As the European markets navigate through uncertainties surrounding U.S. trade policies, recent economic developments such as the ECB's rate cut and Germany's proposed increase in defense and infrastructure spending have provided a mixed backdrop for investors. In this environment, identifying high growth tech stocks involves looking for companies that can leverage innovation and adaptability to thrive despite broader market challenges.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Devyser Diagnostics | 27.27% | 98.23% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Wiit (BIT:WIIT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wiit S.p.A. offers cloud services to businesses both in Italy and internationally, with a market capitalization of €424.51 million.

Operations: Wiit S.p.A. specializes in delivering cloud services to businesses across Italy and beyond. The company's revenue model centers on providing tailored cloud solutions, leveraging its expertise in managed services to support various business needs.

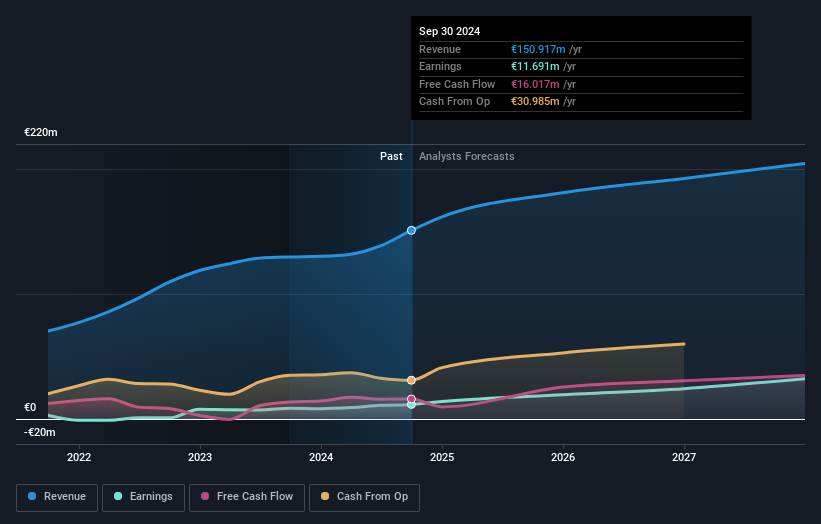

Wiit, a standout in the European tech landscape, is navigating through a dynamic market with notable agility. Over the past year, earnings surged by 35.4%, significantly outpacing the IT industry's growth of 6%. This robust performance is underpinned by an impressive forecast of annual earnings growth at 19.9%, eclipsing Italy's average market expansion of 7.8%. Additionally, Wiit's strategic focus on R&D has fostered innovation and competitiveness; however, specific financial figures on R&D spending were not provided. The company also benefits from high-quality earnings and a strong financial position characterized by positive free cash flow. Looking ahead, while revenue growth projections stand at 7% annually—modest compared to some high-growth benchmarks—it still surpasses the broader Italian market forecast of 4.2%. This blend of solid financial health and strategic market positioning suggests Wiit may continue to thrive amidst evolving industry demands.

- Unlock comprehensive insights into our analysis of Wiit stock in this health report.

Gain insights into Wiit's past trends and performance with our Past report.

SoftwareONE Holding (SWX:SWON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SoftwareONE Holding AG is a global provider of software and cloud solutions, operating across various regions including Switzerland, Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific with a market capitalization of CHF887.73 million.

Operations: The company generates revenue primarily from its operations in various regions, with significant contributions from DACH (CHF301.10 million), Rest of EMEA (CHF299.50 million), and APAC (CHF163.40 million).

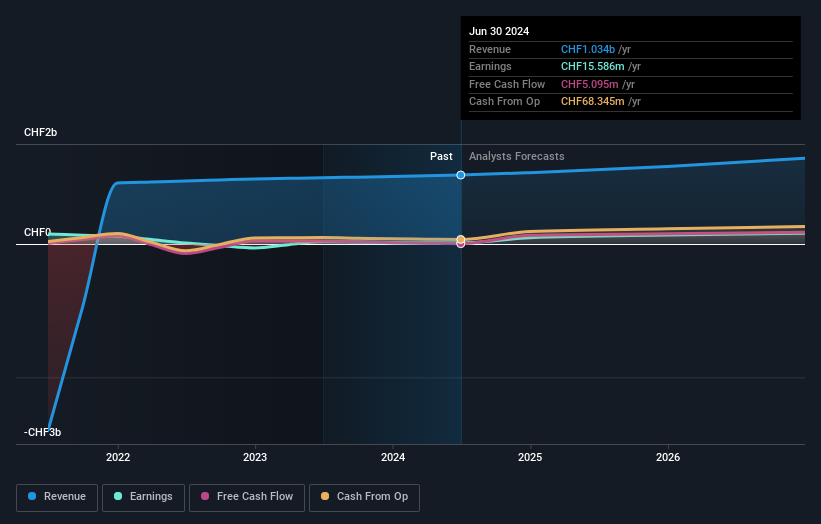

SoftwareONE Holding AG, amidst a strategic transformation, is aligning with market demands through significant partnerships and executive shifts. Recently, they announced a collaboration with ServiceNow to enhance IT modernization in the cloud, aiming to boost customer ROI and operational efficiency—a move reflecting their commitment to innovation despite current unprofitability. Their R&D focus remains robust as they navigate through a volatile market; however, specifics on R&D spending are not disclosed. With expected revenue growth of 5.8% annually outpacing the Swiss market's 4.4%, and projected earnings growth at an impressive 53.1% per year, SoftwareONE is positioning itself for profitability within three years. This trajectory is supported by recent executive changes aimed at strengthening their financial strategy following a slight net loss reported for FY2024.

