- Portugal

- /

- Telecom Services and Carriers

- /

- ENXTLS:NOS

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets continue to show resilience, with the pan-European STOXX Europe 600 Index posting its longest streak of weekly gains since August 2012, investors are increasingly looking towards dividend stocks as a means to bolster their portfolios amidst mixed economic signals. In this environment, selecting stocks with a strong track record of consistent dividend payouts and robust financial health can be crucial in navigating the uncertainties posed by fluctuating inflation rates and varying economic growth across key European economies.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.30% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.29% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.91% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.83% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.47% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.40% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.35% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.58% | ★★★★★★ |

| Thermador Groupe (ENXTPA:THEP) | 3.16% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.70% | ★★★★★☆ |

Click here to see the full list of 222 stocks from our Top European Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

NOS S.G.P.S (ENXTLS:NOS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NOS, S.G.P.S., S.A. operates in the telecommunications and entertainment sectors with a market capitalization of €2.18 billion.

Operations: NOS, S.G.P.S., S.A. generates revenue primarily from its telecommunications and entertainment operations.

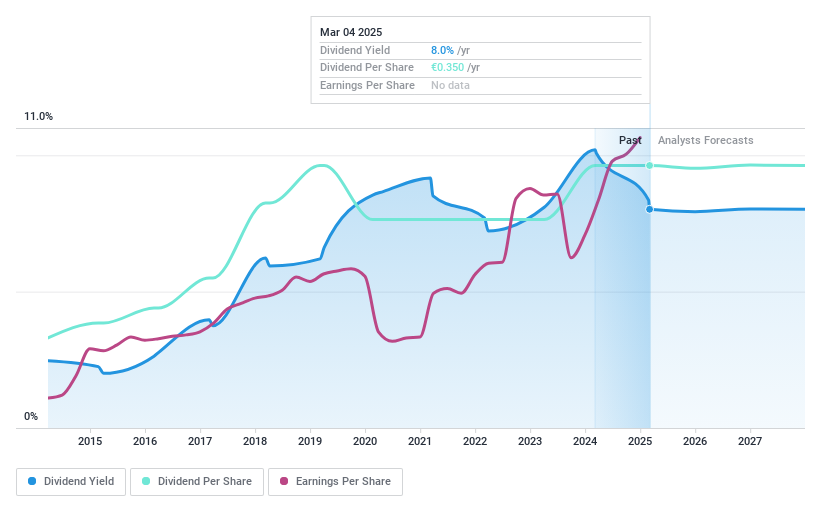

Dividend Yield: 8.2%

NOS S.G.P.S. reported strong earnings growth with net income rising to €71.1 million in Q4 2024, up from €54.7 million the previous year, supporting its dividend payments well covered by a 69.7% payout ratio and a low 39% cash payout ratio. However, its dividend history has been volatile over the past decade despite recent increases and remains unreliable. The stock trades at a significant discount to estimated fair value, enhancing its appeal for value-focused investors seeking high yields in Portugal's market.

- Dive into the specifics of NOS S.G.P.S here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that NOS S.G.P.S is trading behind its estimated value.

Engie (ENXTPA:ENGI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENGIE SA operates in the power, natural gas, and energy services sectors with a market cap of approximately €41.82 billion.

Operations: ENGIE SA's revenue segments include Retail (€14.48 billion), Nuclear (€3.73 billion), Flex Gen (€6.33 billion), Networks (€8.28 billion), Renewables (€5.64 billion), and Energy Solutions (€10.13 billion).

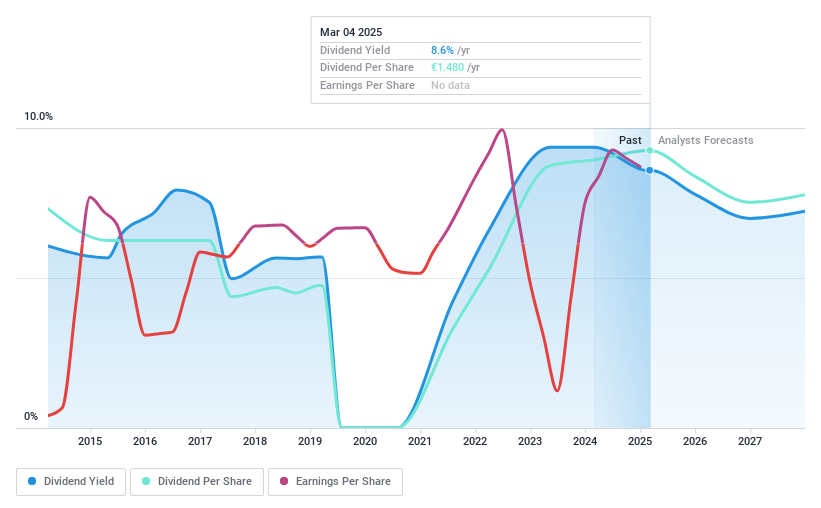

Dividend Yield: 8.6%

Engie's recent earnings report showed a net income increase to €4.11 billion, up from €2.21 billion the previous year, supporting a dividend increase to €1.48 per share payable in April 2025. Despite this growth, Engie's dividend sustainability is questionable due to a high cash payout ratio of 95.5% and historical volatility in payments over the past decade. The stock trades at good value compared to peers, but its financial position is weakened by high debt levels and declining revenue forecasts.

- Delve into the full analysis dividend report here for a deeper understanding of Engie.

- Insights from our recent valuation report point to the potential undervaluation of Engie shares in the market.

Wienerberger (WBAG:WIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wienerberger AG is a company that produces and sells clay blocks, facing bricks, roof tiles, and pavers in Europe with a market cap of €3.53 billion.

Operations: Wienerberger AG's revenue is derived from its production and sale of clay blocks, facing bricks, roof tiles, and pavers across Europe.

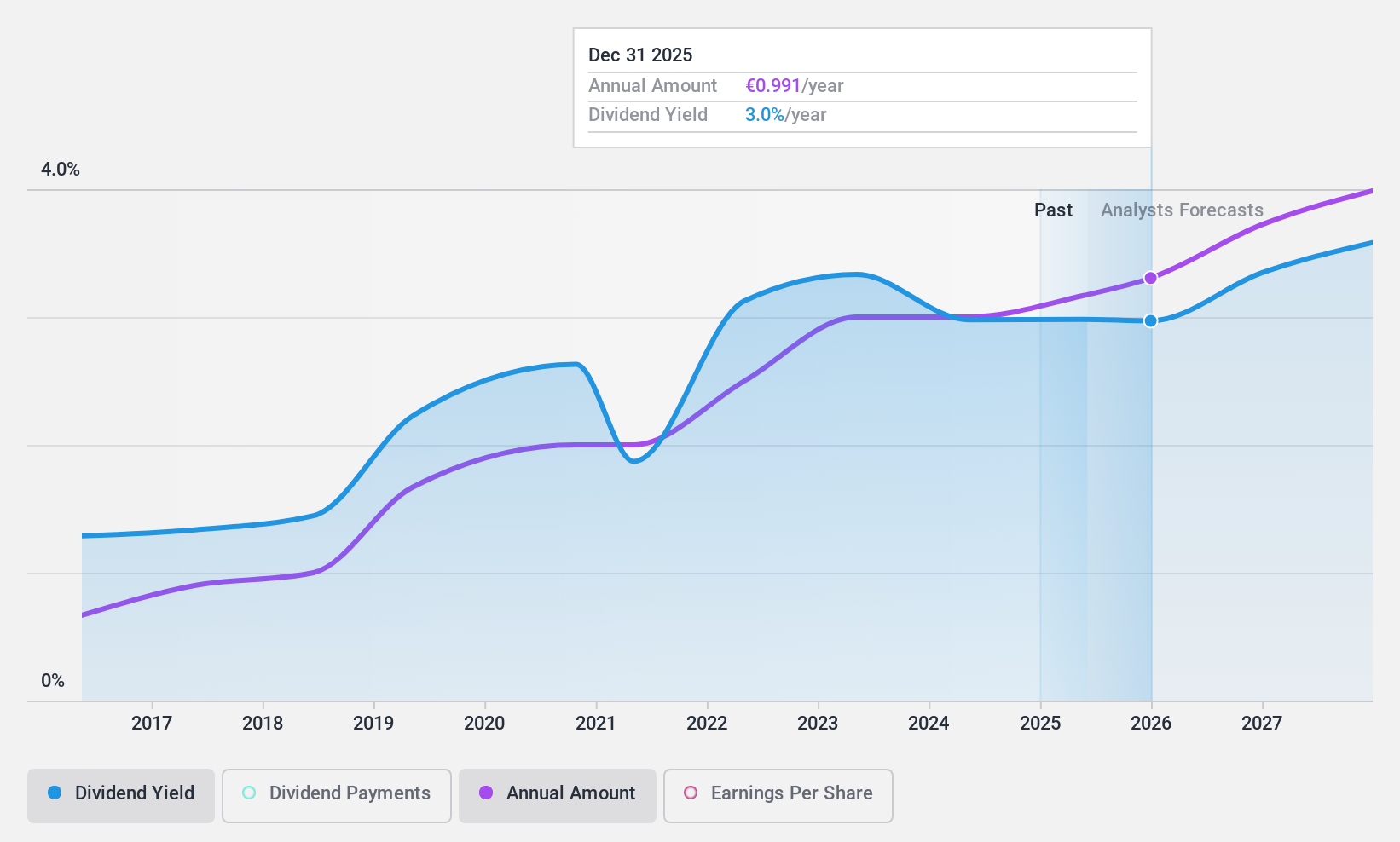

Dividend Yield: 3%

Wienerberger's dividend growth is evident with a proposed increase to €0.95 per share, but its sustainability is questionable due to a high payout ratio of 131.3% and inadequate earnings coverage. Despite stable dividends over the past decade, recent earnings reveal a significant drop in net income to €79.76 million from €334.36 million last year, highlighting financial challenges. However, strategic expansions like Wioniq offer potential growth avenues in water and energy infrastructure sectors.

- Click here and access our complete dividend analysis report to understand the dynamics of Wienerberger.

- The valuation report we've compiled suggests that Wienerberger's current price could be inflated.

Where To Now?

- Discover the full array of 222 Top European Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOS S.G.P.S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:NOS

NOS S.G.P.S

Engages in the telecommunications and entertainment business..

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives