- Poland

- /

- Entertainment

- /

- WSE:CDA

Additional Considerations Required While Assessing CDA's (WSE:CDA) Strong Earnings

Unsurprisingly, CDA S.A.'s (WSE:CDA) stock price was strong on the back of its healthy earnings report. However, we think that shareholders may be missing some concerning details in the numbers.

Check out our latest analysis for CDA

Examining Cashflow Against CDA's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. The accrual ratio subtracts the FCF from the profit for a given period, and divides the result by the average operating assets of the company over that time. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

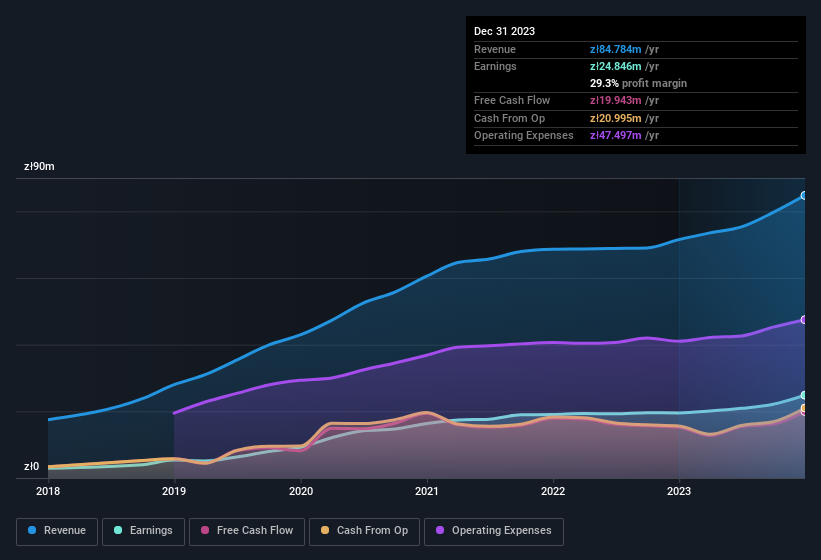

CDA has an accrual ratio of 1.09 for the year to December 2023. That means it didn't generate anywhere near enough free cash flow to match its profit. Statistically speaking, that's a real negative for future earnings. Indeed, in the last twelve months it reported free cash flow of zł20m, which is significantly less than its profit of zł24.8m. We note, however, that CDA grew its free cash flow over the last year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of CDA.

Our Take On CDA's Profit Performance

As we discussed above, we think CDA's earnings were not supported by free cash flow, which might concern some investors. As a result, we think it may well be the case that CDA's underlying earnings power is lower than its statutory profit. But at least holders can take some solace from the 50% per annum growth in EPS for the last three. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about CDA as a business, it's important to be aware of any risks it's facing. For instance, we've identified 3 warning signs for CDA (1 shouldn't be ignored) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of CDA's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CDA

CDA

Engages in the provision of video on demand services in Poland.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Amazon - A Fundamental and Historical Valuation

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

The "Sleeping Giant" Stumbles, Then Wakes Up

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Trending Discussion