- Poland

- /

- Paper and Forestry Products

- /

- WSE:KMP

Dividend Investors: Don't Be Too Quick To Buy Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP S.A. (WSE:KMP) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP S.A. (WSE:KMP) is about to go ex-dividend in just four days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Meaning, you will need to purchase Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP's shares before the 18th of July to receive the dividend, which will be paid on the 28th of July.

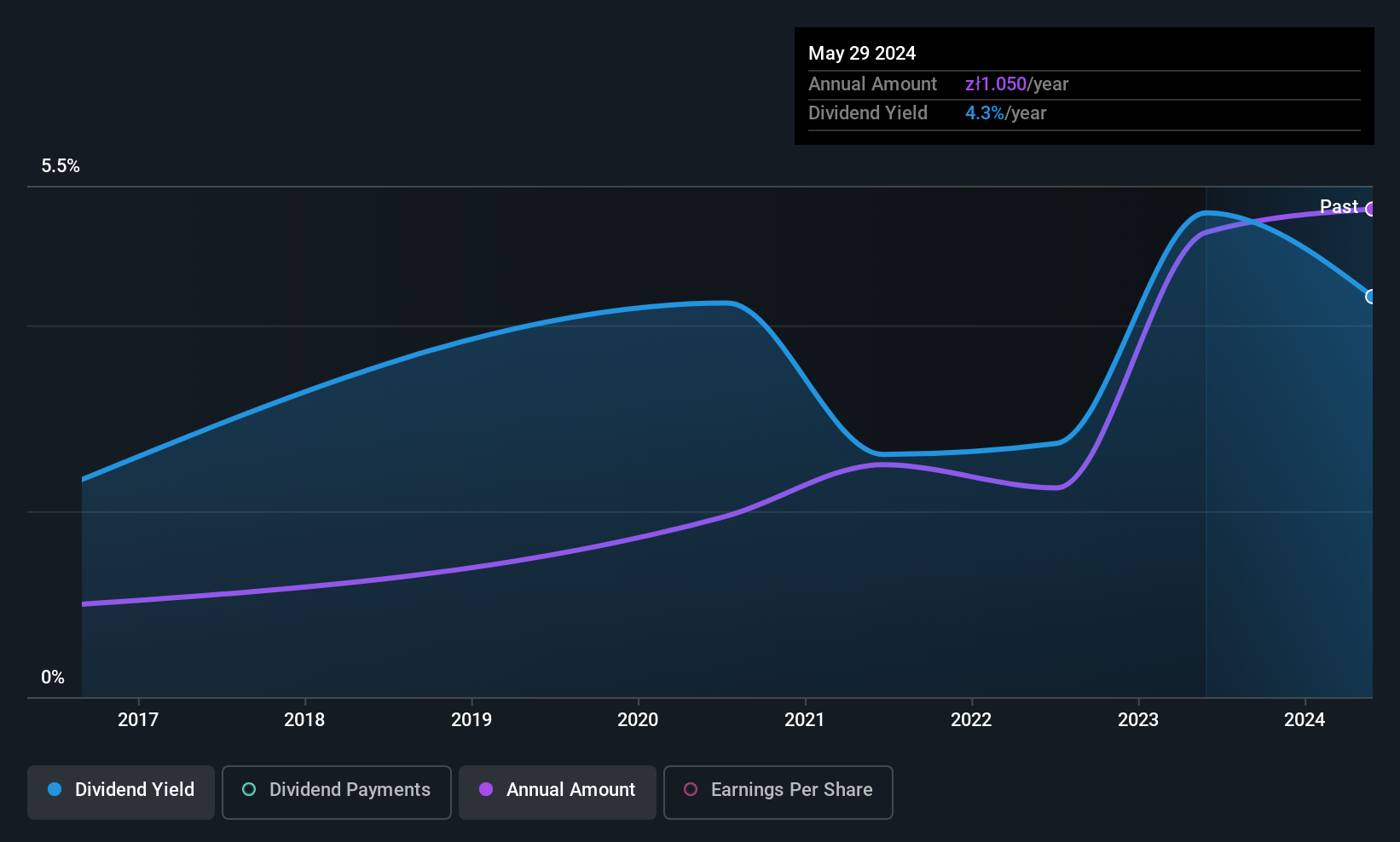

The company's next dividend payment will be zł1.30 per share. Last year, in total, the company distributed zł1.20 to shareholders. Calculating the last year's worth of payments shows that Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP has a trailing yield of 4.4% on the current share price of zł27.20. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP has been able to grow its dividends, or if the dividend might be cut.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. An unusually high payout ratio of 232% of its profit suggests something is happening other than the usual distribution of profits to shareholders. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 94% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want to look more closely here.

As Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

See our latest analysis for Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. With that in mind, we're discomforted by Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP's 23% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last nine years, Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP has lifted its dividend by approximately 22% a year on average. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP is already paying out 232% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

Final Takeaway

Has Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP got what it takes to maintain its dividend payments? Not only are earnings per share declining, but Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP is paying out an uncomfortably high percentage of both its earnings and cashflow to shareholders as dividends. This is a starkly negative combination that often suggests a dividend cut could be in the company's near future. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP. Be aware that Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP is showing 5 warning signs in our investment analysis, and 2 of those are a bit unpleasant...

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:KMP

Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP

Przedsiebiorstwo Produkcyjno - Handlowe KOMPAP S.A.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)