- Poland

- /

- Basic Materials

- /

- WSE:IZO

Some Shareholders Feeling Restless Over Izolacja Jarocin Spolka Akcyjna's (WSE:IZO) P/E Ratio

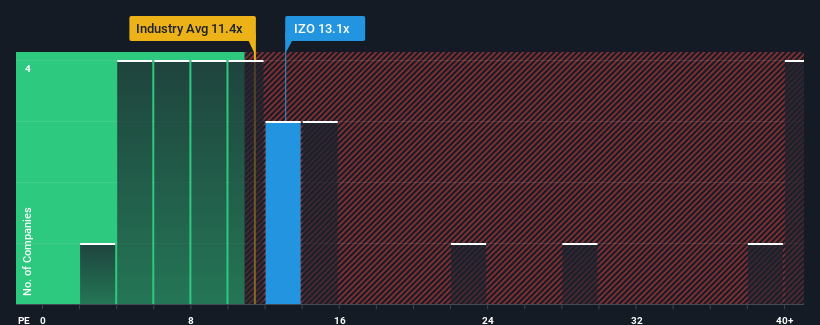

There wouldn't be many who think Izolacja Jarocin Spolka Akcyjna's (WSE:IZO) price-to-earnings (or "P/E") ratio of 13.1x is worth a mention when the median P/E in Poland is similar at about 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

For example, consider that Izolacja Jarocin Spolka Akcyjna's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Izolacja Jarocin Spolka Akcyjna

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Izolacja Jarocin Spolka Akcyjna would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 41%. As a result, earnings from three years ago have also fallen 39% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Izolacja Jarocin Spolka Akcyjna's P/E sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Bottom Line On Izolacja Jarocin Spolka Akcyjna's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Izolacja Jarocin Spolka Akcyjna currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Izolacja Jarocin Spolka Akcyjna (at least 1 which is potentially serious), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:IZO

Izolacja Jarocin Spolka Akcyjna

Manufactures and sells waterproofing and sealing products for the construction industry.

Flawless balance sheet and good value.

Market Insights

Community Narratives