A Piece Of The Puzzle Missing From Impresa - Sociedade Gestora de Participações Sociais, S.A.'s (ELI:IPR) 36% Share Price Climb

Impresa - Sociedade Gestora de Participações Sociais, S.A. (ELI:IPR) shareholders have had their patience rewarded with a 36% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 3.7% isn't as impressive.

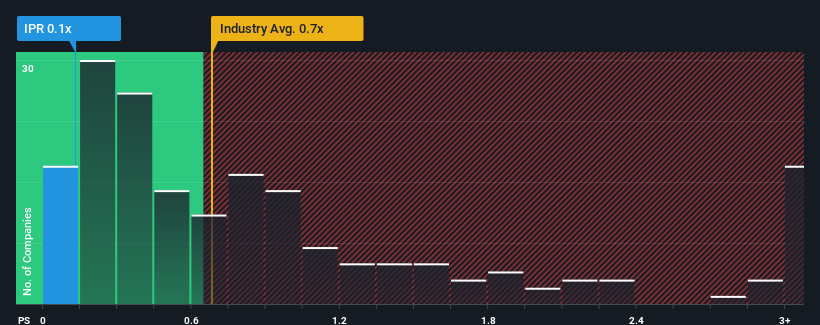

In spite of the firm bounce in price, it would still be understandable if you think Impresa - Sociedade Gestora de Participações Sociais is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Portugal's Media industry have P/S ratios above 0.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Impresa - Sociedade Gestora de Participações Sociais

How Impresa - Sociedade Gestora de Participações Sociais Has Been Performing

We'd have to say that with no tangible growth over the last year, Impresa - Sociedade Gestora de Participações Sociais' revenue has been unimpressive. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. Those who are bullish on Impresa - Sociedade Gestora de Participações Sociais will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Impresa - Sociedade Gestora de Participações Sociais, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Impresa - Sociedade Gestora de Participações Sociais' is when the company's growth is on track to lag the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 4.5% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

It's interesting to note that the rest of the industry is similarly expected to decline by 0.3% over the next year, which is just as bad as the company's recent medium-term revenue decline.

With this information, it's perhaps strange but not a major surprise that Impresa - Sociedade Gestora de Participações Sociais is trading at a lower P/S in comparison. In general, shrinking revenues are unlikely to lead to a stable P/S long-term, which could set up shareholders for future disappointment regardless. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From Impresa - Sociedade Gestora de Participações Sociais' P/S?

Despite Impresa - Sociedade Gestora de Participações Sociais' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Impresa - Sociedade Gestora de Participações Sociais currently trades on a lower than expected P/S since its recent three-year revenue growth is no worse than the forecasts for a struggling industry. There could be some further unobserved threats to revenue preventing the P/S ratio from keeping up with the industry average. Perhaps there is some hesitation about the company's ability to stay its recent medium-term course and resist further pain to its business from the broader industry turmoil. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Impresa - Sociedade Gestora de Participações Sociais you should be aware of, and 2 of them shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:IPR

Impresa - Sociedade Gestora de Participações Sociais

Operates in the media industry in Portugal and internationally.

Slight and slightly overvalued.

Market Insights

Community Narratives