- Poland

- /

- Electric Utilities

- /

- WSE:TPE

Here's Why We Think TAURON Polska Energia (WSE:TPE) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in TAURON Polska Energia (WSE:TPE). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for TAURON Polska Energia

How Fast Is TAURON Polska Energia Growing Its Earnings Per Share?

In the last three years TAURON Polska Energia's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. TAURON Polska Energia's EPS shot up from zł0.49 to zł0.70; a result that's bound to keep shareholders happy. That's a commendable gain of 43%.

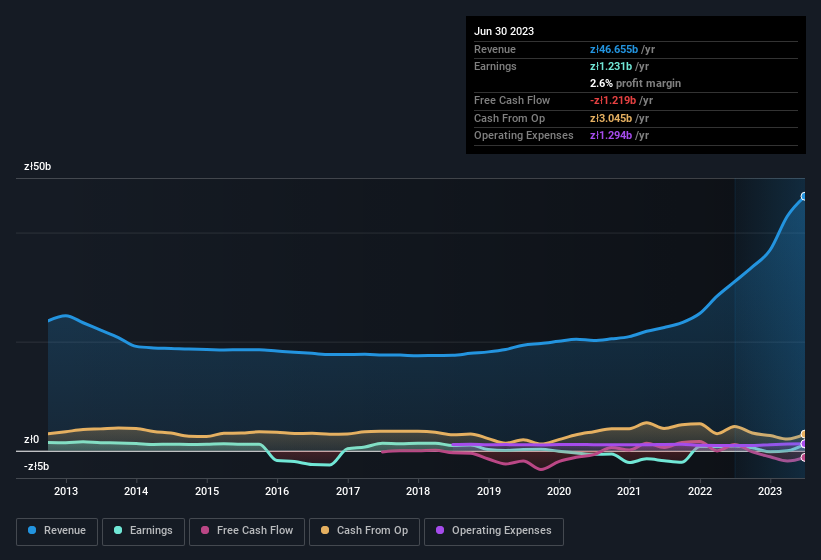

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of TAURON Polska Energia's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The music to the ears of TAURON Polska Energia shareholders is that EBIT margins have grown from 4.5% to 6.8% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for TAURON Polska Energia's future profits.

Are TAURON Polska Energia Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to TAURON Polska Energia, with market caps between zł4.3b and zł14b, is around zł2.8m.

TAURON Polska Energia's CEO took home a total compensation package of zł783k in the year prior to December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does TAURON Polska Energia Deserve A Spot On Your Watchlist?

You can't deny that TAURON Polska Energia has grown its earnings per share at a very impressive rate. That's attractive. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. We think that based on its merits alone, this stock is worth watching into the future. We don't want to rain on the parade too much, but we did also find 2 warning signs for TAURON Polska Energia (1 makes us a bit uncomfortable!) that you need to be mindful of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TAURON Polska Energia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:TPE

TAURON Polska Energia

Through its subsidiaries, generates, distributes, and supplies electricity and heat in Poland.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives