As European markets reach record highs, buoyed by a rally in technology stocks and anticipated lower U.S. borrowing costs, investors are increasingly turning their attention to dividend stocks as a means of enhancing portfolio stability. In this environment, selecting dividend-paying stocks can be an effective strategy for those looking to capitalize on the current market sentiment while potentially benefiting from consistent income streams.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.31% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.37% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.91% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.77% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.00% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.95% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.27% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.64% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 3.99% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.67% | ★★★★★☆ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

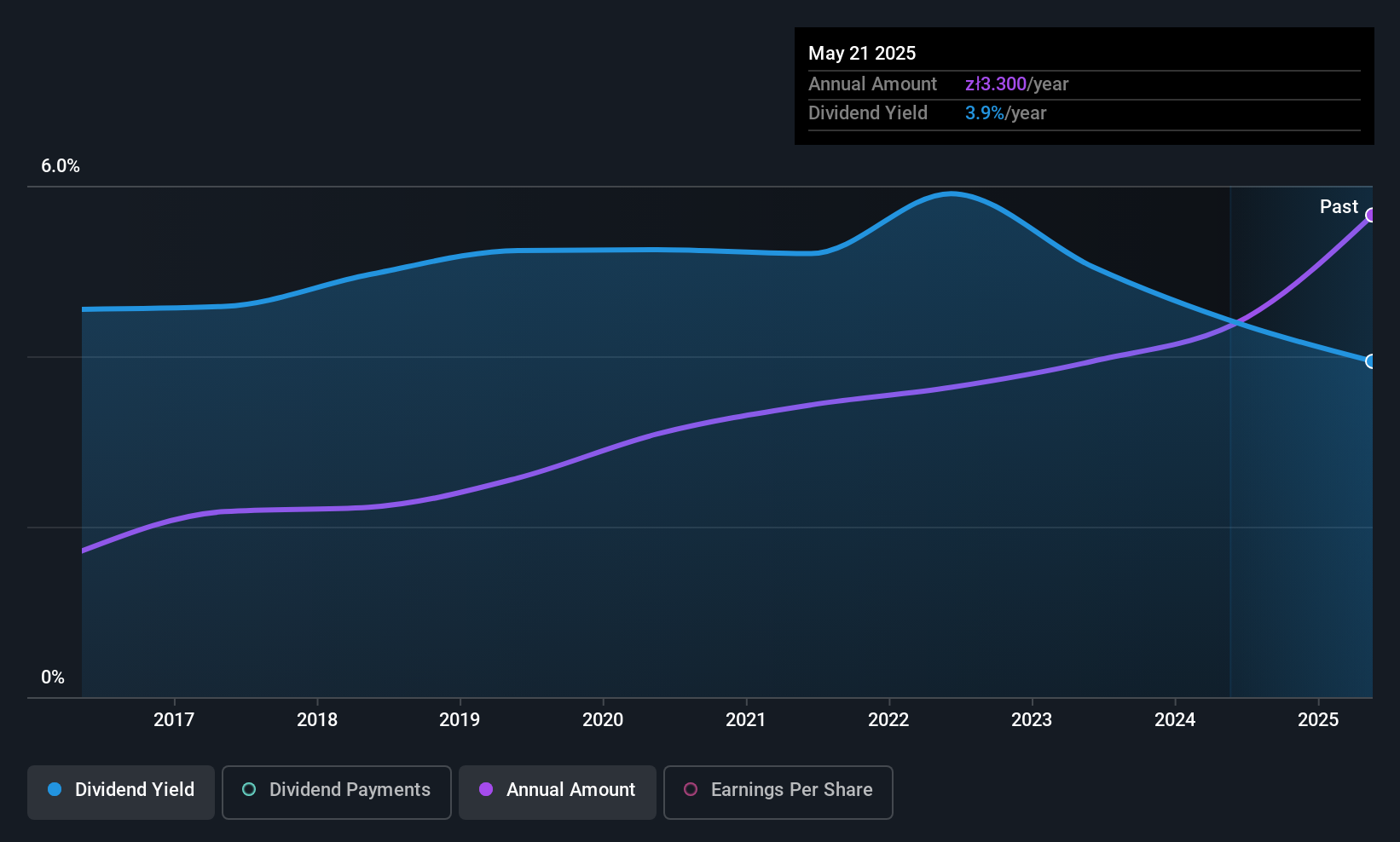

Asseco Business Solutions (WSE:ABS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asseco Business Solutions S.A. designs and develops enterprise software solutions in Poland and internationally, with a market cap of PLN2.88 billion.

Operations: Asseco Business Solutions S.A. generates revenue primarily from its ERP (Enterprise Resource Planning) Segment, amounting to PLN423.80 million.

Dividend Yield: 3.8%

Asseco Business Solutions has demonstrated reliable and stable dividend growth over the past decade. However, its dividend yield of 3.78% is relatively low compared to top-tier Polish market payers. Recent earnings reports show slight increases in revenue but a decrease in net income for Q2 2025, with dividends not fully covered by earnings due to a high payout ratio of 91.8%. Despite this, cash flow coverage remains adequate at an 80.3% cash payout ratio.

- Click here to discover the nuances of Asseco Business Solutions with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Asseco Business Solutions is priced higher than what may be justified by its financials.

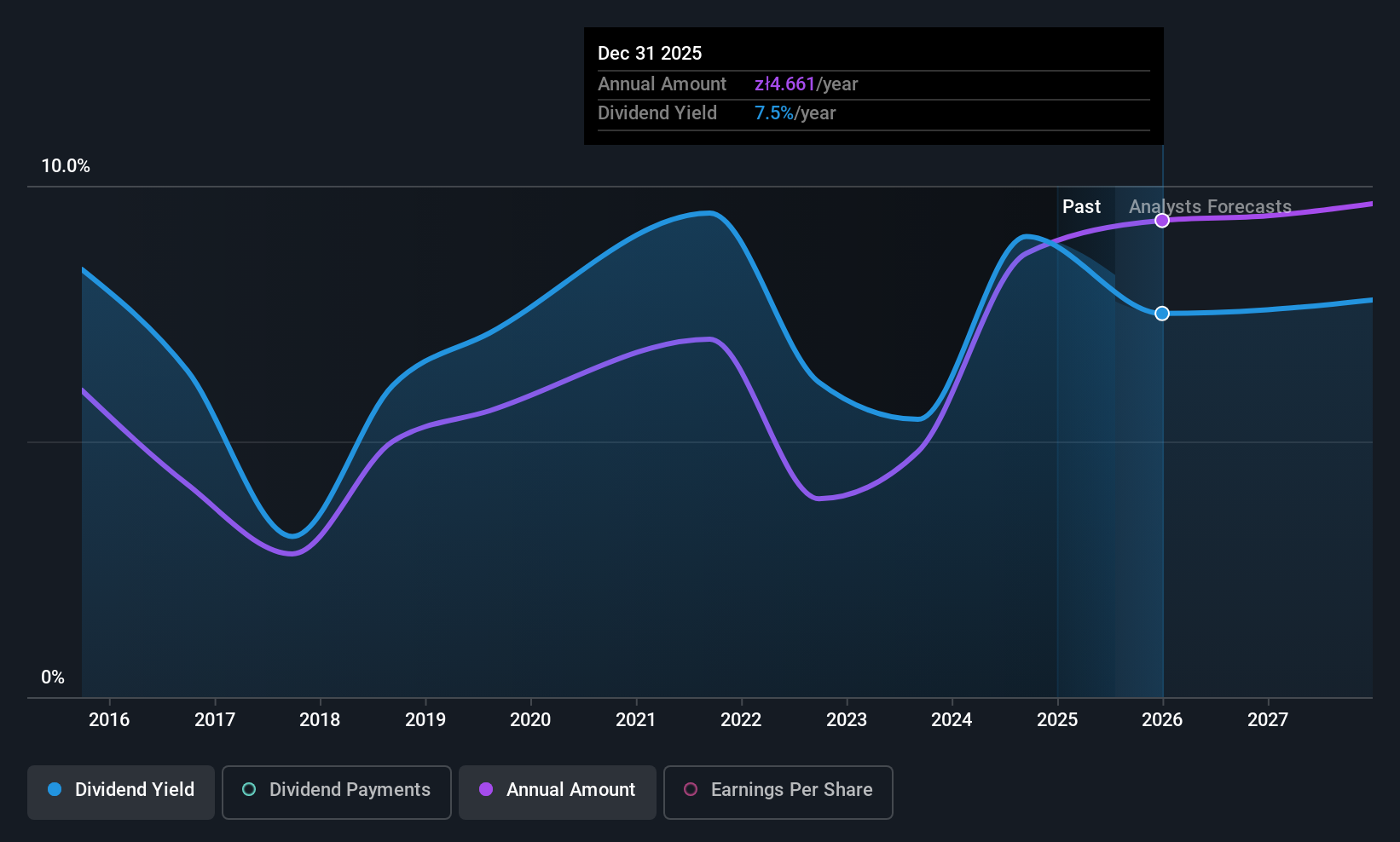

Powszechny Zaklad Ubezpieczen (WSE:PZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Powszechny Zaklad Ubezpieczen SA offers life and non-life insurance products and services across Poland, the Baltic States, and Ukraine, with a market cap of PLN48.53 billion.

Operations: Powszechny Zaklad Ubezpieczen SA's revenue segments include Mass Insurance (PLN16.13 billion), Banking Activities (PLN42.39 billion), Group and Individually Continued Insurance (PLN11.91 billion), Corporate Insurance (PLN5.45 billion), operations in the Baltic Countries (PLN3.50 billion), Individual Protective Insurance (PLN1.55 billion), Investments (PLN844 million), Pensions (PLN373 million), Ukraine operations (PLN281 million) and Life Investment Insurance (PLN109 million).

Dividend Yield: 8%

Powszechny Zaklad Ubezpieczen's dividends are well-covered by both earnings and cash flows, with a payout ratio of 63% and a cash payout ratio of 14.6%. Despite recent earnings growth, the company has faced volatility in its dividend payments over the past decade. However, its current dividend yield is among the top 25% in Poland. The recent CEO change may impact future stability, but current financials suggest robust coverage for dividends.

- Dive into the specifics of Powszechny Zaklad Ubezpieczen here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Powszechny Zaklad Ubezpieczen shares in the market.

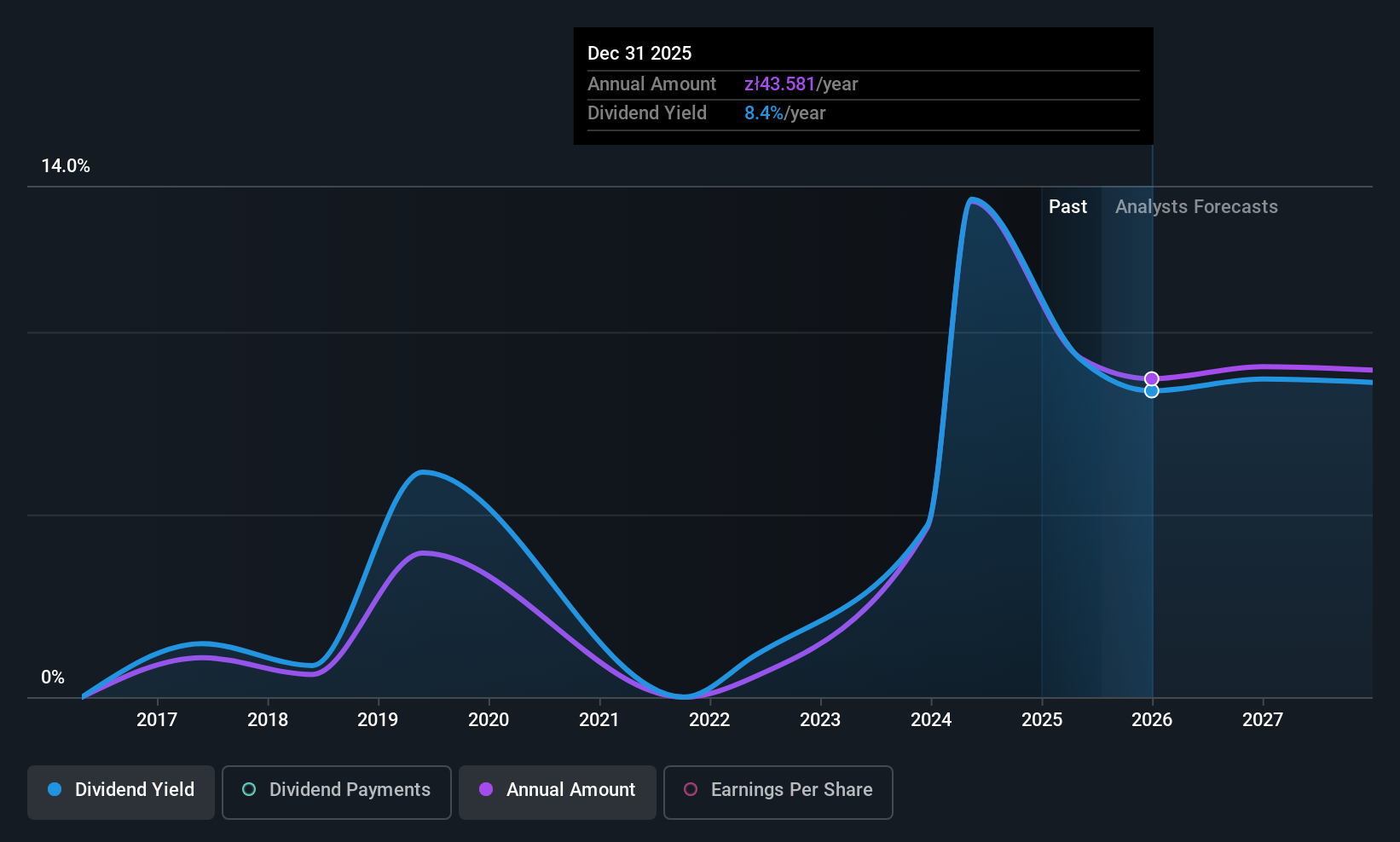

Santander Bank Polska (WSE:SPL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Santander Bank Polska S.A. offers a range of banking products and services to individuals, SMEs, corporate clients, and public sector institutions with a market cap of PLN49.73 billion.

Operations: Santander Bank Polska S.A. generates revenue through its key segments: Retail Banking (PLN10.10 billion), Business and Corporate Banking (PLN2.95 billion), and Corporate & Investment Banking (PLN1.49 billion).

Dividend Yield: 9.5%

Santander Bank Polska's dividends are currently covered by earnings with a payout ratio of 81%, and they are forecast to remain sustainable over the next three years. Despite an attractive dividend yield in the top 25% of the Polish market, its dividend track record has been unstable and volatile over the past decade. The bank trades at a significant discount to its estimated fair value, but concerns exist due to high levels of bad loans and low allowance for them. Recent earnings reports showed strong growth in net income compared to last year.

- Click to explore a detailed breakdown of our findings in Santander Bank Polska's dividend report.

- Our valuation report here indicates Santander Bank Polska may be undervalued.

Make It Happen

- Dive into all 224 of the Top European Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ABS

Asseco Business Solutions

Designs and develops enterprise software solutions in Poland and internationally.

Solid track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives