- Poland

- /

- Basic Materials

- /

- WSE:IZO

Here's Why I Think Izolacja Jarocin Spolka Akcyjna (WSE:IZO) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Izolacja Jarocin Spolka Akcyjna (WSE:IZO). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Izolacja Jarocin Spolka Akcyjna

How Quickly Is Izolacja Jarocin Spolka Akcyjna Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Izolacja Jarocin Spolka Akcyjna has grown EPS by 14% per year. That's a pretty good rate, if the company can sustain it.

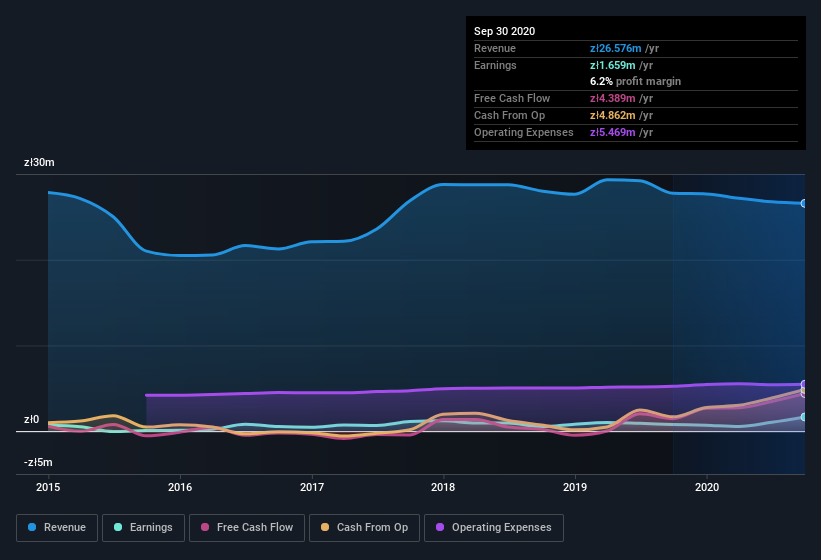

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Izolacja Jarocin Spolka Akcyjna's EBIT margins have actually improved by 3.8 percentage points in the last year, to reach 8.9%, but, on the flip side, revenue was down 4.2%. That's not ideal.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since Izolacja Jarocin Spolka Akcyjna is no giant, with a market capitalization of zł10.0m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Izolacja Jarocin Spolka Akcyjna Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Izolacja Jarocin Spolka Akcyjna insiders own a meaningful share of the business. In fact, they own 61% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only zł10.0m Izolacja Jarocin Spolka Akcyjna is really small for a listed company. That means insiders only have zł6.1m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations under zł820m, like Izolacja Jarocin Spolka Akcyjna, the median CEO pay is around zł517k.

The Izolacja Jarocin Spolka Akcyjna CEO received total compensation of just zł247k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Izolacja Jarocin Spolka Akcyjna Deserve A Spot On Your Watchlist?

One important encouraging feature of Izolacja Jarocin Spolka Akcyjna is that it is growing profits. The fact that EPS is growing is a genuine positive for Izolacja Jarocin Spolka Akcyjna, but the pretty picture gets better than that. Boasting both modest CEO pay and considerable insider ownership, I'd argue this one is worthy of the watchlist, at least. What about risks? Every company has them, and we've spotted 3 warning signs for Izolacja Jarocin Spolka Akcyjna you should know about.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Izolacja Jarocin Spolka Akcyjna, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:IZO

Izolacja Jarocin Spolka Akcyjna

Manufactures and sells waterproofing and sealing products for the construction industry.

Flawless balance sheet and good value.

Market Insights

Community Narratives