- Poland

- /

- Telecom Services and Carriers

- /

- WSE:OPL

Orange Polska (WSE:OPL) Might Have The Makings Of A Multi-Bagger

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, we've noticed some promising trends at Orange Polska (WSE:OPL) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Orange Polska:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.062 = zł1.3b ÷ (zł26b - zł5.3b) (Based on the trailing twelve months to September 2023).

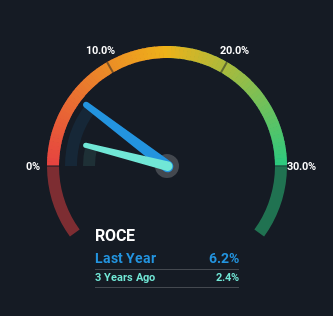

So, Orange Polska has an ROCE of 6.2%. Ultimately, that's a low return and it under-performs the Telecom industry average of 9.7%.

See our latest analysis for Orange Polska

Above you can see how the current ROCE for Orange Polska compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Orange Polska.

The Trend Of ROCE

Orange Polska has not disappointed with their ROCE growth. Looking at the data, we can see that even though capital employed in the business has remained relatively flat, the ROCE generated has risen by 471% over the last five years. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

The Bottom Line

As discussed above, Orange Polska appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. Since the stock has returned a solid 74% to shareholders over the last five years, it's fair to say investors are beginning to recognize these changes. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

If you want to continue researching Orange Polska, you might be interested to know about the 1 warning sign that our analysis has discovered.

While Orange Polska may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:OPL

Orange Polska

Provides telecommunications services for individuals, businesses, and wholesale customers in Poland.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives