European Market Picks: 3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

Amid recent profit-taking and political uncertainties, the European markets have seen a slight downturn, with the STOXX Europe 600 Index dropping 1.10% from its record highs. Despite these challenges, opportunities may exist for investors to explore stocks that could be trading below their estimated value, especially those resilient in times of economic fluctuations and geopolitical tensions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.15 | €2.27 | 49.4% |

| Mo-BRUK (WSE:MBR) | PLN295.00 | PLN582.68 | 49.4% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.75 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.23 | 49.2% |

| DigiTouch (BIT:DGT) | €1.92 | €3.79 | 49.3% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.35 | €6.64 | 49.5% |

| Bilendi (ENXTPA:ALBLD) | €21.80 | €43.21 | 49.5% |

| Atea (OB:ATEA) | NOK143.20 | NOK282.10 | 49.2% |

| Aquafil (BIT:ECNL) | €1.94 | €3.85 | 49.5% |

| Aker BioMarine (OB:AKBM) | NOK86.30 | NOK170.38 | 49.3% |

Let's review some notable picks from our screened stocks.

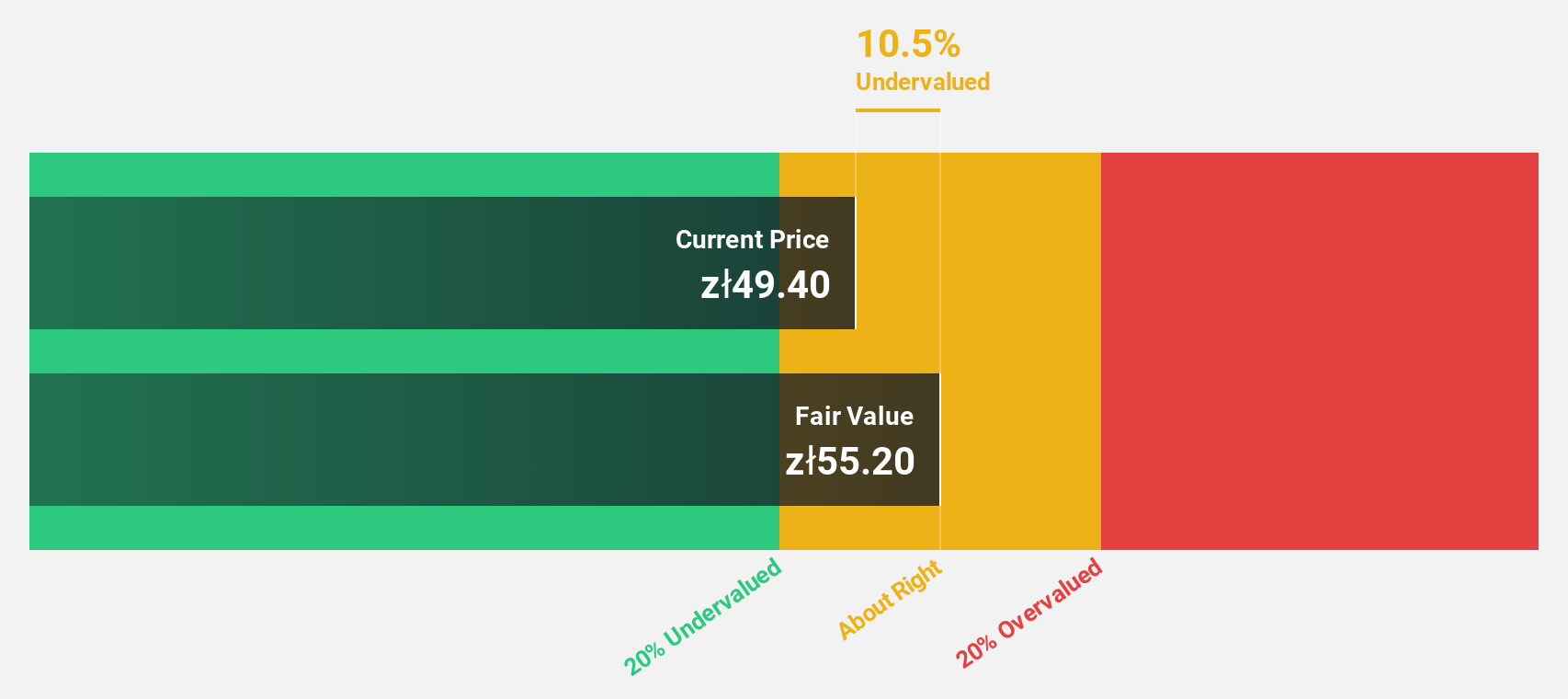

Laboratorios Farmaceuticos Rovi (BME:ROVI)

Overview: Laboratorios Farmaceuticos Rovi, S.A. is a pharmaceutical company that manufactures, sells, and markets its products in Spain, the European Union, OECD countries, and internationally with a market cap of €3.06 billion.

Operations: The company generates revenue through its Marketing segment, which accounts for €454.42 million, and its Manufacturing segment, contributing €553.78 million.

Estimated Discount To Fair Value: 24.5%

Laboratorios Farmaceuticos Rovi is trading at €59.8, significantly below its estimated fair value of €79.23, indicating it could be undervalued based on cash flows. Despite a slight decline in recent sales and net income, the company forecasts earnings growth of 18.2% annually—outpacing the Spanish market—and revenue growth of 8.6% per year. The acquisition of a manufacturing site in Phoenix may bolster future production capabilities despite current revenue guidance showing a mid-single-digit decrease for 2025.

- According our earnings growth report, there's an indication that Laboratorios Farmaceuticos Rovi might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Laboratorios Farmaceuticos Rovi.

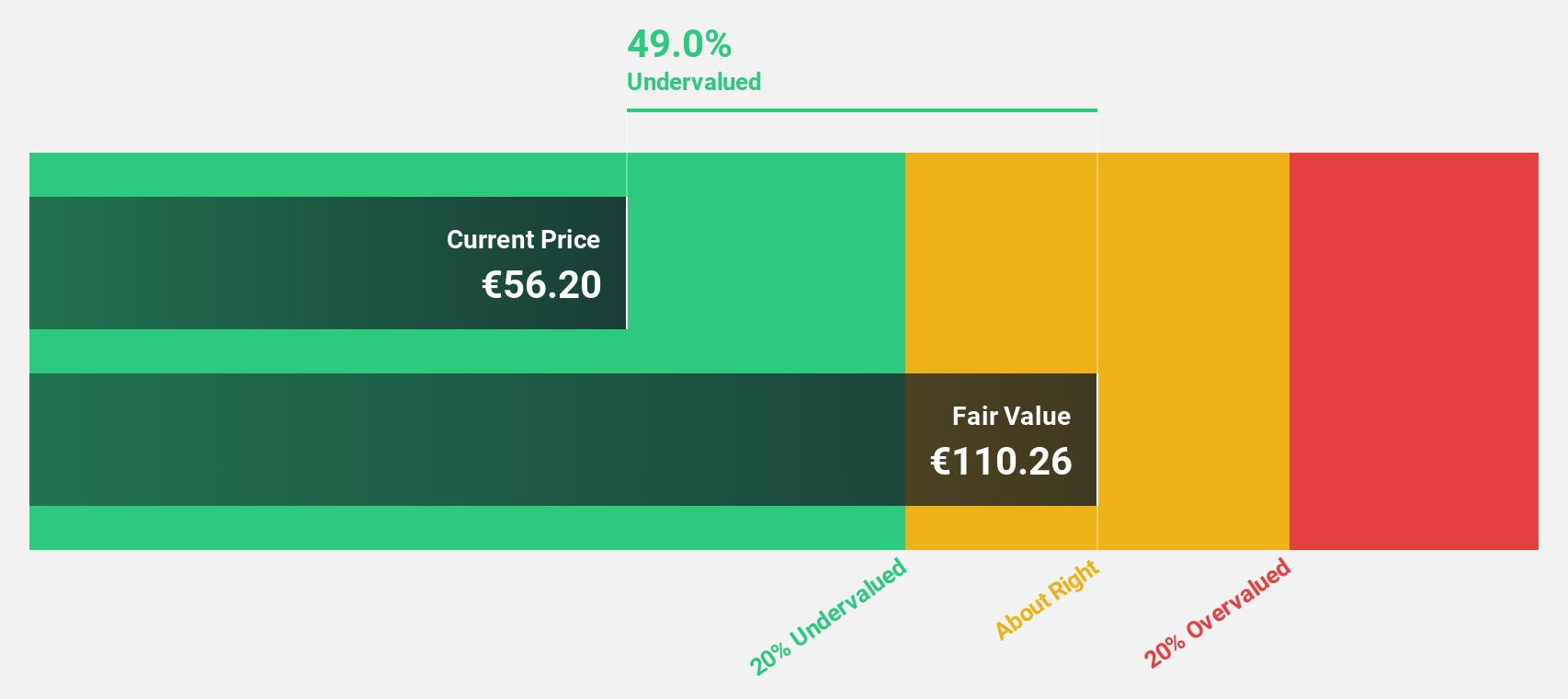

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF1.61 billion, operates globally through its subsidiaries to offer X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets.

Operations: The company's revenue is derived from three main segments: X-Ray Systems (CHF109.40 million), Industrial X-Ray Modules (CHF96.50 million), and Plasma Control Technologies (CHF287.40 million).

Estimated Discount To Fair Value: 37%

Comet Holding is trading at CHF206.6, significantly below its estimated fair value of CHF328.08, highlighting its potential undervaluation based on cash flows. Despite recent volatility in share price and lowered 2025 earnings guidance, the company reported strong half-year results with sales rising to CHF227.15 million and net income nearly doubling from a year ago. Forecasts suggest robust earnings growth of 35% annually over the next three years, outpacing the Swiss market's growth rate.

- Upon reviewing our latest growth report, Comet Holding's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Comet Holding's balance sheet by reading our health report here.

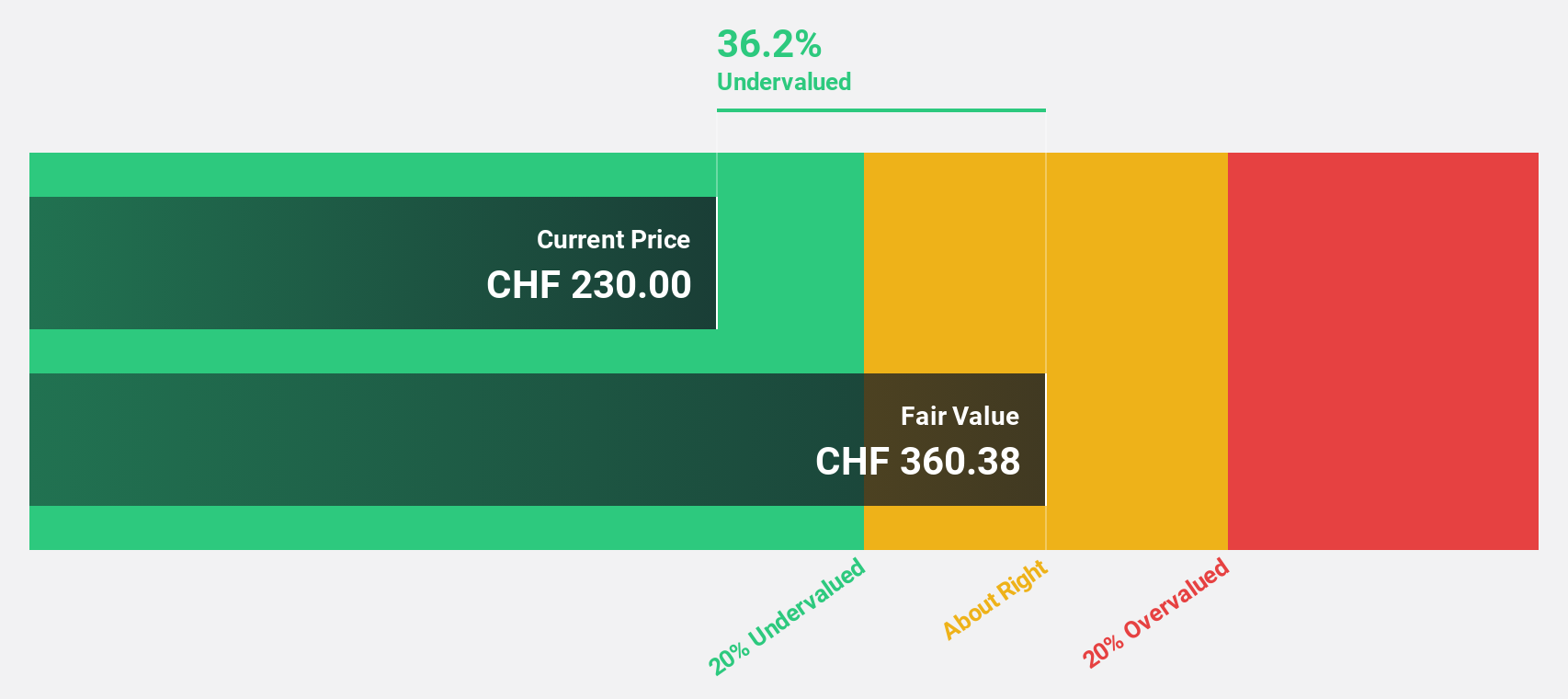

Shoper (WSE:SHO)

Overview: Shoper S.A. offers Software as a Service solutions for e-commerce in Poland, with a market cap of PLN1.42 billion.

Operations: The company generates revenue from Solutions amounting to PLN163.88 million and Subscriptions totaling PLN44.03 million.

Estimated Discount To Fair Value: 13%

Shoper is trading at PLN50.6, slightly below its estimated fair value of PLN58.16, reflecting potential undervaluation based on cash flows. Recent earnings showed revenue growth to PLN105.4 million and net income rising to PLN19.1 million for the half year, with earnings per share improving year-over-year. Forecasts indicate significant earnings growth of 21.72% annually over the next three years, outpacing the Polish market's rate and supported by strong return on equity projections at 55%.

- In light of our recent growth report, it seems possible that Shoper's financial performance will exceed current levels.

- Dive into the specifics of Shoper here with our thorough financial health report.

Summing It All Up

- Click through to start exploring the rest of the 204 Undervalued European Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SHO

Shoper

Provides Software as a Service solutions for e-commerce in Poland.

Outstanding track record with high growth potential.

Market Insights

Community Narratives