- Poland

- /

- Diversified Financial

- /

- WSE:CAP

TTS (Transport Trade Services) And 2 Other European Penny Stocks With Promising Prospects

Reviewed by Simply Wall St

The European market has recently shown mixed results, with the pan-European STOXX Europe 600 Index rising for the fourth consecutive week amid easing trade tensions between China and the U.S. This backdrop presents a fertile ground for exploring investment opportunities in lesser-known stocks. While penny stocks may seem like a relic of past market trends, they continue to hold relevance by offering potential growth in smaller or newer companies. By focusing on those with strong financial health, investors can uncover promising prospects that balance stability with potential upside.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.285 | SEK2.19B | ✅ 4 ⚠️ 1 View Analysis > |

| Transferator (NGM:TRAN A) | SEK3.13 | SEK300.72M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.80 | SEK284.94M | ✅ 3 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.46 | SEK210.5M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.71 | PLN125.75M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.464 | NOK105.21M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.65 | €55.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.63 | €17.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.23 | €307.88M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 449 stocks from our European Penny Stocks screener.

Let's review some notable picks from our screened stocks.

TTS (Transport Trade Services) (BVB:TTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TTS (Transport Trade Services) S.A. is a company based in Romania that specializes in providing freight forwarding services, with a market capitalization of RON690.83 million.

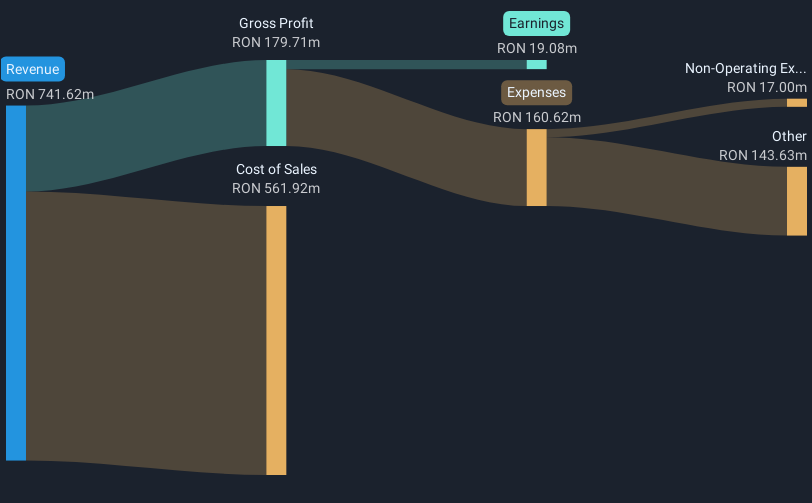

Operations: The company's revenue is primarily derived from its forwarding segment, which generated RON541.74 million, followed by river transport at RON353.07 million and port operations contributing RON153.71 million.

Market Cap: RON690.83M

Transport Trade Services (TTS) shows mixed signals as a penny stock. The company reported a significant drop in revenue to RON 733.8 million and net income to RON 19.08 million for 2024, compared to the previous year. Despite high-quality past earnings and strong cash flow covering its debt, TTS faces challenges with low return on equity at 2% and reduced profit margins from last year's 24% to 2.6%. Although trading below estimated fair value suggests potential upside, recent dividend decreases indicate financial caution amid negative earnings growth over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of TTS (Transport Trade Services).

- Gain insights into TTS (Transport Trade Services)'s future direction by reviewing our growth report.

High (ENXTPA:HCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Co. SA offers consumer engagement chain solutions in France, Belgium, and Spain with a market cap of €69.94 million.

Operations: The company's revenue is primarily generated from its advertising segment, amounting to €146.38 million.

Market Cap: €69.94M

High Co. SA's recent performance and financial health present a mixed picture. The company reported stable revenue growth, reaching €146.38 million in 2024, but faced a decline in net income to €7.46 million from the previous year. Despite this, High Co.'s debt management is strong, with zero debt-to-equity and interest well-covered by EBIT. The company's dividends have increased to €0.25 per share for fiscal year 2024, alongside an exceptional dividend of €1 per share following asset disposal. However, forecasts indicate potential earnings decline over the next three years and its return on equity remains low at 9.7%.

- Click to explore a detailed breakdown of our findings in High's financial health report.

- Assess High's future earnings estimates with our detailed growth reports.

Capitea (WSE:CAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Capitea S.A., with a market cap of PLN66 million, operates in Poland offering financial services through its subsidiaries.

Operations: The company generates revenue from its Unclassified Services segment, amounting to PLN194.48 million.

Market Cap: PLN66M

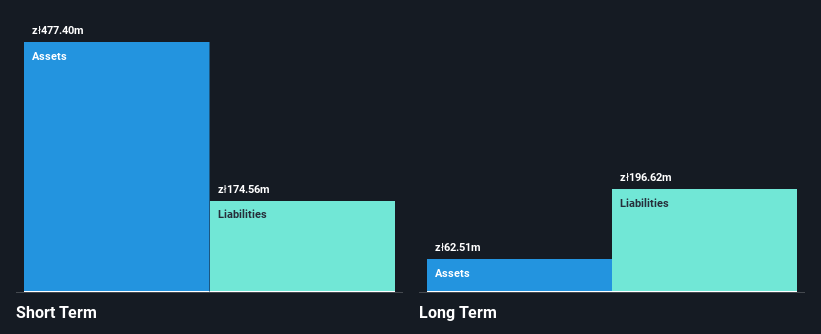

Capitea S.A.'s financial landscape is characterized by a mix of strengths and challenges. The company has demonstrated consistent earnings growth, with a 40.3% annual increase over the past five years, though recent growth slowed to 18.7%. Despite high debt levels, its short-term assets comfortably cover both short and long-term liabilities. Capitea's return on equity is outstanding at 62.72%, albeit skewed by significant debt, which also contributes to its volatile share price. While trading significantly below estimated fair value, one-off losses have impacted recent earnings quality, highlighting the need for cautious consideration in this penny stock investment space.

- Dive into the specifics of Capitea here with our thorough balance sheet health report.

- Learn about Capitea's historical performance here.

Seize The Opportunity

- Access the full spectrum of 449 European Penny Stocks by clicking on this link.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CAP

Excellent balance sheet and good value.

Market Insights

Community Narratives