As global markets continue to navigate the evolving landscape of U.S. trade policies and AI investments, major indices like the S&P 500 have reached new heights, fueled by optimism surrounding potential tariff relief and technological advancements. With growth stocks outperforming value shares, investors are increasingly seeking stable income sources amid market fluctuations. In this environment, dividend stocks stand out as a reliable option for generating consistent returns through regular payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.07% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.05% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

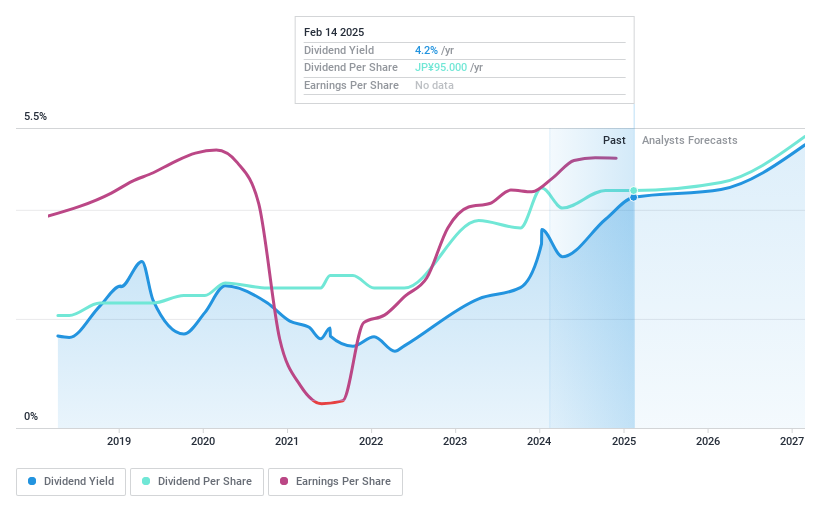

DIP (TSE:2379)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DIP Corporation, with a market cap of ¥124.97 billion, is a labor force solution company that offers personnel recruiting services in Japan.

Operations: DIP Corporation generates revenue through its DX Business, which accounts for ¥6.63 billion, and its Human Resources Services Business, contributing ¥49.55 billion.

Dividend Yield: 4%

DIP Corporation's dividend payments are well-supported by a low cash payout ratio of 46.2% and an earnings payout ratio of 53.4%, indicating strong coverage by cash flows and earnings. Despite this, the company's dividend history is less stable, with significant volatility over its seven-year payment period, including annual drops exceeding 20%. However, DIP trades at a good value compared to peers and industry benchmarks and offers a competitive dividend yield in the top quartile of the JP market.

- Click to explore a detailed breakdown of our findings in DIP's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of DIP shares in the market.

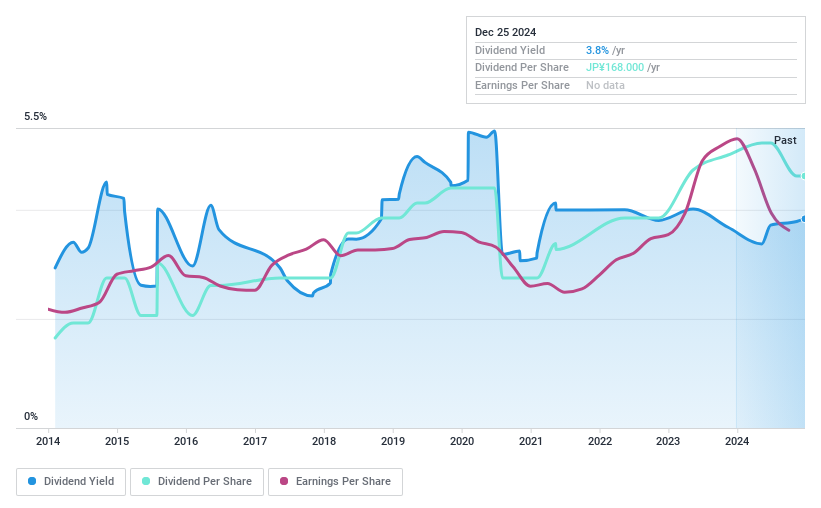

Yuasa Trading (TSE:8074)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yuasa Trading Co., Ltd. operates in the lifestyle and industry support sectors in Japan and has a market cap of ¥91.29 billion.

Operations: Yuasa Trading Co., Ltd.'s revenue segments include Energy (¥18.66 billion), Industrial Equipment (¥94.56 billion), Construction Machines (¥43.03 billion), Building Supplies & Exterior (¥61.20 billion), Industrial Machinery Division (¥114.83 billion), and Housing, Air & Fluidic Control Systems (¥218.43 billion).

Dividend Yield: 3.9%

Yuasa Trading's dividend yield of 3.87% places it in the top 25% of JP market payers, yet its sustainability is questionable due to a high cash payout ratio of 99.9%. Despite a low earnings payout ratio of 39.2%, dividends are not well-covered by free cash flow, and recent reductions from JPY 86 to JPY 72 per share highlight volatility concerns. The stock trades at a favorable P/E ratio of 10.1x compared to the market average, offering potential value amidst these challenges.

- Navigate through the intricacies of Yuasa Trading with our comprehensive dividend report here.

- According our valuation report, there's an indication that Yuasa Trading's share price might be on the expensive side.

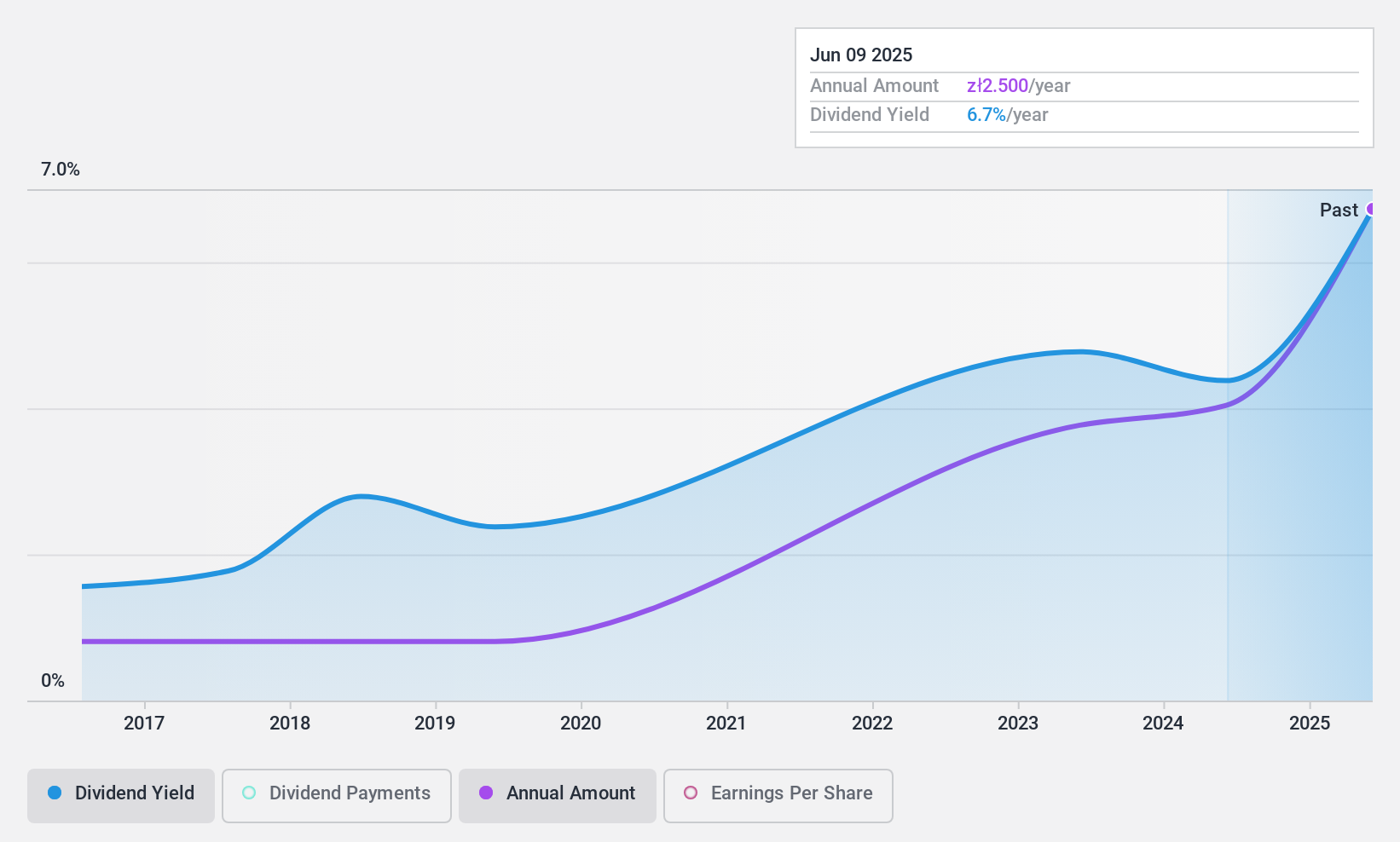

Selena FM (WSE:SEL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Selena FM S.A. operates through its subsidiaries to produce, distribute, and sell construction chemicals, building materials for doors and windows, and general building accessories to both professional and individual users, with a market cap of PLN688.13 million.

Operations: Selena FM S.A.'s revenue is segmented into America (PLN107.88 million), Parent Company (PLN898.66 million), Western Europe (PLN458.90 million), Production in Poland (PLN687.26 million), Distribution in Poland (PLN327.80 million), and Eastern Europe and Asia (PLN489.75 million).

Dividend Yield: 4.8%

Selena FM's dividend yield of 4.76% is lower than the top 25% in the Polish market. Despite a reasonable payout ratio of 59.7% and cash payout ratio of 72.2%, indicating coverage by earnings and cash flows, its dividend history has been volatile over the past decade, raising reliability concerns. The recent earnings report shows a decline in quarterly net income to PLN 24.93 million from PLN 54.89 million, potentially impacting future dividends despite stable nine-month results.

- Click here and access our complete dividend analysis report to understand the dynamics of Selena FM.

- Our valuation report here indicates Selena FM may be overvalued.

Where To Now?

- Unlock our comprehensive list of 1972 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SEL

Selena FM

Through its subsidiaries, produces, distributes, and sells construction chemicals, building materials for doors and windows, and general building accessories to professional and individual users.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives