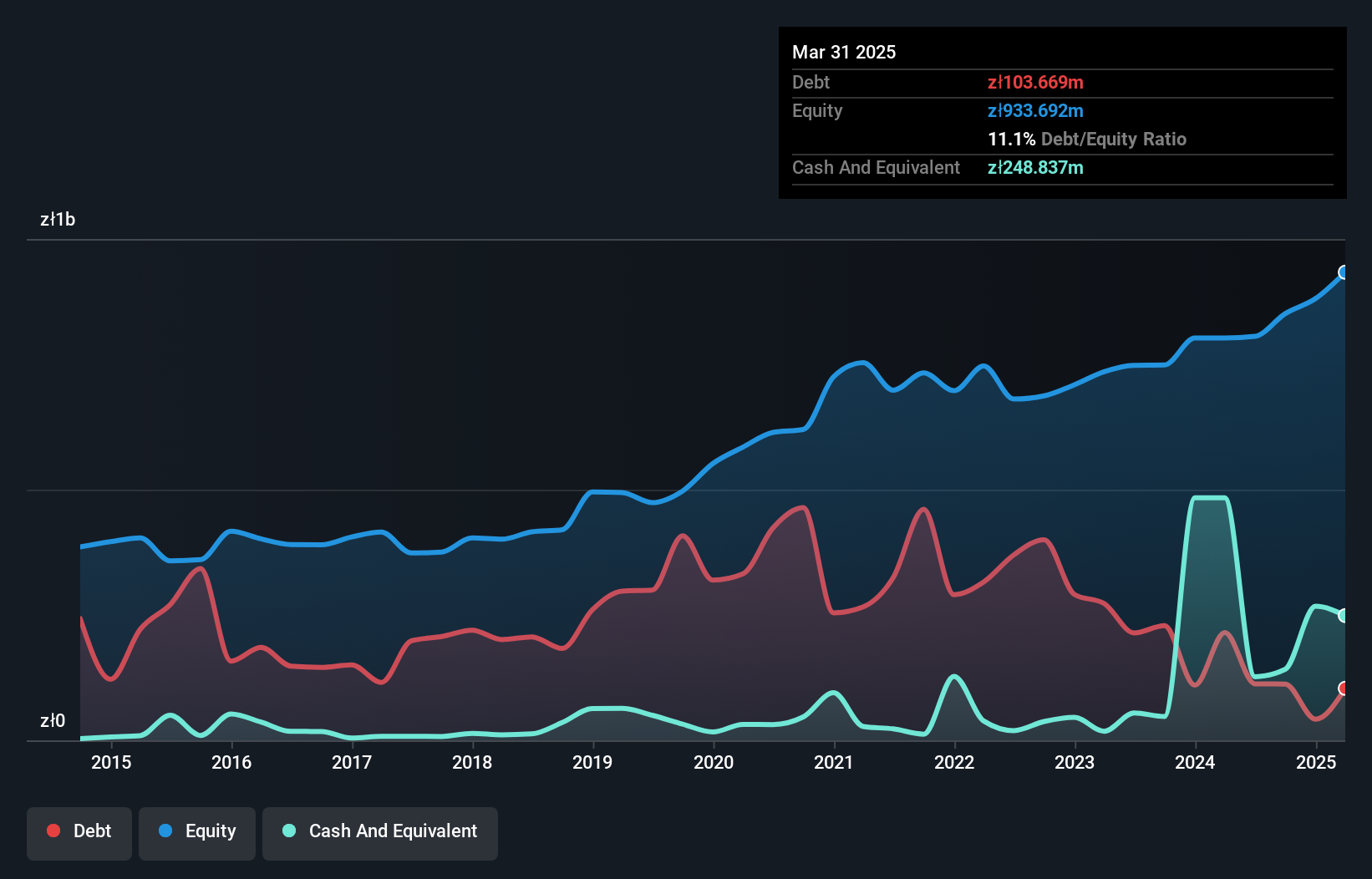

Newag, a smaller player in the European market, has shown impressive growth recently. Over the past year, earnings surged by 72.9%, outpacing the broader machinery industry which saw a -22.6% shift. The company reported first-quarter sales of PLN 374.6 million, up from PLN 223.37 million last year, and net income soared to PLN 52.3 million from PLN 14.67 million over the same period. Newag's debt-to-equity ratio improved significantly over five years from 56.8% to just 11.1%, reflecting stronger financial health and more cash than total debt on its books.

- Click to explore a detailed breakdown of our findings in Newag's health report.

Understand Newag's track record by examining our Past report.

Next Steps

- Click through to start exploring the rest of the 326 European Undiscovered Gems With Strong Fundamentals now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:TEL

CNTEE Transelectrica

CNTEE Transelectrica SA acts as a transmission and system operator of the national power system.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives