- Portugal

- /

- Renewable Energy

- /

- ENXTLS:EDPR

EDP Renováveis (ELI:EDPR investor three-year losses grow to 49% as the stock sheds €598m this past week

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term EDP Renováveis, S.A. (ELI:EDPR) shareholders, since the share price is down 51% in the last three years, falling well short of the market decline of around 6.2%. And the ride hasn't got any smoother in recent times over the last year, with the price 40% lower in that time. Shareholders have had an even rougher run lately, with the share price down 24% in the last 90 days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for EDP Renováveis

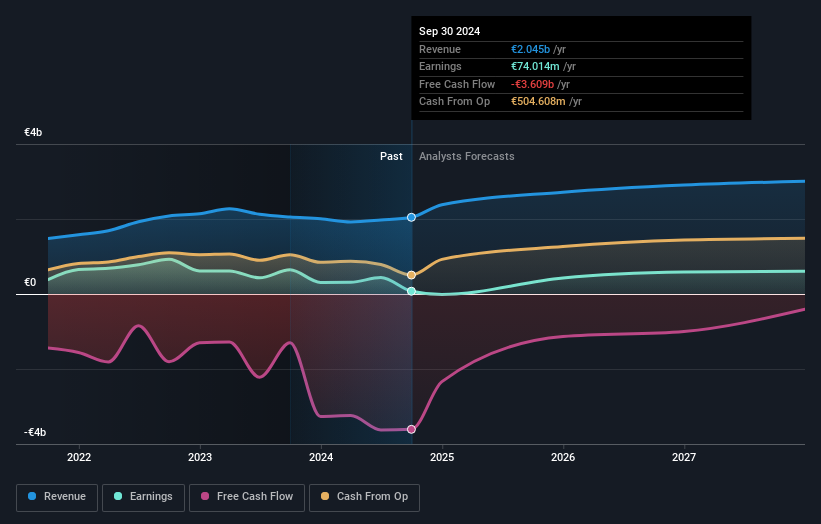

We don't think that EDP Renováveis' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

In the last three years, EDP Renováveis saw its revenue grow by 7.3% per year, compound. That's not a very high growth rate considering it doesn't make profits. It's likely this weak growth has contributed to an annualised return of 15% for the last three years. When a stock falls hard like this, some investors like to add the company to a watchlist (in case the business recovers, longer term). Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for EDP Renováveis in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that EDP Renováveis shareholders are down 39% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 4.5%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with EDP Renováveis (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

But note: EDP Renováveis may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Portuguese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if EDP Renováveis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:EDPR

EDP Renováveis

A renewable energy company, plans, constructs, operates, and maintains electricity power stations.

Reasonable growth potential minimal.

Similar Companies

Market Insights

Community Narratives