- Poland

- /

- Basic Materials

- /

- WSE:IZO

Is Now The Time To Put Izolacja Jarocin Spolka Akcyjna (WSE:IZO) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Izolacja Jarocin Spolka Akcyjna (WSE:IZO). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Izolacja Jarocin Spolka Akcyjna

How Quickly Is Izolacja Jarocin Spolka Akcyjna Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Izolacja Jarocin Spolka Akcyjna has grown EPS by 51% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

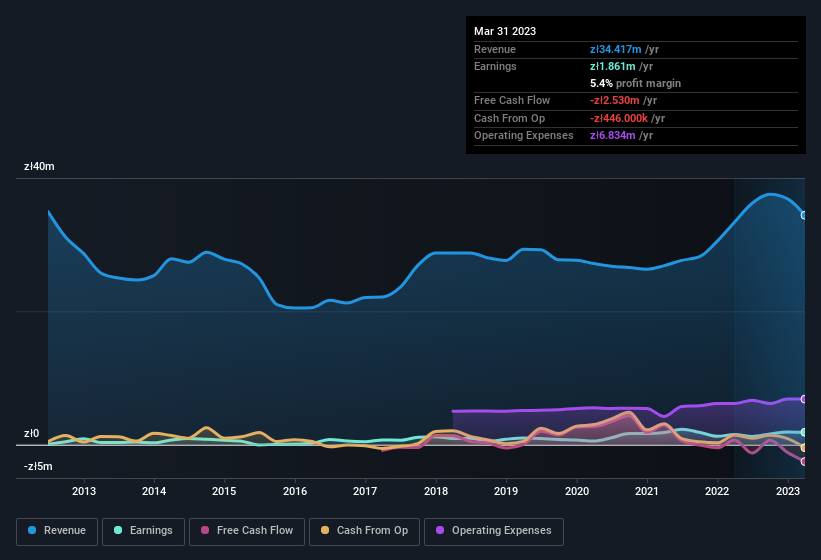

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Izolacja Jarocin Spolka Akcyjna is growing revenues, and EBIT margins improved by 2.1 percentage points to 7.5%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Izolacja Jarocin Spolka Akcyjna is no giant, with a market capitalisation of zł12m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Izolacja Jarocin Spolka Akcyjna Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Izolacja Jarocin Spolka Akcyjna insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 60%, company insiders are in control and have plenty of capital behind the venture. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Of course, Izolacja Jarocin Spolka Akcyjna is a very small company, with a market cap of only zł12m. So this large proportion of shares owned by insiders only amounts to zł7.5m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Izolacja Jarocin Spolka Akcyjna, with market caps under zł812m is around zł490k.

The Izolacja Jarocin Spolka Akcyjna CEO received zł247k in compensation for the year ending December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Izolacja Jarocin Spolka Akcyjna Deserve A Spot On Your Watchlist?

Izolacja Jarocin Spolka Akcyjna's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Izolacja Jarocin Spolka Akcyjna certainly ticks a few boxes, so we think it's probably well worth further consideration. You should always think about risks though. Case in point, we've spotted 3 warning signs for Izolacja Jarocin Spolka Akcyjna you should be aware of, and 2 of them make us uncomfortable.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:IZO

Izolacja Jarocin Spolka Akcyjna

Manufactures and sells waterproofing and sealing products for the construction industry.

Flawless balance sheet and fair value.