We Wouldn't Be Too Quick To Buy Doha Insurance Group Q.P.S.C. (DSM:DOHI) Before It Goes Ex-Dividend

Doha Insurance Group Q.P.S.C. (DSM:DOHI) stock is about to trade ex-dividend in four days. Investors can purchase shares before the 23rd of March in order to be eligible for this dividend, which will be paid on the 1st of January.

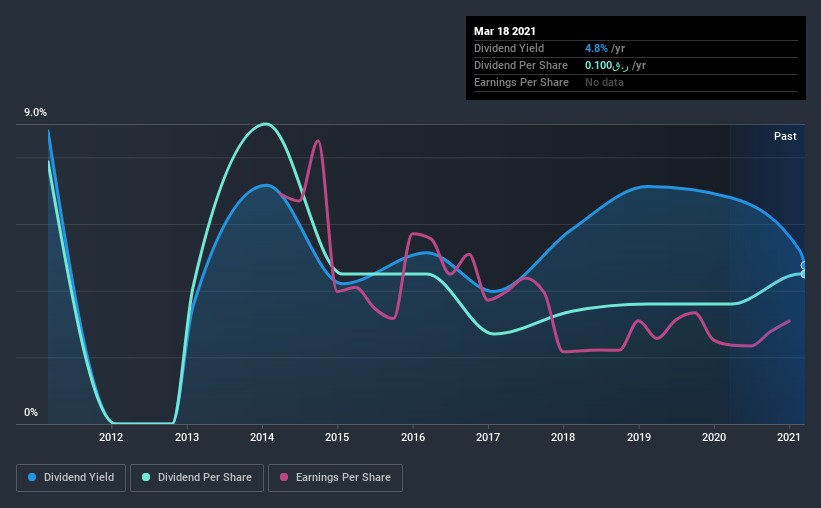

Doha Insurance Group Q.P.S.C's next dividend payment will be ر.ق0.10 per share, and in the last 12 months, the company paid a total of ر.ق0.10 per share. Calculating the last year's worth of payments shows that Doha Insurance Group Q.P.S.C has a trailing yield of 4.8% on the current share price of QAR2.101. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Doha Insurance Group Q.P.S.C can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Doha Insurance Group Q.P.S.C

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. It paid out 83% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit Doha Insurance Group Q.P.S.C paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Doha Insurance Group Q.P.S.C's earnings per share have dropped 12% a year over the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Doha Insurance Group Q.P.S.C has seen its dividend decline 5.4% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

Has Doha Insurance Group Q.P.S.C got what it takes to maintain its dividend payments? Earnings per share have been declining and the company is paying out more than half its profits to shareholders; not an enticing combination. Doha Insurance Group Q.P.S.C doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

With that in mind though, if the poor dividend characteristics of Doha Insurance Group Q.P.S.C don't faze you, it's worth being mindful of the risks involved with this business. We've identified 3 warning signs with Doha Insurance Group Q.P.S.C (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Doha Insurance Group Q.P.S.C, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About DSM:DOHI

Doha Insurance Group Q.P.S.C

Engages in insurance and reinsurance businesses in Qatar, the United Arab Emirates, Lebanon, Luxembourg, and Jordan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)