David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Maxcom S.A. (WSE:MXC) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Maxcom

What Is Maxcom's Debt?

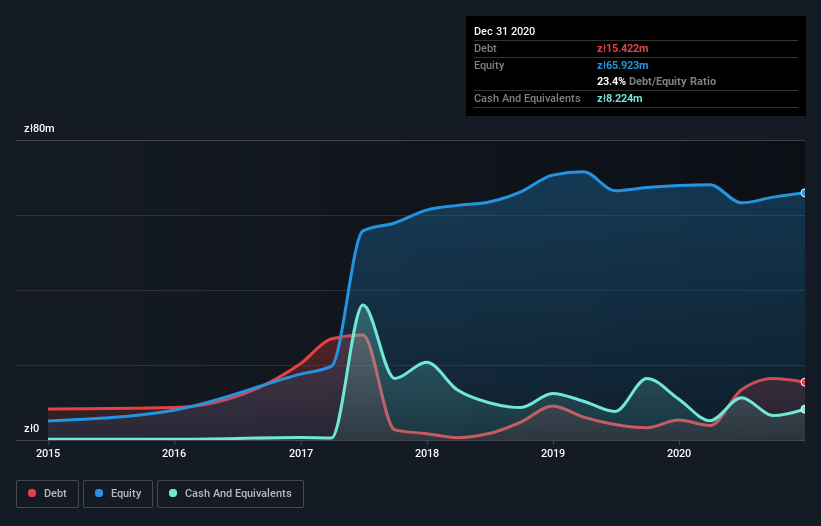

As you can see below, at the end of December 2020, Maxcom had zł15.4m of debt, up from zł5.32m a year ago. Click the image for more detail. However, it does have zł8.22m in cash offsetting this, leading to net debt of about zł7.20m.

How Strong Is Maxcom's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Maxcom had liabilities of zł20.8m due within 12 months and liabilities of zł4.36m due beyond that. Offsetting these obligations, it had cash of zł8.22m as well as receivables valued at zł20.6m due within 12 months. So it can boast zł3.73m more liquid assets than total liabilities.

This short term liquidity is a sign that Maxcom could probably pay off its debt with ease, as its balance sheet is far from stretched.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 1.2 times EBITDA, Maxcom is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 8.5 times the interest expense over the last year. Fortunately, Maxcom grew its EBIT by 5.6% in the last year, making that debt load look even more manageable. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Maxcom will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Maxcom burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Based on what we've seen Maxcom is not finding it easy, given its conversion of EBIT to free cash flow, but the other factors we considered give us cause to be optimistic. In particular, we thought its interest cover was a positive. Considering this range of data points, we think Maxcom is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Maxcom (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Maxcom or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:MXC

Maxcom

Produces, distributes, and sells consumer electronics products in Poland and internationally.

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)