- Qatar

- /

- Basic Materials

- /

- DSM:QNCD

Does Qatar National Cement Company (Q.P.S.C.)'s (DSM:QNCD) Statutory Profit Adequately Reflect Its Underlying Profit?

Broadly speaking, profitable businesses are less risky than unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding Qatar National Cement Company (Q.P.S.C.) (DSM:QNCD).

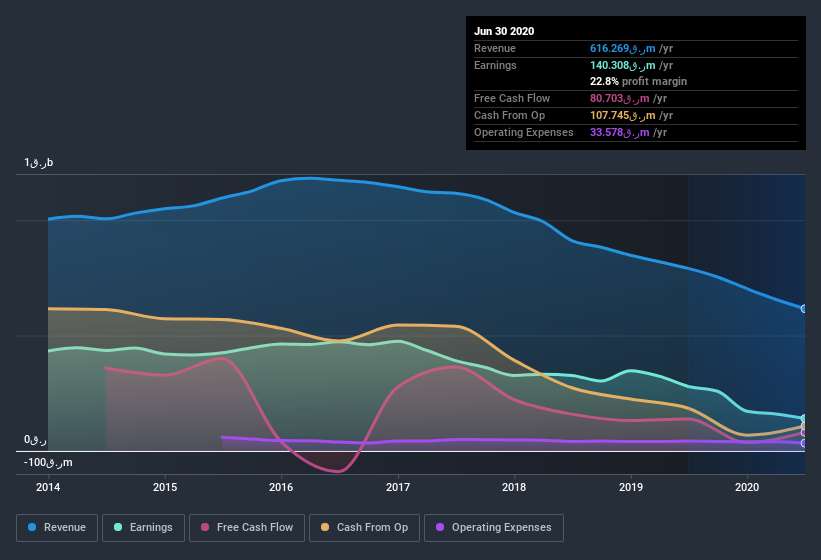

While Qatar National Cement Company (Q.P.S.C.) was able to generate revenue of ر.ق616.3m in the last twelve months, we think its profit result of ر.ق140.3m was more important. The chart below shows that both revenue and profit have declined over the last three years.

Check out our latest analysis for Qatar National Cement Company (Q.P.S.C.)

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Qatar National Cement Company (Q.P.S.C.).

Our Take On Qatar National Cement Company (Q.P.S.C.)'s Profit Performance

Therefore, it seems possible to us that Qatar National Cement Company (Q.P.S.C.)'s true underlying earnings power is actually less than its statutory profit. So while earnings quality is important, it's equally important to consider the risks facing Qatar National Cement Company (Q.P.S.C.) at this point in time. For example, we've found that Qatar National Cement Company (Q.P.S.C.) has 3 warning signs (1 shouldn't be ignored!) that deserve your attention before going any further with your analysis.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you decide to trade Qatar National Cement Company (Q.P.S.C.), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Qatar National Cement Company (Q.P.S.C.) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About DSM:QNCD

Qatar National Cement Company (Q.P.S.C.)

Manufactures and sells cement, lime, washed sand, and other related products in Qatar.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026