Celon Pharma (WSE:CLN) Shareholders Have Enjoyed A 12% Share Price Gain

By buying an index fund, investors can approximate the average market return. But if you choose individual stocks with prowess, you can make superior returns. Just take a look at Celon Pharma S.A. (WSE:CLN), which is up 12%, over three years, soundly beating the market decline of 19% (not including dividends).

See our latest analysis for Celon Pharma

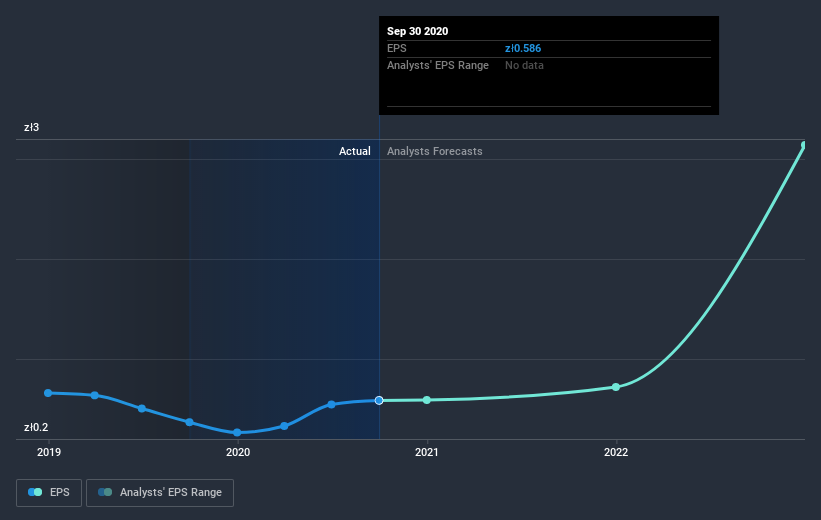

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Celon Pharma achieved compound earnings per share growth of 14% per year. The average annual share price increase of 4% is actually lower than the EPS growth. So one could reasonably conclude that the market has cooled on the stock. Of course, with a P/E ratio of 66.82, the market remains optimistic.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Celon Pharma has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Celon Pharma will grow revenue in the future.

A Different Perspective

The last twelve months weren't great for Celon Pharma shares, which performed worse than the market, costing holders 4.2%, including dividends. The market shed around 1.8%, no doubt weighing on the stock price. Investors are up over three years, booking 4% per year, much better than the more recent returns. The recent sell-off could be an opportunity if the business remains sound, so it may be worth checking the fundamental data for signs of a long-term growth trend. Before forming an opinion on Celon Pharma you might want to consider these 3 valuation metrics.

But note: Celon Pharma may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you’re looking to trade Celon Pharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Celon Pharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:CLN

Celon Pharma

An integrated pharmaceutical company, engages in the research, manufacture, and marketing of pharmaceutical products and preparations.

Reasonable growth potential and fair value.

Market Insights

Community Narratives