- Get an in-depth perspective on SoftwareONE Holding's performance by reading our health report here.

Assess SoftwareONE Holding's past performance with our detailed historical performance reports.

Vercom (WSE:VRC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vercom S.A. develops cloud communications platforms and has a market cap of PLN2.47 billion.

Operations: The company generates revenue primarily from its CPaaS segment, amounting to PLN462.07 million.

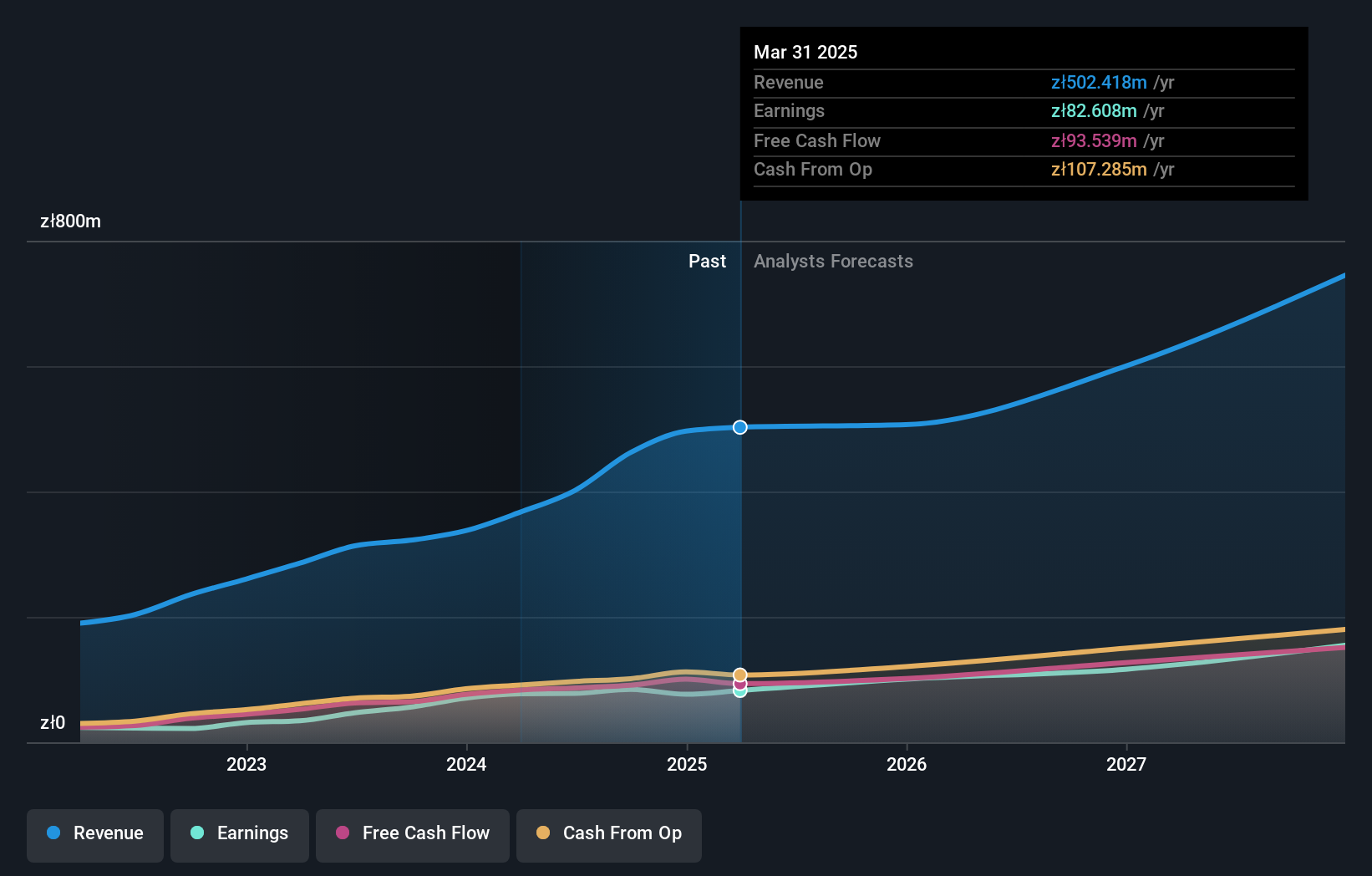

Vercom, a standout in the European tech landscape, is rapidly outpacing its regional market with projected revenue growth of 14.2% annually, significantly higher than Poland's average of 5%. This growth trajectory is underpinned by a robust increase in earnings, expected to rise by 18.4% each year. Notably, Vercom's commitment to innovation is reflected in its R&D spending trends which have consistently aligned with its revenue gains; however, exact figures on R&D expenses were not disclosed. The company has also demonstrated superior performance compared to the broader software industry, having achieved an impressive earnings growth rate of 50.3% over the past year—triple that of the industry average at 14.5%. With these strong financial fundamentals and a clear focus on expanding its technological capabilities, Vercom appears well-positioned for sustained growth and market leadership in high-growth tech sectors across Europe.

- Click here to discover the nuances of Vercom with our detailed analytical health report.

Understand Vercom's track record by examining our Past report.

Key Takeaways

- Discover the full array of 245 European High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Vercom, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VRC

High growth potential with excellent balance sheet.

Market Insights

Community Narratives