- France

- /

- Capital Markets

- /

- ENXTPA:AMUN

3 Dividend Stocks To Consider In Your Portfolio

Reviewed by Simply Wall St

As global markets continue to reach new highs, with major indices like the Dow Jones Industrial Average and S&P 500 hitting record levels, investors are navigating a landscape shaped by geopolitical developments and economic data releases. In this environment, dividend stocks can offer a blend of income and potential stability, making them an attractive consideration for those looking to balance growth with consistent returns in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.67% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.18% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.84% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

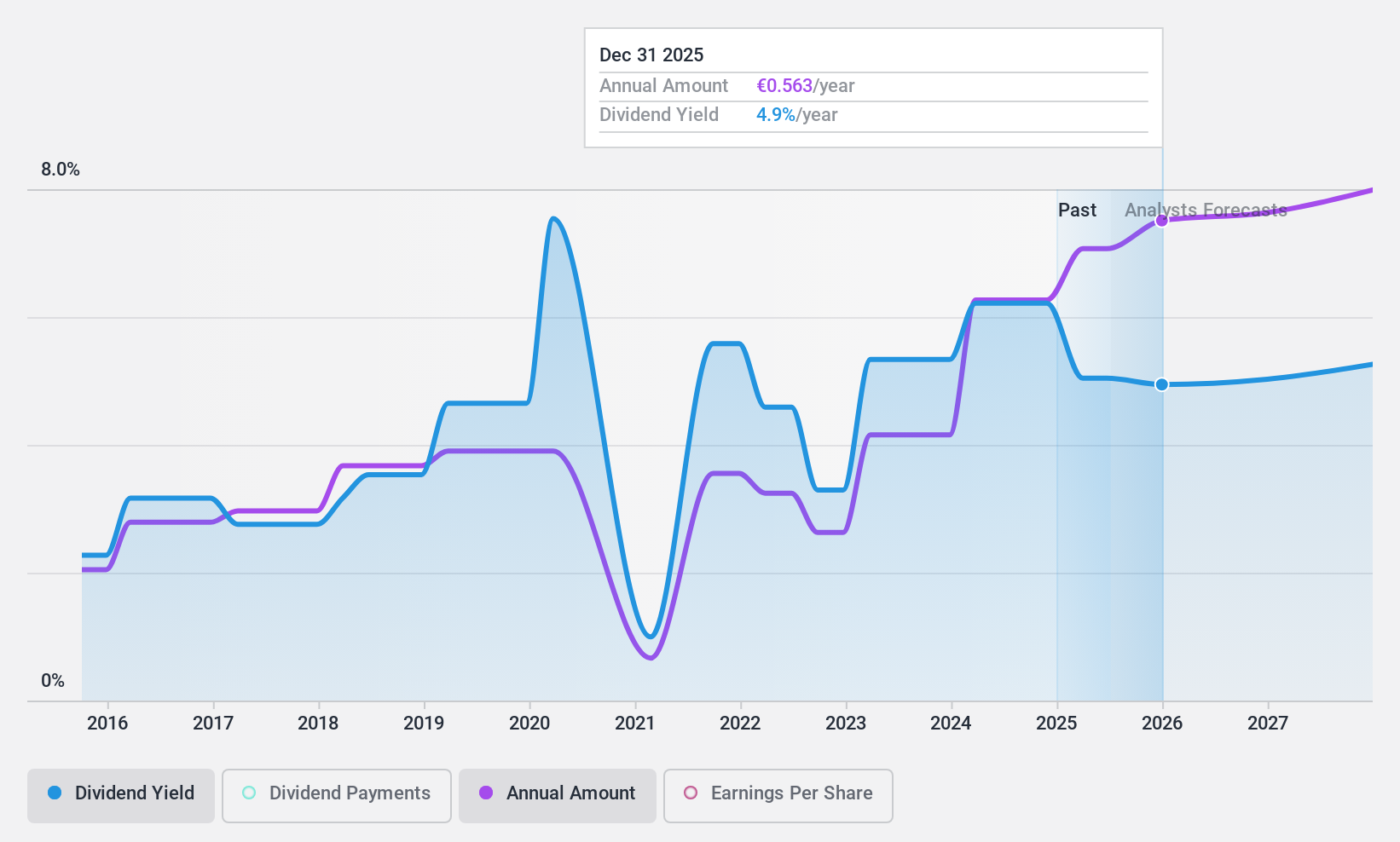

Bankinter (BME:BKT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bankinter, S.A. is a financial institution offering a range of banking products and services to individuals, corporate customers, and small- to medium-sized enterprises in Spain, with a market cap of €6.83 billion.

Operations: Bankinter's revenue segments include BK Portugal (€301.43 million), Corporate Banking (€1.10 billion), Bankinter Consumer Finance Group (€161.93 million), and Wealth Management and Retail Banking (€1.14 billion).

Dividend Yield: 6%

Bankinter's dividend payments are well covered by earnings, with a current payout ratio of 25.8%. Despite a volatile dividend history over the past decade, recent payments have increased. The bank's net income for the first nine months of 2024 rose to €731.05 million from €684.68 million last year, supporting its ability to pay dividends. However, Bankinter has a high level of bad loans at 2.3%, which could impact future payouts if not managed effectively.

- Click here to discover the nuances of Bankinter with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Bankinter's current price could be inflated.

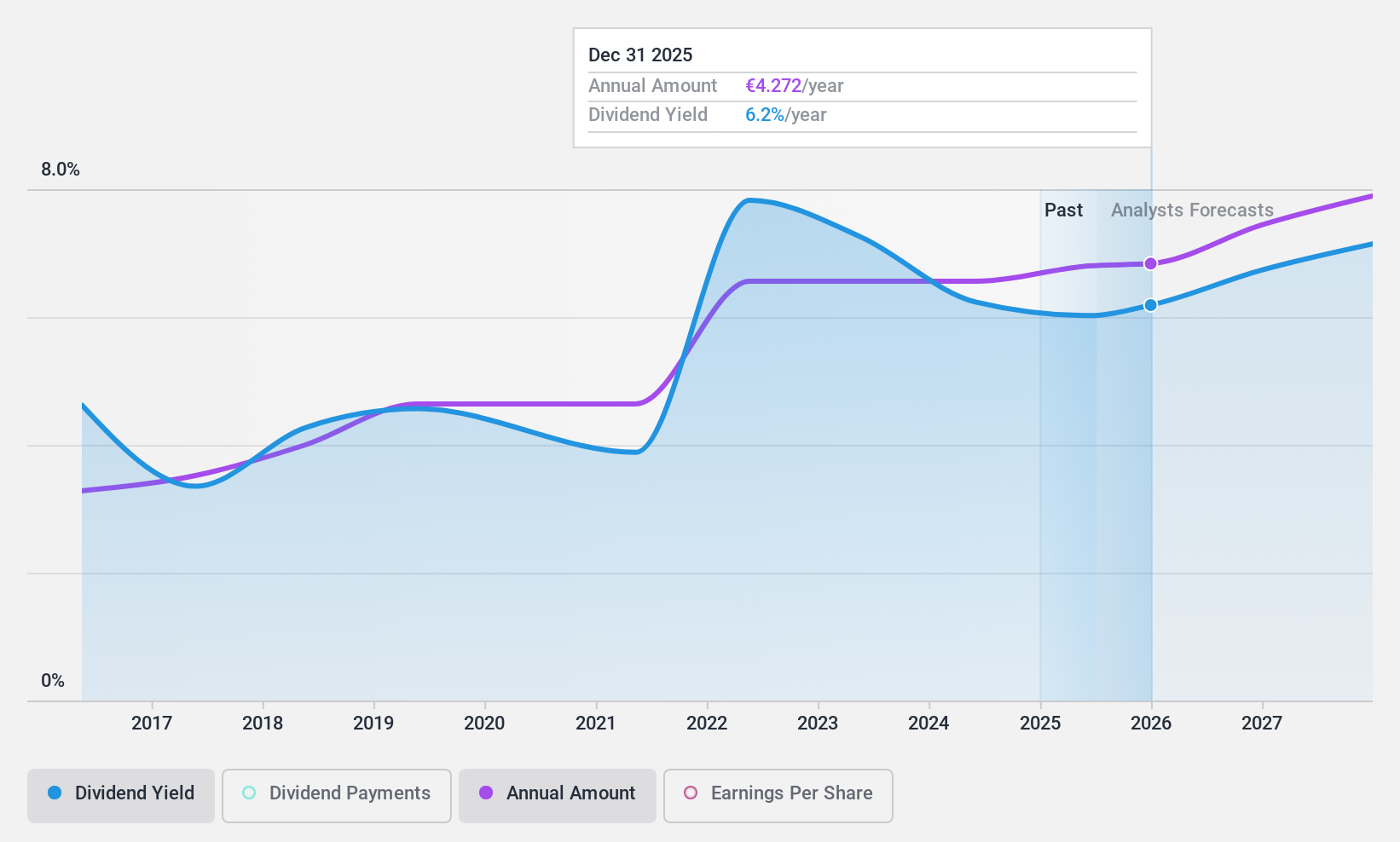

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market cap of €12.49 billion.

Operations: Amundi generates its revenue primarily from its Asset Management segment, which accounts for €6.17 billion.

Dividend Yield: 6.5%

Amundi's dividend yield is among the top 25% in France, supported by a sustainable payout ratio of 69.3% from earnings and 59.9% from cash flows. Despite this, its nine-year dividend history has been volatile. Recent Q3 results show revenue growth to €862 million and net income rising to €320 million, indicating robust financial health. Additionally, Amundi has initiated a share buyback program worth up to €1 billion, potentially enhancing shareholder value further.

- Delve into the full analysis dividend report here for a deeper understanding of Amundi.

- In light of our recent valuation report, it seems possible that Amundi is trading behind its estimated value.

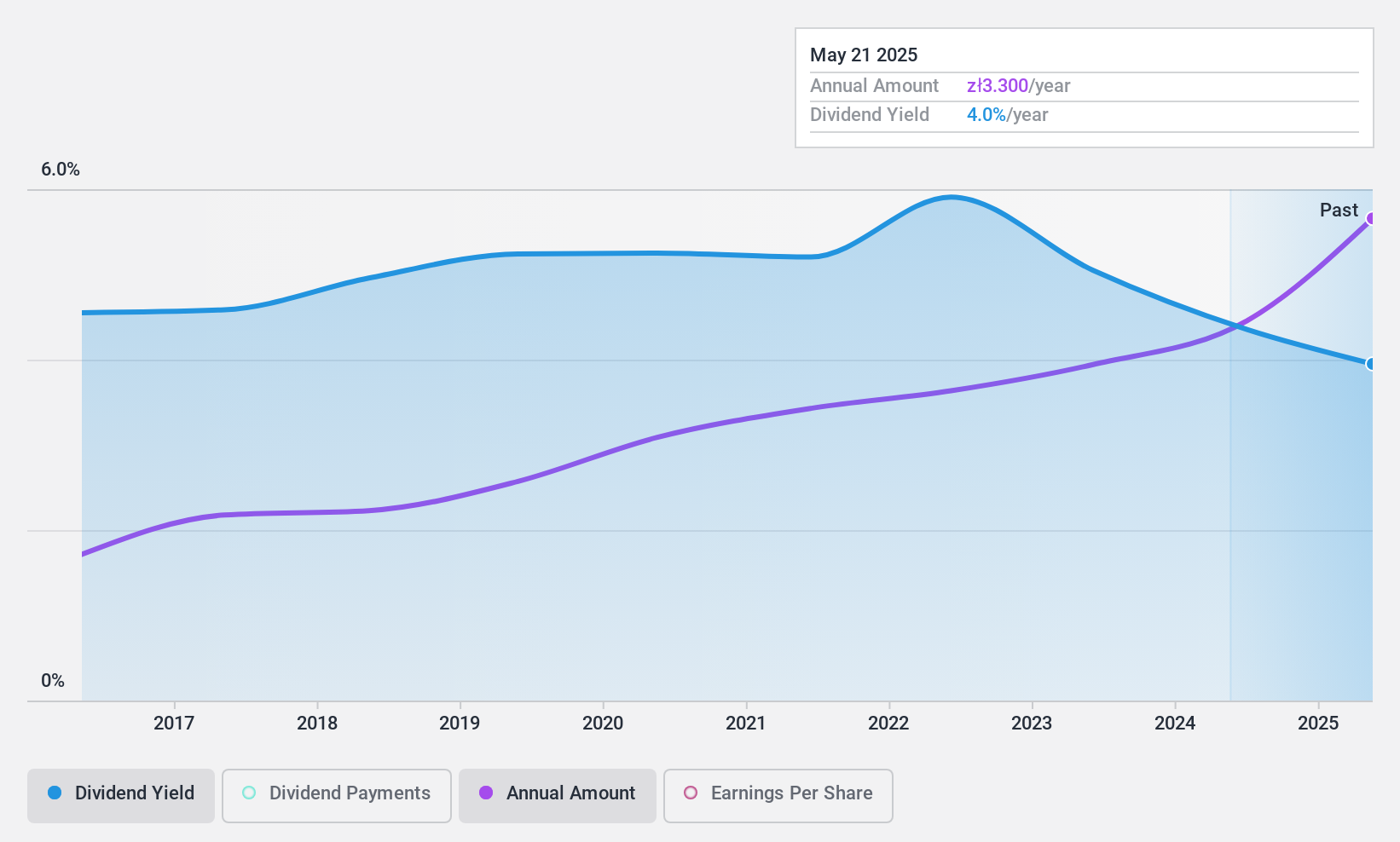

Asseco Business Solutions (WSE:ABS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asseco Business Solutions S.A. designs and develops enterprise software solutions in Poland and internationally, with a market cap of PLN1.71 billion.

Operations: Asseco Business Solutions S.A. generates revenue from its ERP (Enterprise Resource Planning) Segment, amounting to PLN388.19 million.

Dividend Yield: 4.8%

Asseco Business Solutions offers a stable dividend yield of 4.78%, supported by an earnings payout ratio of 83.3% and a cash payout ratio of 82.9%. Over the past decade, dividends have been consistently reliable with growth and stability. Despite trading at a discount to its estimated fair value, its yield is below the top quartile in Poland. Recent financials show solid performance, with Q3 net income rising to PLN 27.67 million and ongoing share buybacks enhancing shareholder returns.

- Unlock comprehensive insights into our analysis of Asseco Business Solutions stock in this dividend report.

- In light of our recent valuation report, it seems possible that Asseco Business Solutions is trading beyond its estimated value.

Next Steps

- Investigate our full lineup of 1956 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AMUN

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives