- Portugal

- /

- Entertainment

- /

- ENXTLS:FCP

Futebol Clube do Porto - Futebol, S.A.D.'s (ELI:FCP) Business And Shares Still Trailing The Industry

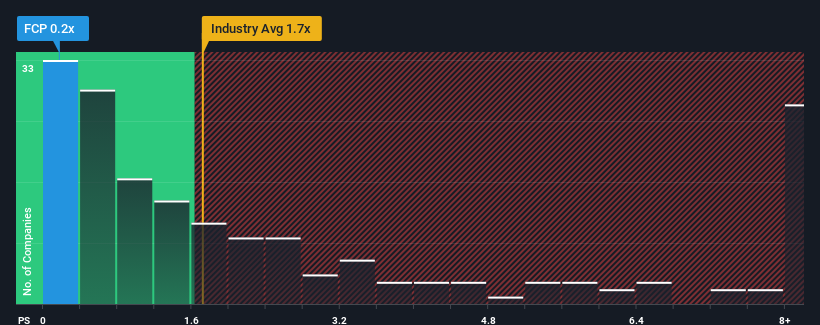

Futebol Clube do Porto - Futebol, S.A.D.'s (ELI:FCP) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Entertainment industry in Portugal, where around half of the companies have P/S ratios above 1.7x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Futebol Clube do Porto - FutebolD

How Has Futebol Clube do Porto - FutebolD Performed Recently?

The revenue growth achieved at Futebol Clube do Porto - FutebolD over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Futebol Clube do Porto - FutebolD will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Futebol Clube do Porto - FutebolD will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Futebol Clube do Porto - FutebolD's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.9% last year. This was backed up an excellent period prior to see revenue up by 32% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Futebol Clube do Porto - FutebolD's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Futebol Clube do Porto - FutebolD's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Futebol Clube do Porto - FutebolD revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Futebol Clube do Porto - FutebolD (2 are potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Futebol Clube do Porto - FutebolD's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTLS:FCP

Futebol Clube do Porto - FutebolD

Futebol Clube do Porto - Futebol, S.A.D., together with its subsidiaries, participates in professional football competitions, and the sporting events promotion and organization in Portugal.

Low risk with weak fundamentals.

Market Insights

Community Narratives