Take Care Before Diving Into The Deep End On IAMBA Arad S.A. (BVB:FERO)

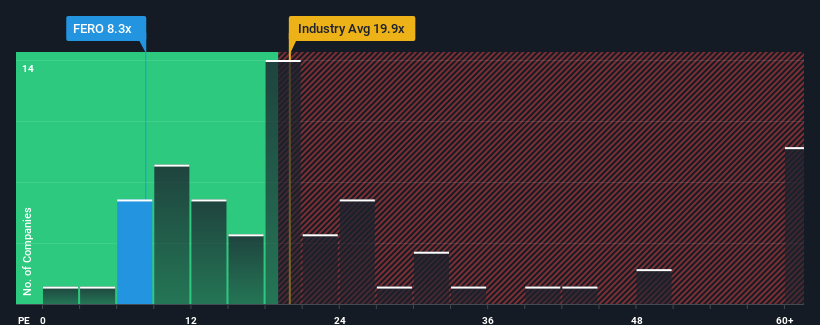

IAMBA Arad S.A.'s (BVB:FERO) price-to-earnings (or "P/E") ratio of 8.3x might make it look like a buy right now compared to the market in Romania, where around half of the companies have P/E ratios above 14x and even P/E's above 38x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's exceedingly strong of late, IAMBA Arad has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for IAMBA Arad

Is There Any Growth For IAMBA Arad?

IAMBA Arad's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 38%. Pleasingly, EPS has also lifted 172% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to decline by 7.0% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that IAMBA Arad's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that IAMBA Arad currently trades on a much lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. We think potential risks might be placing significant pressure on the P/E ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader market turmoil. At least the risk of a price drop looks to be subdued, but investors think future earnings could see a lot of volatility.

Having said that, be aware IAMBA Arad is showing 4 warning signs in our investment analysis, and 2 of those can't be ignored.

If you're unsure about the strength of IAMBA Arad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:FERO

IAMBA Arad

Manufactures and sells hardware for doors, windows, and furniture in Romania.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives