European Equities Priced Below Estimated Value In September 2025

Reviewed by Simply Wall St

As European markets experience a modest uptick, with the STOXX Europe 600 Index rising by 1.03% amid expectations of a U.S. Federal Reserve rate cut, investors are keenly observing opportunities in equities that may be priced below their estimated value. In this environment, identifying stocks that exhibit strong fundamentals and potential for growth can be crucial for investors looking to capitalize on market dynamics where central bank policies and economic forecasts play pivotal roles.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.04 | SEK85.80 | 49.8% |

| Rheinmetall (XTRA:RHM) | €1950.00 | €3819.19 | 48.9% |

| Micro Systemation (OM:MSAB B) | SEK63.00 | SEK122.75 | 48.7% |

| DSV (CPSE:DSV) | DKK1371.00 | DKK2694.66 | 49.1% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.82 | 50% |

| Brockhaus Technologies (XTRA:BKHT) | €9.92 | €19.22 | 48.4% |

| ATON Green Storage (BIT:ATON) | €2.09 | €4.09 | 48.9% |

| Atea (OB:ATEA) | NOK142.00 | NOK280.67 | 49.4% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.96 | €3.79 | 48.3% |

| adidas (XTRA:ADS) | €178.30 | €350.73 | 49.2% |

Let's uncover some gems from our specialized screener.

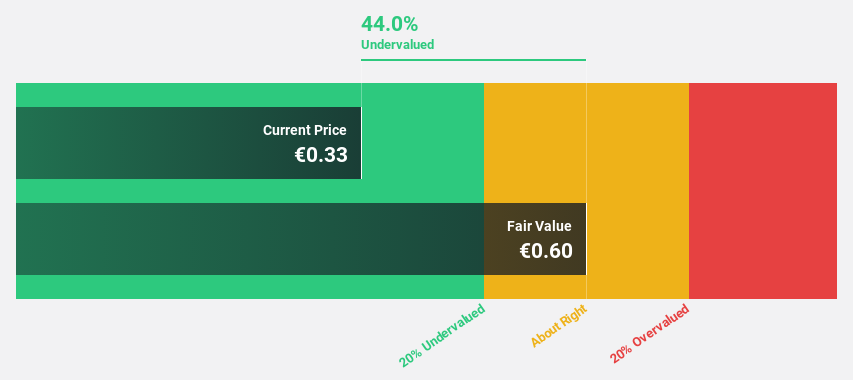

Obrascón Huarte Lain (BME:OHLA)

Overview: Obrascón Huarte Lain, S.A. operates in the construction and concession sectors across various regions including the United States, Canada, Latin America, Europe, and internationally with a market cap of €591.70 million.

Operations: The company's revenue primarily comes from its construction segment, which generated €3.40 billion, followed by the industrial segment with €199.92 million.

Estimated Discount To Fair Value: 26%

Obrascón Huarte Lain is trading at a good value, 26% below its estimated fair value of €0.58, despite recent volatility and shareholder dilution. The company reported a lower net loss for the first half of 2025 compared to the previous year, with revenue slightly declining to €1.74 billion. Forecasts suggest profitability within three years with above-average market growth and faster-than-market revenue increases in Spain, highlighting potential undervaluation based on cash flows.

- Upon reviewing our latest growth report, Obrascón Huarte Lain's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Obrascón Huarte Lain.

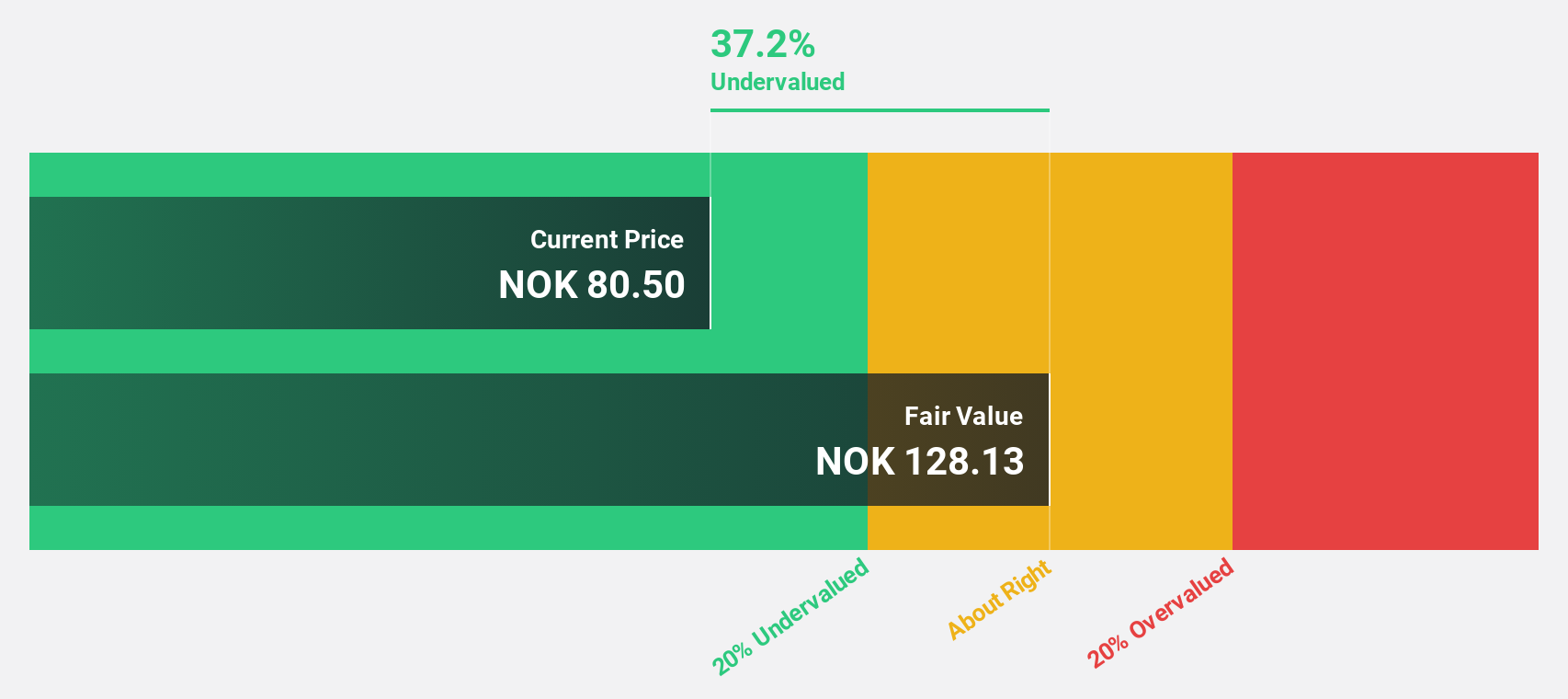

Europris (OB:EPR)

Overview: Europris ASA is a discount variety retailer operating in Norway with a market cap of NOK16.86 billion.

Operations: The company's revenue is primarily generated from its retail - variety stores segment, amounting to NOK14.36 billion.

Estimated Discount To Fair Value: 29.8%

Europris is trading 29.8% below its estimated fair value of NOK146.68, with earnings projected to grow significantly at 23.3% annually, outpacing the Norwegian market. Despite a decline in profit margins from 8.6% to 5%, revenue growth is expected at 5% per year, surpassing the market's rate of 2.4%. Recent expansions include a new store in Stavanger and full ownership of Swedish retailer ÖoB, enhancing their retail footprint across Norway and Sweden.

- Our growth report here indicates Europris may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Europris' balance sheet health report.

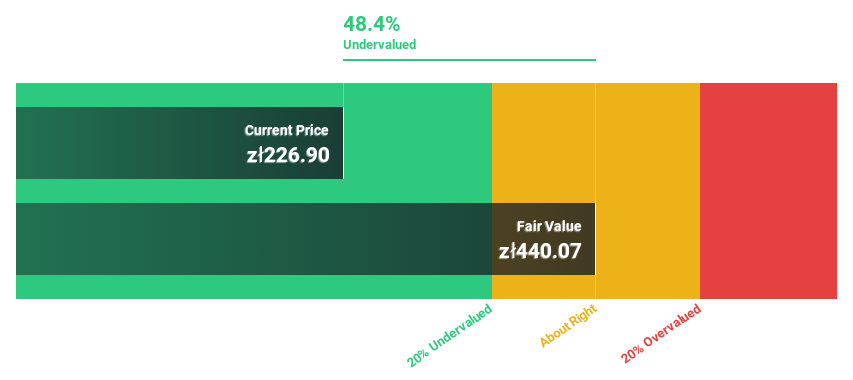

CD Projekt (WSE:CDR)

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for PCs and consoles in Poland, with a market cap of PLN25.68 billion.

Operations: The company's revenue is primarily derived from its segments CD PROJEKT RED, contributing PLN812.26 million, and GOG.Com, generating PLN205.97 million.

Estimated Discount To Fair Value: 33.6%

CD Projekt is trading at PLN257, significantly below its estimated fair value of PLN386.99, suggesting it's undervalued based on cash flows. The company's revenue and earnings are forecast to grow substantially at 35.1% and 43.5% per year, respectively, outpacing the Polish market's growth rates. Despite a recent decline in net income to PLN154.96 million for H1 2025 from PLN170.01 million the previous year, CD Projekt maintains high-quality earnings with strong future growth potential.

- Our expertly prepared growth report on CD Projekt implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of CD Projekt here with our thorough financial health report.

Summing It All Up

- Explore the 211 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Europris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:EPR

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives