- Germany

- /

- Electrical

- /

- DB:3CA

European Growth Companies With High Insider Ownership For September 2025

Reviewed by Simply Wall St

As European markets navigate the complexities of interest rate policies and trade uncertainties, major stock indexes have shown resilience, with Italy’s FTSE MIB and Germany’s DAX posting gains. In this environment, growth companies with high insider ownership can offer unique insights into market confidence and potential long-term stability.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 91.4% |

| KebNi (OM:KEBNI B) | 38% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

We'll examine a selection from our screener results.

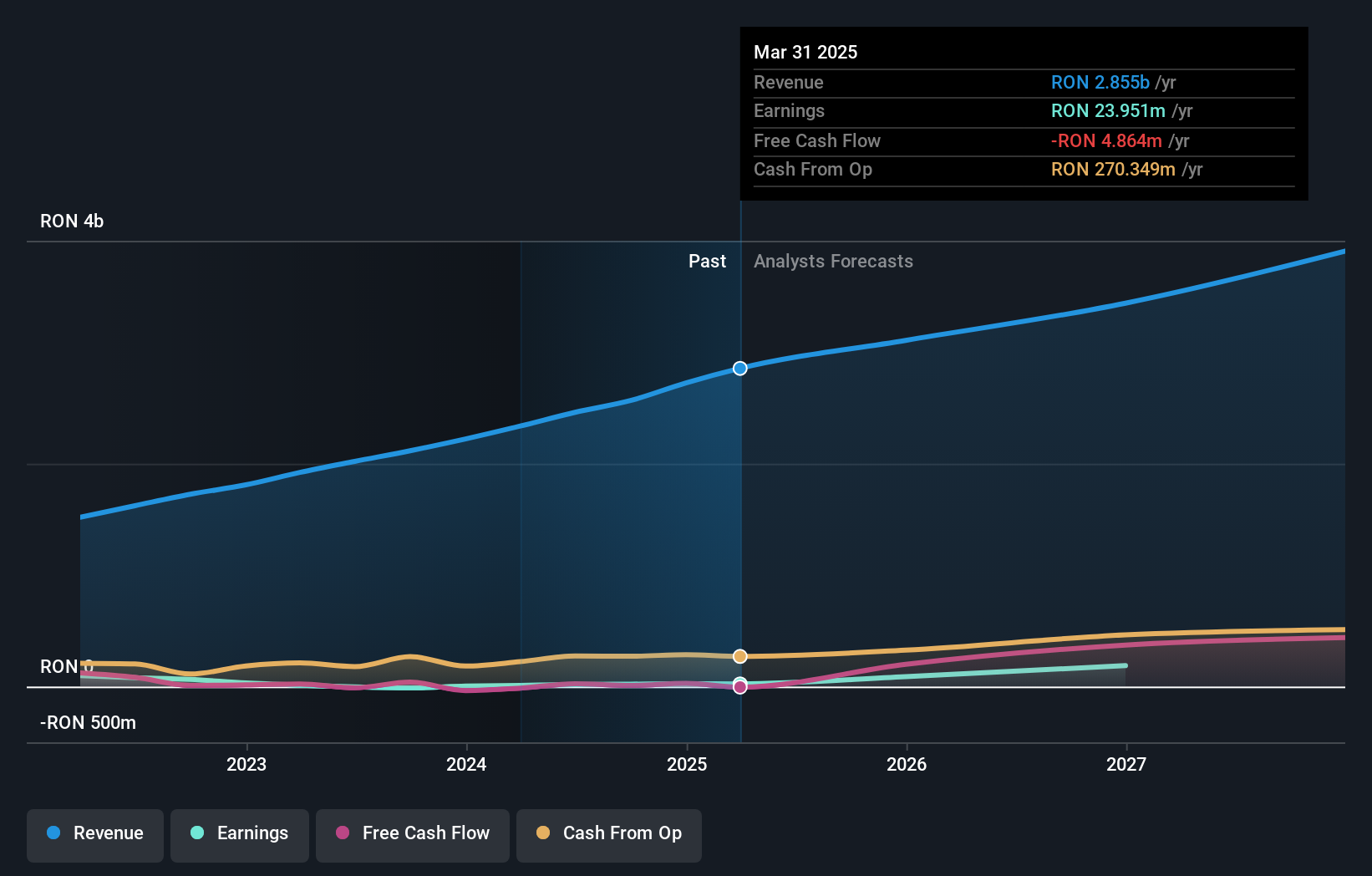

Med Life (BVB:M)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Med Life S.A. is a private healthcare provider offering services through its clinics and hospitals across various cities in Romania, with a market cap of RON3.96 billion.

Operations: The company's revenue is primarily derived from its clinics (RON1.12 billion), hospitals (RON781.54 million), laboratories (RON322.15 million), corporate services (RON296.52 million), pharmacies (RON73.59 million), and stomatology services (RON121.88 million).

Insider Ownership: 39.3%

Earnings Growth Forecast: 77.3% p.a.

Med Life's recent earnings report showed a rise in sales to RON 1.57 billion, but a net loss of RON 2.56 million highlights challenges despite growth prospects. Earnings are expected to grow significantly at 77.32% annually, outpacing the Romanian market average of 5.8%. However, profit margins have decreased and interest payments remain poorly covered by earnings. The stock trades at a substantial discount to its estimated fair value, suggesting potential upside if financial health improves.

- Unlock comprehensive insights into our analysis of Med Life stock in this growth report.

- Upon reviewing our latest valuation report, Med Life's share price might be too pessimistic.

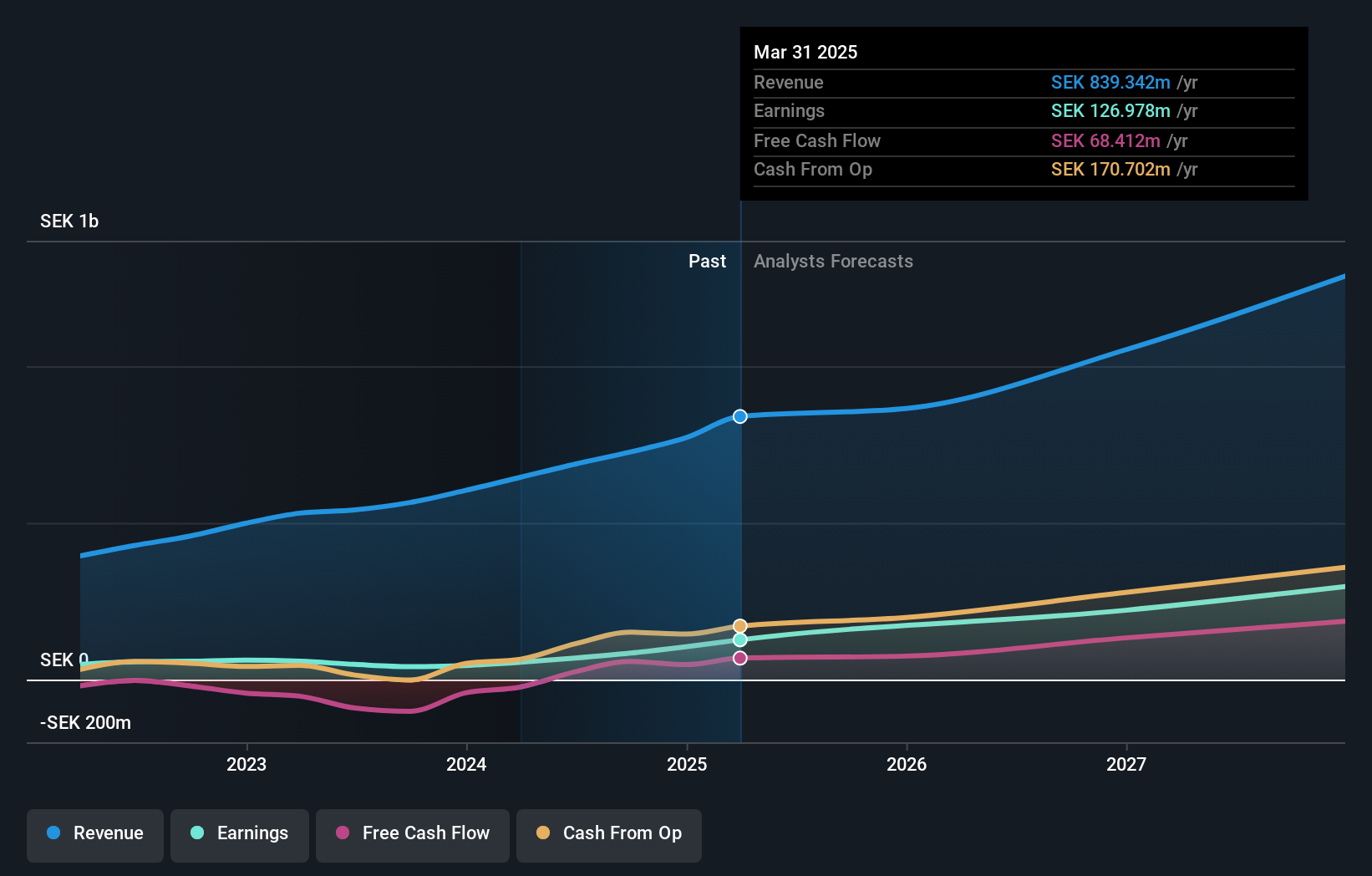

Plejd (DB:3CA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plejd AB (publ) is a technology company that develops products and services for smart lighting control across several European countries and internationally, with a market cap of €10.28 billion.

Operations: Plejd generates revenue from its Electronic Security Devices segment, amounting to SEK 910.20 million.

Insider Ownership: 39.2%

Earnings Growth Forecast: 32.1% p.a.

Plejd AB's recent earnings report highlights robust growth, with sales increasing to SEK 498.83 million and net income doubling to SEK 82.11 million for the first half of 2025. Earnings are forecasted to grow significantly at 32.13% annually, outpacing both revenue growth and the German market average. Despite high volatility in its share price, Plejd benefits from substantial insider ownership without significant recent selling, suggesting confidence in its long-term prospects amidst a challenging market environment.

- Get an in-depth perspective on Plejd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Plejd shares in the market.

Sparebanken Norge (OB:SBNOR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sparebanken Vest is a financial services company offering banking and financing services in the counties of Vestland and Rogaland, Norway, with a market cap of NOK19.29 billion.

Operations: The company's revenue segments include Estate Agency Business (NOK392 million), Banking Operations - Bulder Bank (NOK395 million), Banking Operations - Retail Market (NOK3.44 billion), and Banking Operations - Corporate Market (NOK2.44 billion).

Insider Ownership: 10.1%

Earnings Growth Forecast: 25.8% p.a.

Sparebanken Norge demonstrates strong growth potential with earnings expected to rise significantly at 25.8% annually, surpassing the Norwegian market average. Recent earnings showed a substantial increase, with net income reaching NOK 1.7 billion in Q2 2025. While the bank's revenue is projected to grow faster than the national average, its funding relies heavily on external borrowing, which carries higher risk. Despite these risks, it trades at a favorable price-to-earnings ratio of 9.1x compared to peers and maintains stable insider ownership without recent significant selling activities.

- Navigate through the intricacies of Sparebanken Norge with our comprehensive analyst estimates report here.

- Our valuation report here indicates Sparebanken Norge may be undervalued.

Key Takeaways

- Dive into all 220 of the Fast Growing European Companies With High Insider Ownership we have identified here.

- Seeking Other Investments? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:3CA

Plejd

A technology company, develops products and services for smart lighting control in Sweden, Norway, Finland, the Netherlands, Germany, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives