Fabryka Farb i Lakierów Sniezka's (WSE:SKA) Shareholders Will Receive A Bigger Dividend Than Last Year

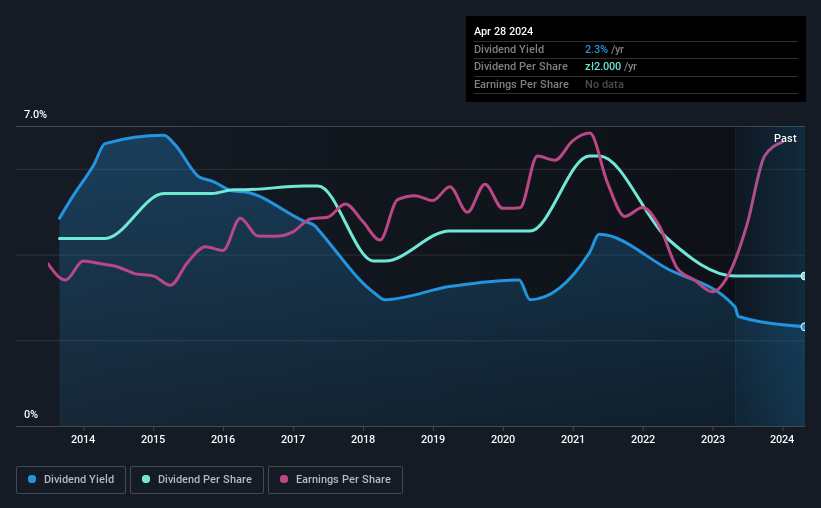

The board of Fabryka Farb i Lakierów Sniezka SA (WSE:SKA) has announced that it will be increasing its dividend by 59% on the 29th of May to PLN3.17, up from last year's comparable payment of PLN2.00. This takes the annual payment to 2.3% of the current stock price, which unfortunately is below what the industry is paying.

View our latest analysis for Fabryka Farb i Lakierów Sniezka

Fabryka Farb i Lakierów Sniezka's Dividend Is Well Covered By Earnings

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. However, Fabryka Farb i Lakierów Sniezka's earnings easily cover the dividend. This means that most of what the business earns is being used to help it grow.

Looking forward, earnings per share could rise by 4.7% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 49% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the annual payment back then was PLN2.50, compared to the most recent full-year payment of PLN2.00. The dividend has shrunk at around 2.2% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings have grown at around 4.7% a year for the past five years, which isn't massive but still better than seeing them shrink. While growth may be thin on the ground, Fabryka Farb i Lakierów Sniezka could always pay out a higher proportion of earnings to increase shareholder returns.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for Fabryka Farb i Lakierów Sniezka (1 makes us a bit uncomfortable!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:SKA

Fabryka Farb i Lakierów Sniezka

Engages in the manufacture and sale of decorative paints in Poland, Hungary, Ukraine, Belarus, and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives