As the pan-European STOXX Europe 600 Index enjoys a fourth consecutive week of gains amid hopes for easing trade tensions, small-cap stocks in Europe are drawing increased attention from investors seeking opportunities beyond the major indices. In this environment, identifying promising small-cap companies can be particularly rewarding, as these firms often have unique growth potential and can capitalize on niche market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Dekpol | 70.15% | 14.02% | 14.57% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) is a retailer of home and leisure products operating in Sweden, Norway, Finland, and Germany with a market capitalization of SEK12.52 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden, Norway, and other markets, with Sweden contributing SEK6.68 billion. The company's gross profit margin is a key financial metric to consider when evaluating its performance.

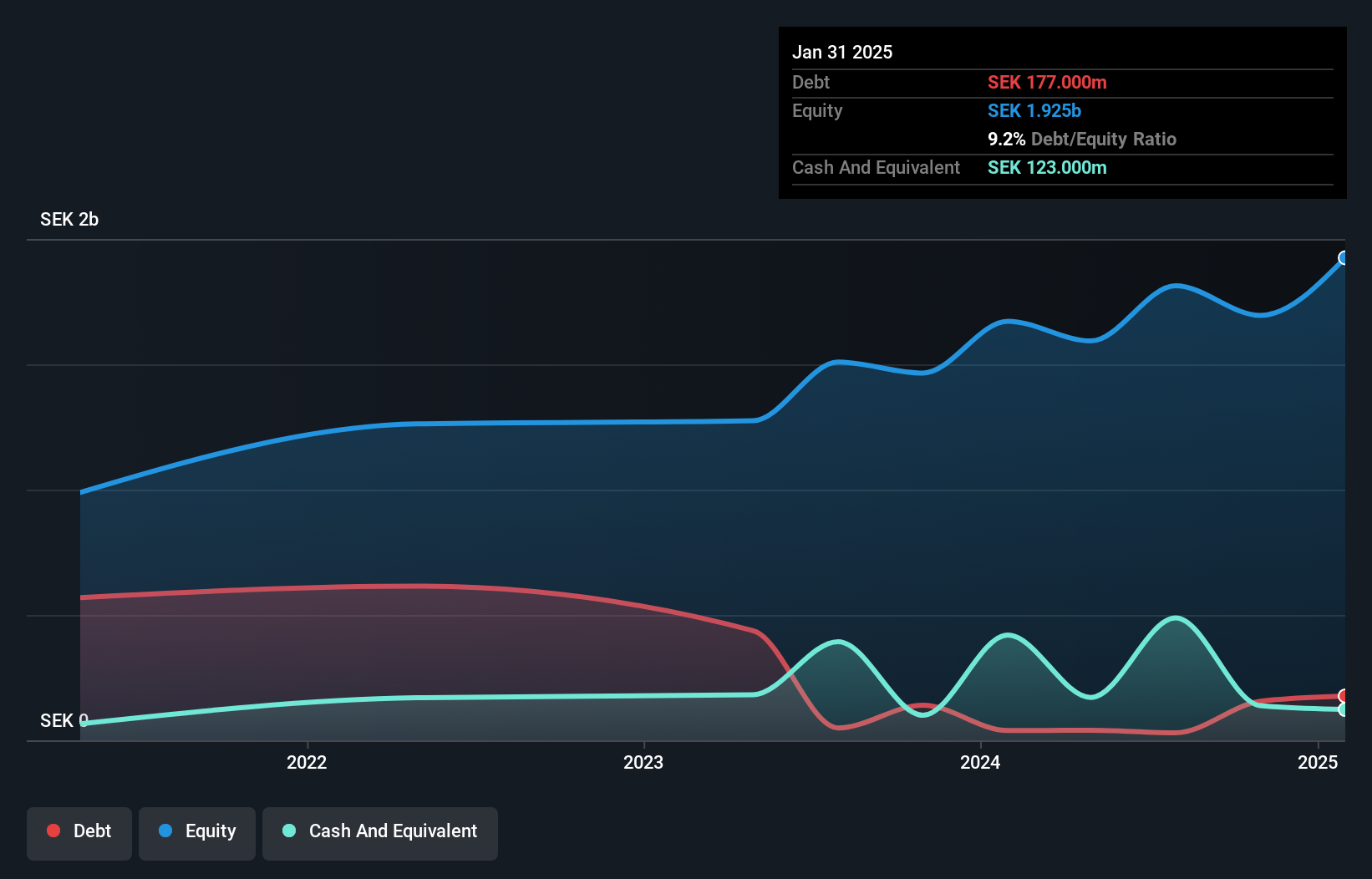

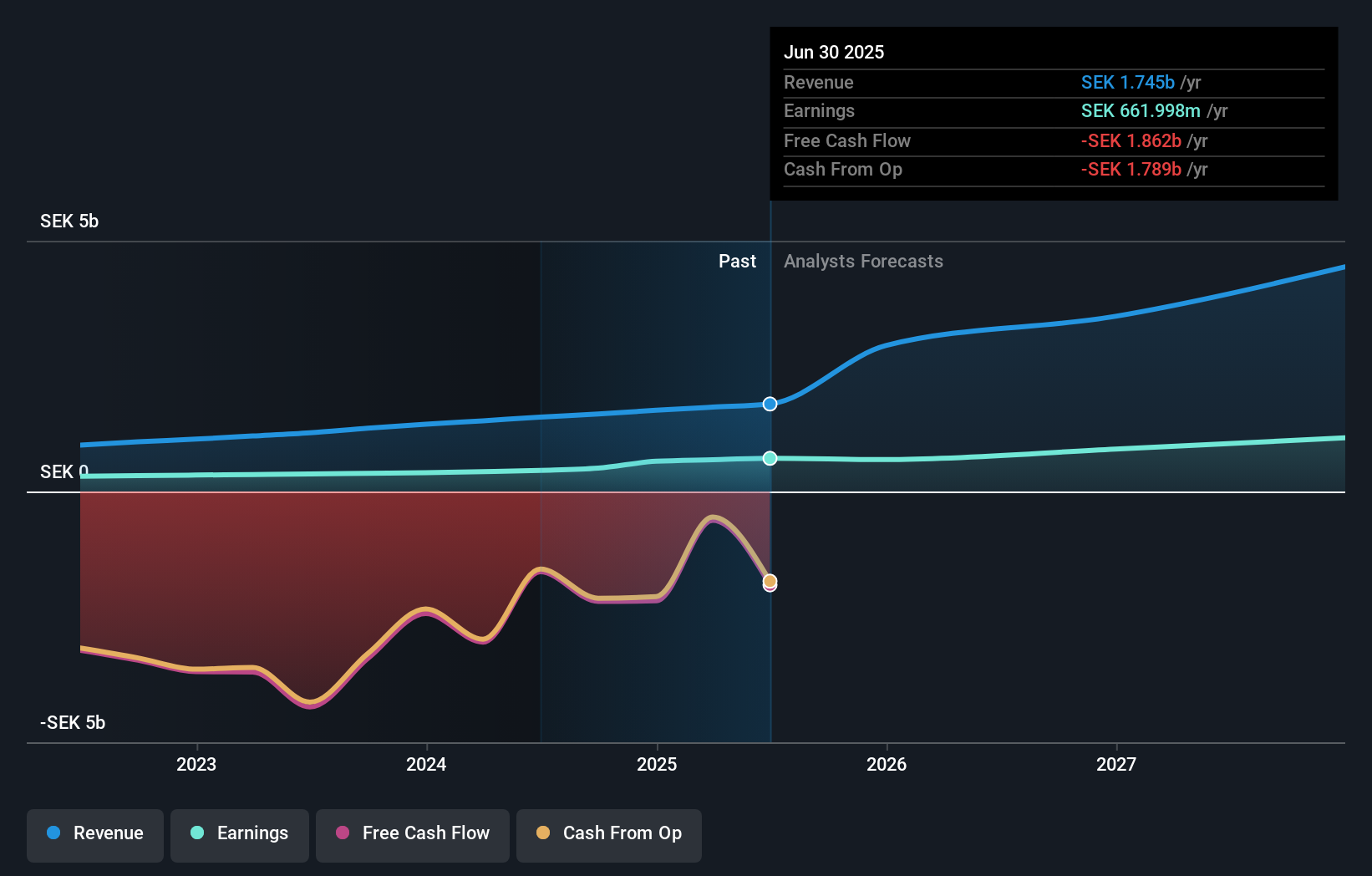

