- Romania

- /

- Hospitality

- /

- BVB:BCM

Casa de Bucovina - Club de Munte's (BVB:BCM) Stock Price Has Reduced 17% In The Past Year

While it may not be enough for some shareholders, we think it is good to see the Casa de Bucovina - Club de Munte S.A. (BVB:BCM) share price up 14% in a single quarter. But that doesn't change the reality of under-performance over the last twelve months. The cold reality is that the stock has dropped 17% in one year, under-performing the market.

View our latest analysis for Casa de Bucovina - Club de Munte

Because Casa de Bucovina - Club de Munte made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In just one year Casa de Bucovina - Club de Munte saw its revenue fall by 45%. That looks pretty grim, at a glance. The stock price has languished lately, falling 17% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

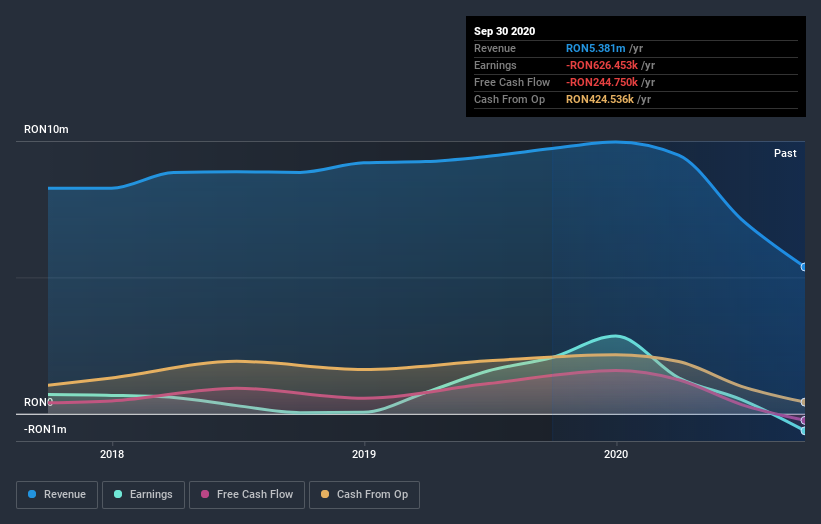

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Casa de Bucovina - Club de Munte's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Casa de Bucovina - Club de Munte the TSR over the last year was -1.8%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in Casa de Bucovina - Club de Munte had a tough year, with a total loss of 1.8% (including dividends), against a market gain of about 5.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 8%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for Casa de Bucovina - Club de Munte (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

But note: Casa de Bucovina - Club de Munte may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RO exchanges.

If you decide to trade Casa de Bucovina - Club de Munte, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BVB:BCM

Flawless balance sheet low.

Market Insights

Community Narratives