- Poland

- /

- Professional Services

- /

- WSE:GPP

February 2025's Stock Selections That May Be Undervalued By Investors

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating interest rates and competitive pressures in the technology sector, investors are closely watching for opportunities amid volatility. The recent turbulence, particularly within U.S. tech stocks due to emerging AI competition, underscores the importance of identifying potentially undervalued stocks that may offer resilience and growth potential in such an environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.00 | NT$527.67 | 50% |

| Brookline Bancorp (NasdaqGS:BRKL) | US$12.06 | US$24.01 | 49.8% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥101.01 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK170.60 | SEK340.70 | 49.9% |

| Elekta (OM:EKTA B) | SEK64.60 | SEK128.36 | 49.7% |

| Kinaxis (TSX:KXS) | CA$171.05 | CA$340.41 | 49.8% |

| AeroEdge (TSE:7409) | ¥1733.00 | ¥3445.33 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.94 | 49.7% |

| QuinStreet (NasdaqGS:QNST) | US$23.71 | US$47.35 | 49.9% |

| Equifax (NYSE:EFX) | US$267.52 | US$531.27 | 49.6% |

Let's dive into some prime choices out of the screener.

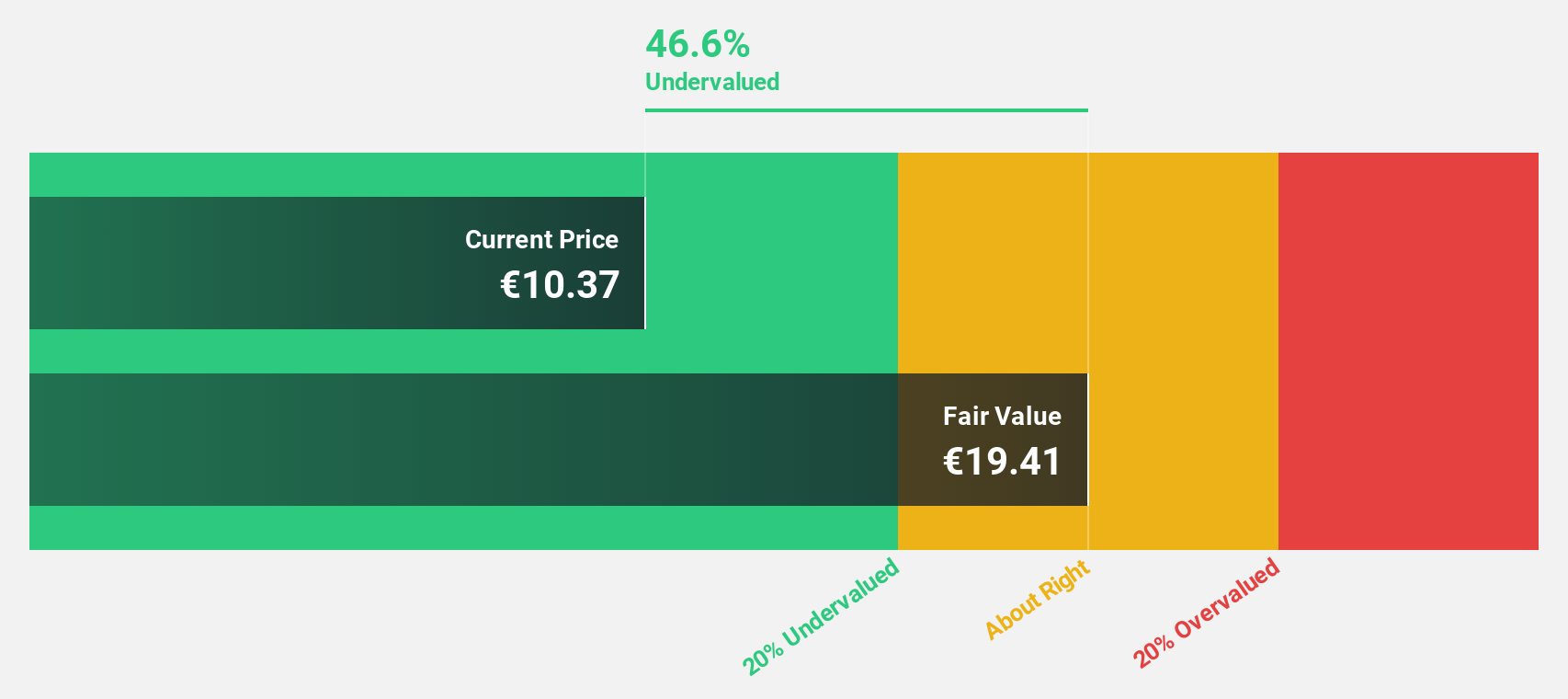

Acerinox (BME:ACX)

Overview: Acerinox, S.A. is a global company that manufactures, processes, and markets stainless steel products across various regions including Spain, the United States, Africa, Asia, and Europe with a market cap of approximately €2.42 billion.

Operations: The company's revenue is primarily derived from its Stainless Steel Business, generating approximately €4.35 billion, and its High Performance Alloys segment, contributing about €1.37 billion.

Estimated Discount To Fair Value: 33.8%

Acerinox is trading 33.8% below its estimated fair value of €14.75, suggesting significant undervaluation based on discounted cash flow analysis. Despite a low profit margin of 0.7% and a dividend not well covered by earnings, the company's earnings are expected to grow significantly at 39.2% per year, outpacing the Spanish market's growth rate of 8.6%. Analysts agree on a potential stock price rise by 33.5%.

- Insights from our recent growth report point to a promising forecast for Acerinox's business outlook.

- Navigate through the intricacies of Acerinox with our comprehensive financial health report here.

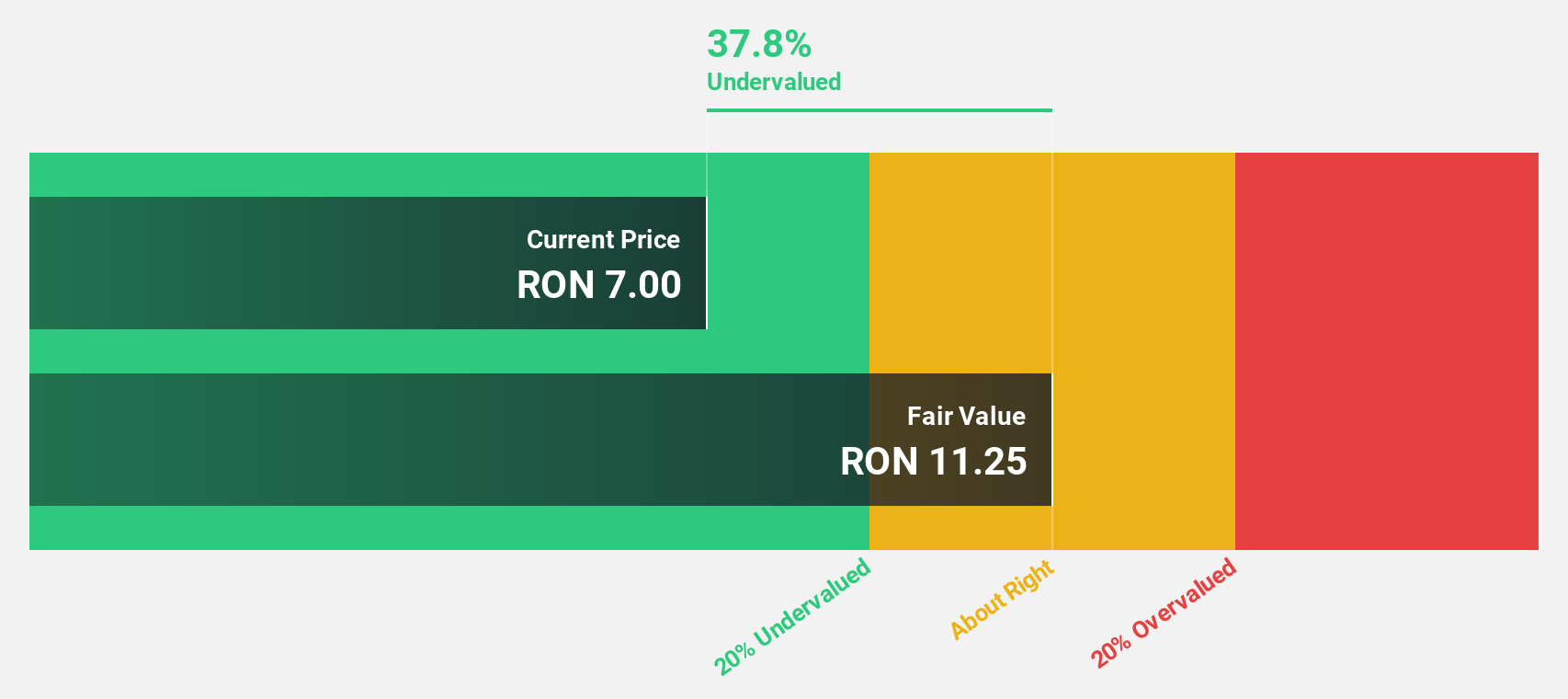

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is involved in the exploration, production, and supply of natural gas in Romania, with a market cap of RON20.85 billion.

Operations: The company's revenue segments consist of RON7.29 billion from production, RON552.61 million from storage, and RON588.62 million from electricity.

Estimated Discount To Fair Value: 34.6%

SNGN Romgaz is trading 34.6% below its estimated fair value of RON8.25, highlighting substantial undervaluation based on discounted cash flow analysis. Earnings and revenue are forecast to grow annually at 7.65% and 10.9%, respectively, outpacing the Romanian market's growth rates. Despite recent declines in quarterly sales and net income, nine-month earnings increased year-over-year to RON2.27 billion from RON2.17 billion, demonstrating resilience amid challenging conditions.

- Our growth report here indicates SNGN Romgaz may be poised for an improving outlook.

- Click here to discover the nuances of SNGN Romgaz with our detailed financial health report.

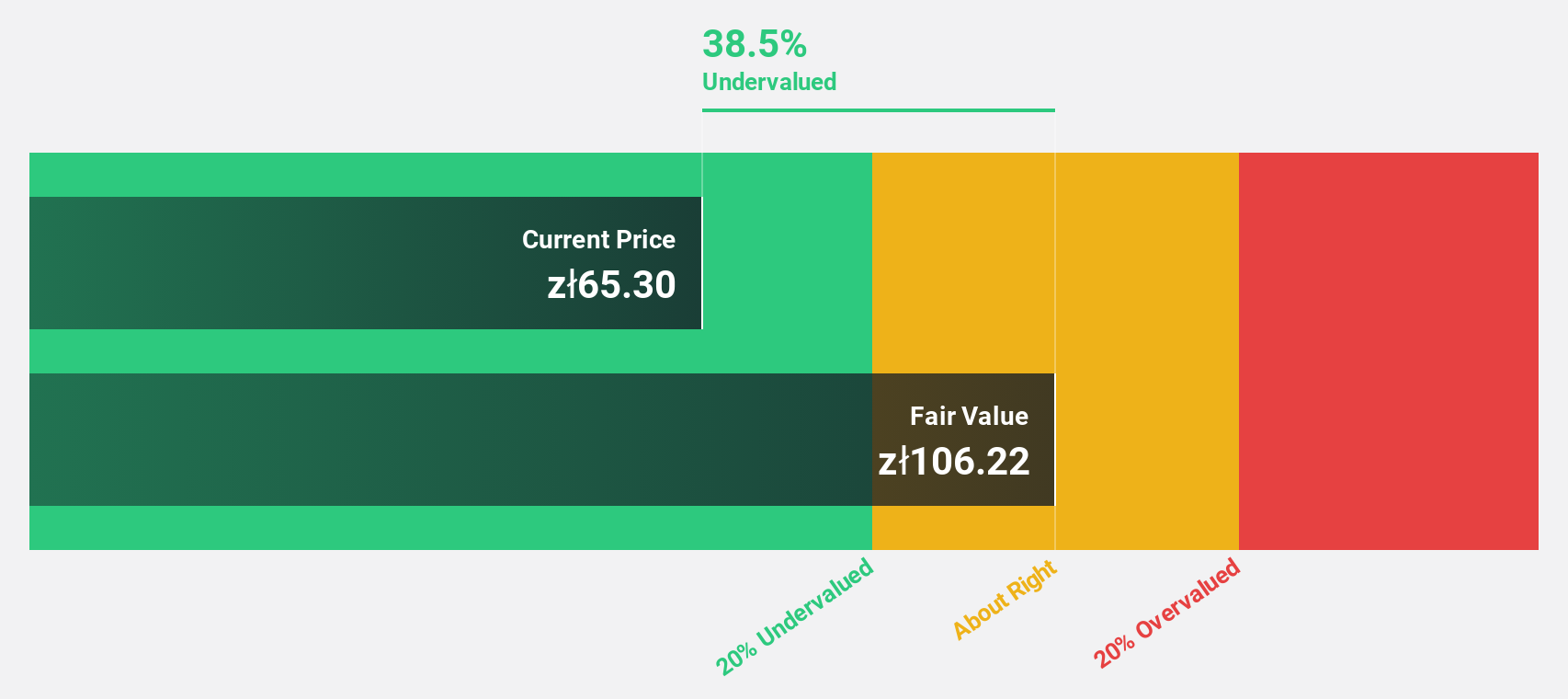

Grupa Pracuj (WSE:GPP)

Overview: Grupa Pracuj S.A. operates in the digital recruitment market across Poland, Ukraine, and Germany with a market cap of PLN3.80 billion.

Operations: The company's revenue is primarily derived from its Staffing & Outsourcing Services segment, which generated PLN756.07 million.

Estimated Discount To Fair Value: 44.4%

Grupa Pracuj is trading at PLN56, significantly below its estimated fair value of PLN100.68, indicating undervaluation based on cash flow analysis. Recent earnings showed growth with third-quarter net income rising to PLN60.59 million from PLN49.59 million year-over-year. Forecasts suggest annual profit growth of 20.2%, outpacing the Polish market's 16.3%. Despite an unstable dividend record, its projected revenue and earnings growth underscore potential investment appeal amidst robust financial performance projections.

- In light of our recent growth report, it seems possible that Grupa Pracuj's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Grupa Pracuj.

Taking Advantage

- Click this link to deep-dive into the 913 companies within our Undervalued Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:GPP

Grupa Pracuj

Operates in the digital recruitment market in Poland, Ukraine, and Germany.

High growth potential with solid track record.

Market Insights

Community Narratives