Rusta, a home and leisure retailer, is making waves with its strategic expansion plans across Sweden, Norway, Finland, and Germany. The company recently opened three new stores in March 2025, bringing its total to 223 locations. Financially robust with a net debt to equity ratio of 2.8%, Rusta's EBIT covers interest payments by 3.4 times. Earnings grew by 12.7% last year and are projected to increase annually by 24.4%. Recent earnings show net income at SEK257 million for Q3 compared to SEK243 million the previous year; however, challenges like currency volatility remain considerations for investors.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions via its proprietary IT platform in Sweden, with a market cap of SEK7.95 billion.

Operations: TF Bank generates revenue primarily from three segments: Credit Cards (SEK677.50 million), Consumer Lending (SEK611.92 million), and Ecommerce Solutions excluding Credit Cards (SEK393.80 million). The net profit margin reflects the company's profitability after accounting for all expenses, providing insight into its financial efficiency.

TF Bank, a relatively small player in the European banking sector, showcases robust financial health with total assets of SEK25.1 billion and equity of SEK2.9 billion. The bank's allowance for bad loans stands at 157%, indicating prudent risk management despite a high non-performing loan ratio of 2.8%. Its earnings growth of 59.6% over the past year outpaced the industry average, highlighting its competitive edge. A proposed extraordinary dividend linked to a divestment underscores its strategic agility, while trading at 43% below estimated fair value suggests potential upside for investors seeking undervalued opportunities in Europe’s financial landscape.

- Dive into the specifics of TF Bank here with our thorough health report.

Examine TF Bank's past performance report to understand how it has performed in the past.

Cyber_Folks (WSE:CBF)

Simply Wall St Value Rating: ★★★★★★

Overview: Cyber_Folks S.A. is a technology company focused on business digitization and enterprise support services in Poland and internationally, with a market capitalization of PLN 2.36 billion.

Operations: Cyber_Folks generates revenue primarily from its SaaS segment (PLN 2.37 million) and VERCOM services (PLN 496.23 million), with additional contributions from the Cyber Folks segment (PLN 158.63 million).

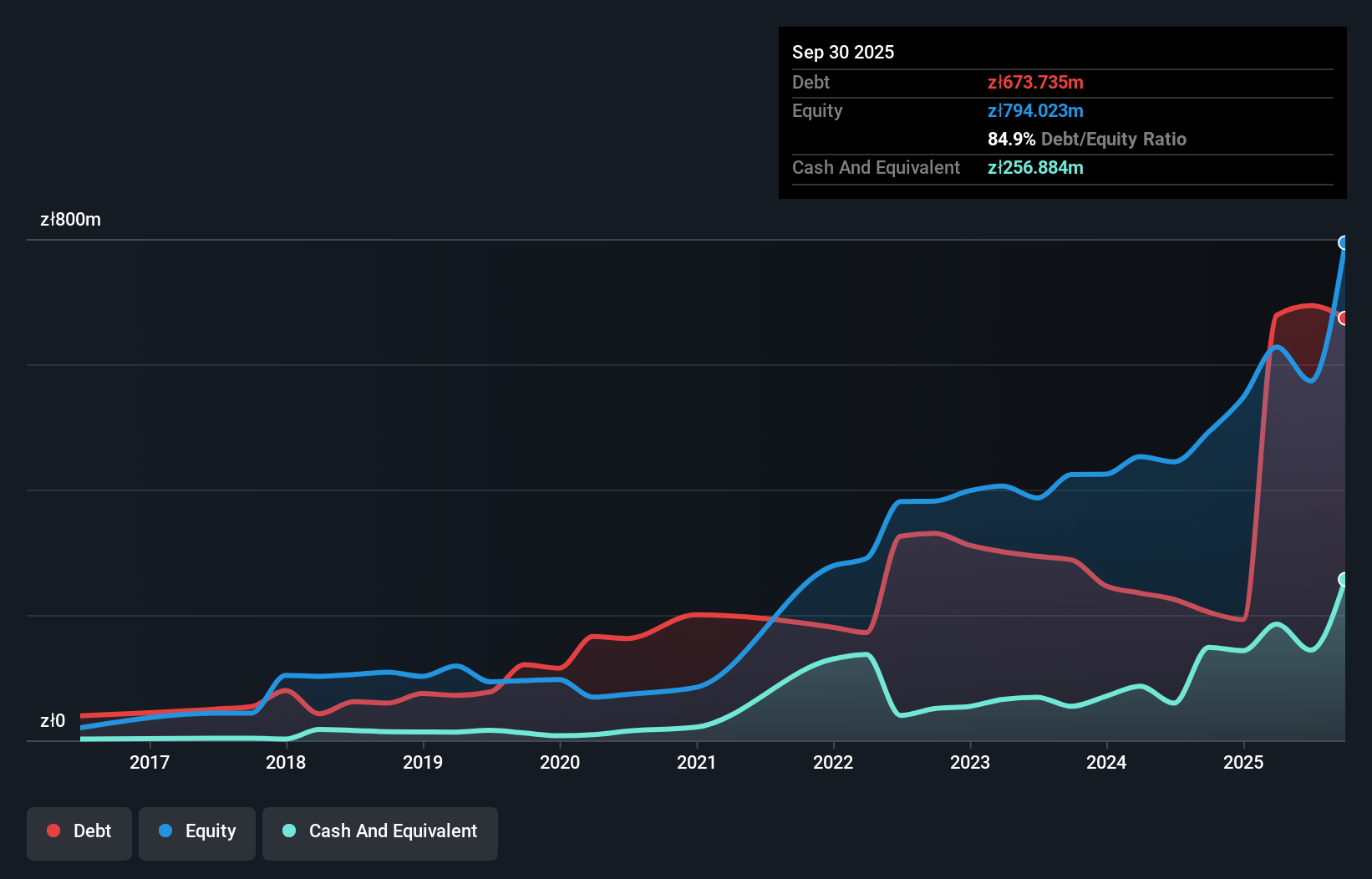

Cyber_Folks has shown impressive financial performance, with earnings growth of 129.8% over the past year, significantly outpacing the Telecom industry's 26.7%. The company's net income rose to PLN116.78 million from PLN50.83 million in the previous year, and its basic earnings per share jumped to PLN8.26 from PLN3.6. A noteworthy reduction in debt levels is evident as their debt-to-equity ratio decreased from 118.5% to 35.2% over five years, indicating sound financial management and a satisfactory net debt-to-equity ratio of 9.1%. Cyber_Folks also announced a dividend increase to PLN2 per share for June 2025, reflecting confidence in its cash flow position and future prospects.

- Unlock comprehensive insights into our analysis of Cyber_Folks stock in this health report.

Gain insights into Cyber_Folks' past trends and performance with our Past report.

Next Steps

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 326 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Rusta AB (publ) retails home and leisure products in Sweden, Norway, Finland, and Germany.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives