- Qatar

- /

- Marine and Shipping

- /

- DSM:QNNS

Not Many Are Piling Into Qatar Navigation Q.P.S.C. (DSM:QNNS) Just Yet

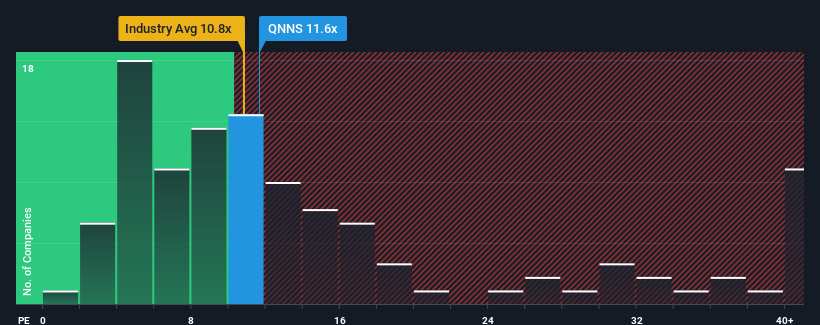

Qatar Navigation Q.P.S.C.'s (DSM:QNNS) price-to-earnings (or "P/E") ratio of 11.6x might make it look like a buy right now compared to the market in Qatar, where around half of the companies have P/E ratios above 14x and even P/E's above 19x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Qatar Navigation Q.P.S.C as its earnings have been rising slower than most other companies. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

Check out our latest analysis for Qatar Navigation Q.P.S.C

How Is Qatar Navigation Q.P.S.C's Growth Trending?

Qatar Navigation Q.P.S.C's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 1,643% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 13% per annum as estimated by the two analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 8.2% per year, which is noticeably less attractive.

In light of this, it's peculiar that Qatar Navigation Q.P.S.C's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Qatar Navigation Q.P.S.C currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Qatar Navigation Q.P.S.C that you should be aware of.

If these risks are making you reconsider your opinion on Qatar Navigation Q.P.S.C, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Qatar Navigation Q.P.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DSM:QNNS

Qatar Navigation Q.P.S.C

Operates as a maritime and logistics company in Qatar, the United Arab Emirates, Singapore, and Germany.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)