- Denmark

- /

- Medical Equipment

- /

- CPSE:AMBU B

European Stocks Priced Below Estimated Value In May 2025

Reviewed by Simply Wall St

As European markets experience a boost in sentiment following the easing of trade tensions between the U.S. and China, major indices such as Germany’s DAX and France’s CAC 40 have posted notable gains. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential value relative to their current market price amidst improved economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lectra (ENXTPA:LSS) | €24.10 | €47.47 | 49.2% |

| Absolent Air Care Group (OM:ABSO) | SEK218.00 | SEK417.99 | 47.8% |

| Vestas Wind Systems (CPSE:VWS) | DKK110.30 | DKK214.43 | 48.6% |

| Arcure (ENXTPA:ALCUR) | €4.765 | €9.20 | 48.2% |

| Claranova (ENXTPA:CLA) | €2.84 | €5.48 | 48.2% |

| MilDef Group (OM:MILDEF) | SEK229.00 | SEK437.52 | 47.7% |

| illimity Bank (BIT:ILTY) | €3.684 | €7.28 | 49.4% |

| 3U Holding (XTRA:UUU) | €1.59 | €3.12 | 49.1% |

| Expert.ai (BIT:EXAI) | €1.332 | €2.59 | 48.5% |

| HBX Group International (BME:HBX) | €10.26 | €19.68 | 47.9% |

Underneath we present a selection of stocks filtered out by our screen.

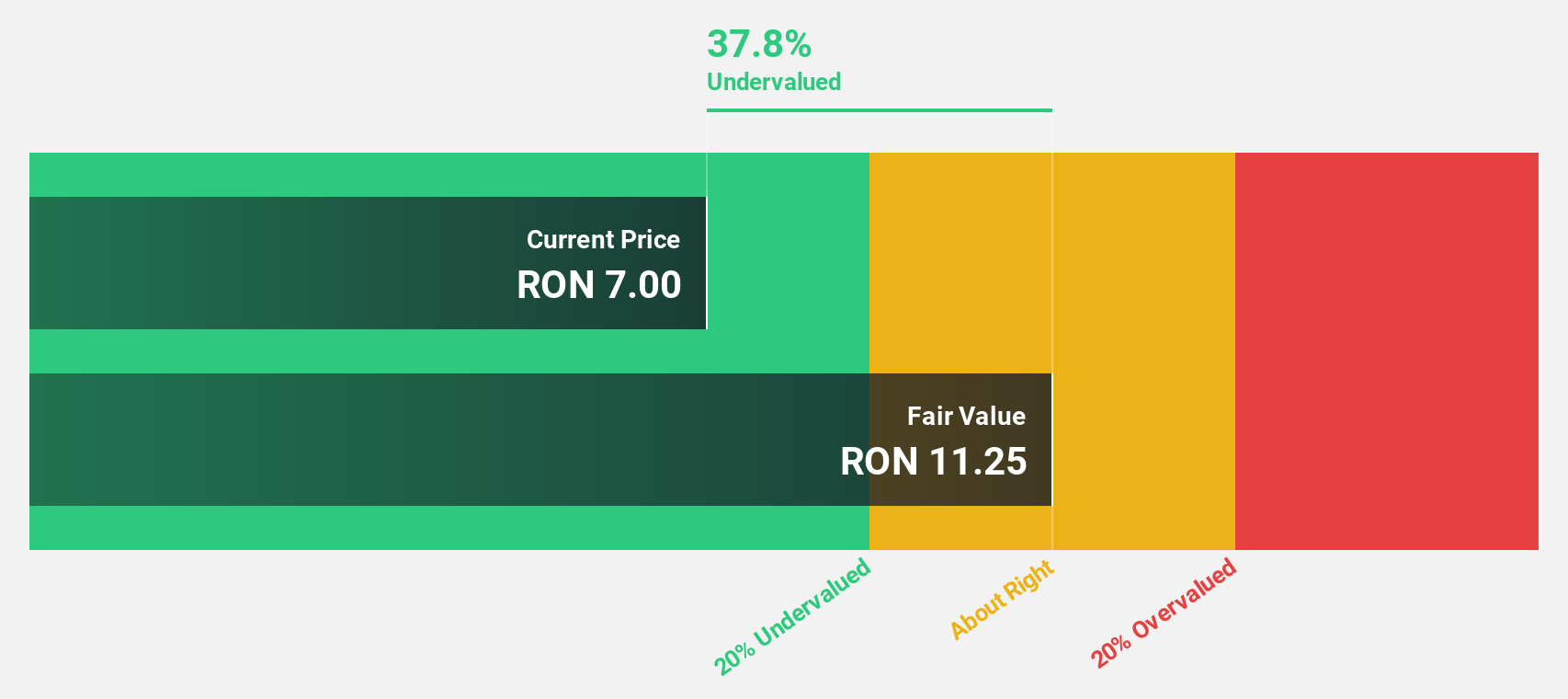

SNGN Romgaz (BVB:SNG)

Overview: SNGN Romgaz SA is a Romanian company involved in the exploration, production, and supply of natural gas, with a market cap of RON22.66 billion.

Operations: The company's revenue segments include natural gas production and supply, generating RON5.23 billion, electricity production contributing RON1.24 billion, and storage services adding RON0.48 billion.

Estimated Discount To Fair Value: 46.8%

SNGN Romgaz is trading at RON5.88, significantly below its estimated fair value of RON11.04, indicating it may be undervalued based on cash flows. Despite slower revenue growth forecasts of 10.5% annually, earnings are expected to grow faster than the Romanian market at 12.8%. Recent quarterly results showed a decline in net income to RON950.98 million from RON1,245.33 million year-on-year, highlighting potential challenges despite its attractive valuation relative to peers and industry standards.

- Our growth report here indicates SNGN Romgaz may be poised for an improving outlook.

- Navigate through the intricacies of SNGN Romgaz with our comprehensive financial health report here.

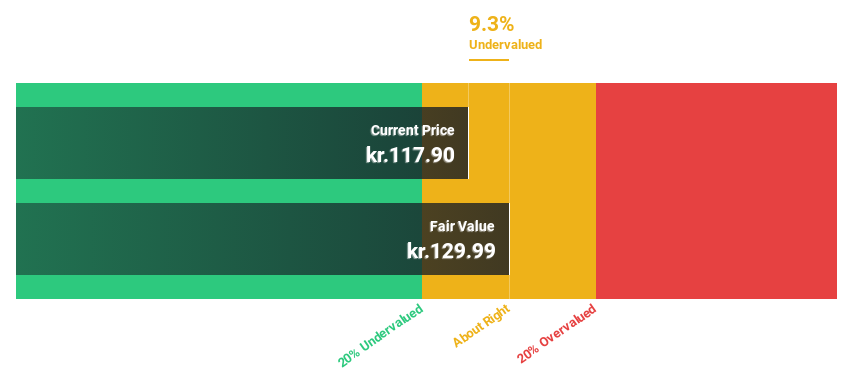

Ambu (CPSE:AMBU B)

Overview: Ambu A/S is a medical technology company that develops, produces, and sells medical devices to hospitals, clinics, and rescue services globally, with a market cap of DKK28.02 billion.

Operations: The company generates revenue primarily from its Disposable Medical Products segment, which accounts for DKK5.83 billion.

Estimated Discount To Fair Value: 17.2%

Ambu A/S, trading at DKK105.2, is below its estimated fair value of DKK126.98, reflecting potential undervaluation based on cash flows. Earnings are projected to grow 24.8% annually over the next three years, outpacing the Danish market's 7.6%. Recent results showed increased sales and net income for Q2 2025 compared to last year, with earnings per share rising from DKK0.54 to DKK0.71, supporting positive growth expectations despite a moderate return on equity forecast of 13.9%.

- The growth report we've compiled suggests that Ambu's future prospects could be on the up.

- Take a closer look at Ambu's balance sheet health here in our report.

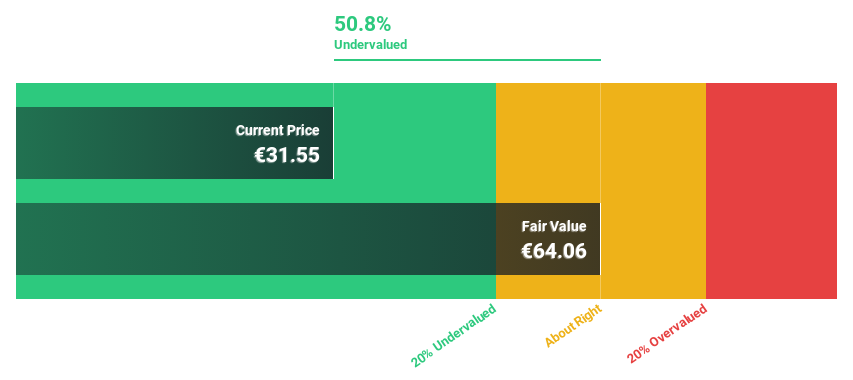

Sword Group (ENXTPA:SWP)

Overview: Sword Group S.E. is a company that offers IT and software solutions globally, with a market cap of €313.74 million.

Operations: The company's revenue is derived from its services in Belux (€109.25 million), Switzerland (€116.37 million), and the United Kingdom (€97.39 million).

Estimated Discount To Fair Value: 46.1%

Sword Group, trading at €33.25, is significantly undervalued based on discounted cash flow analysis with a fair value estimate of €61.64. Despite recent earnings showing a slight decline in net income to €21.81 million, the company’s revenue forecast of 10.8% annually exceeds the French market average and supports its growth potential. The recent WHO contract underscores strategic international expansion, while analysts anticipate a 29.5% stock price increase, reflecting positive sentiment despite dividend sustainability concerns.

- Upon reviewing our latest growth report, Sword Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Sword Group with our detailed financial health report.

Turning Ideas Into Actions

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 173 more companies for you to explore.Click here to unveil our expertly curated list of 176 Undervalued European Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ambu, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:AMBU B

Ambu

A medical technology company, develops, produces, and sells medical devices to hospitals, clinics, and rescue services worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives