In the current European market landscape, smaller-cap stocks have been gaining traction as major indices like the STOXX Europe 600 Index rebound from previous losses, buoyed by positive sentiment following the European Central Bank's rate cuts and easing trade tensions. As investors seek opportunities in this environment, identifying companies with robust fundamentals and growth potential becomes essential for uncovering hidden gems.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

cBrain (CPSE:CBRAIN)

Simply Wall St Value Rating: ★★★★★☆

Overview: cBrain A/S is a software company that delivers software solutions to government, private, education, and non-profit sectors across Denmark, the European Union, and internationally with a market cap of DKK3.31 billion.

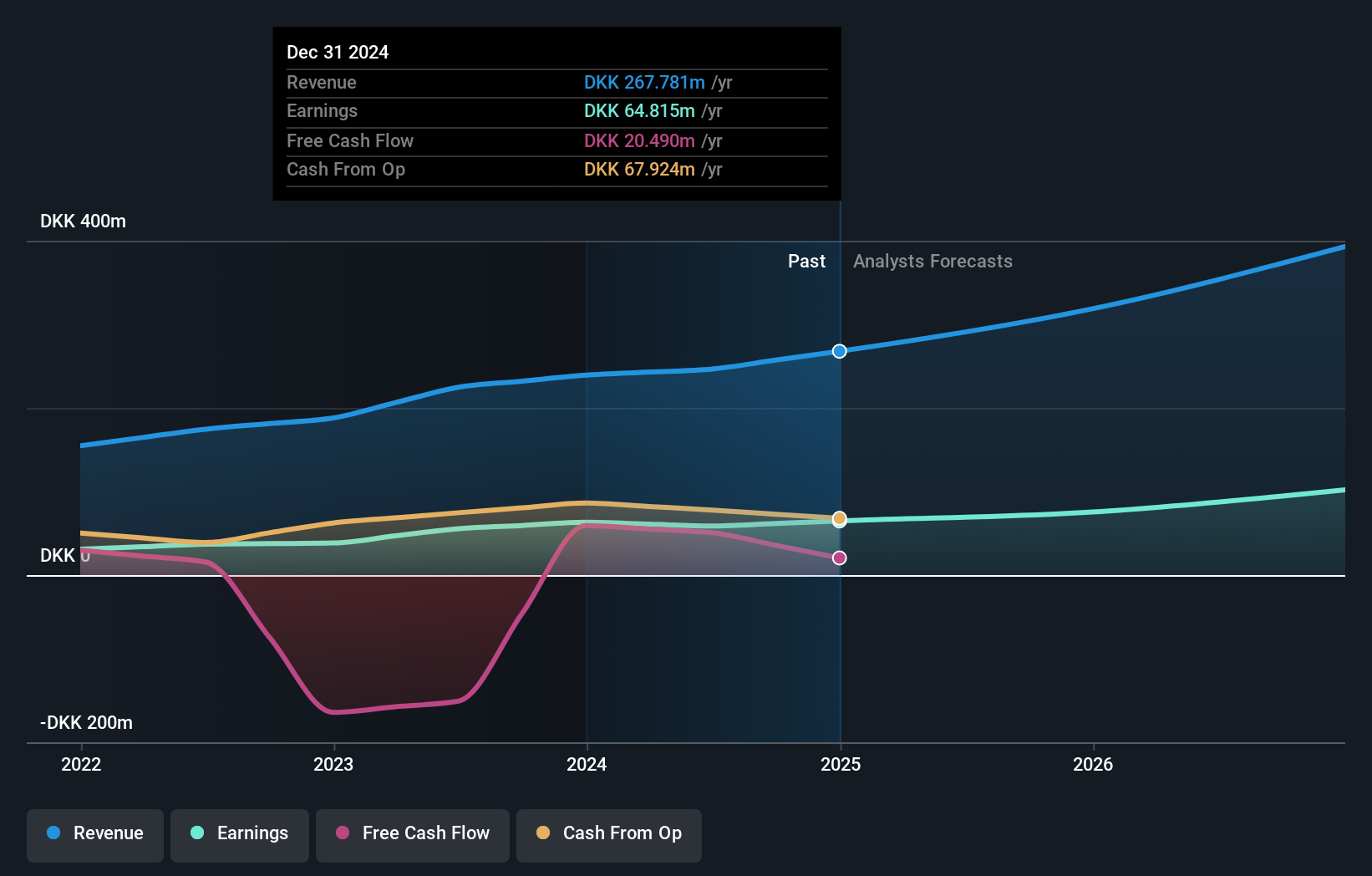

Operations: With a revenue of DKK267.78 million from its software and programming segment, cBrain A/S focuses on providing software solutions to various sectors across Denmark, the EU, and internationally.

cBrain, a small player in the software sector, has shown steady financial health with a net debt to equity ratio of 9.2%, indicating prudent leverage. Its interest payments are comfortably covered by EBIT at 37.5 times, reflecting robust earnings quality. Despite recent annual earnings growth of 2.6%, which trails the industry average of 8.9%, its five-year earnings growth stands at an impressive 34.4% annually. The company forecasts an upbeat future with expected revenue growth between 10-15% and EBT between 18-23% for 2025, alongside a dividend increase to DKK 0.64 per share payable soon.

- Click here and access our complete health analysis report to understand the dynamics of cBrain.

Gain insights into cBrain's historical performance by reviewing our past performance report.

Electrolux Professional (OM:EPRO B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Electrolux Professional AB (publ) provides food service, beverage, and laundry products and solutions to various sectors including restaurants, hotels, healthcare, educational institutions, and other service facilities with a market cap of SEK16.09 billion.

Operations: Electrolux Professional generates revenue primarily from its Food & Beverage segment, which accounts for SEK 7.59 billion, and its Laundry segment, contributing SEK 4.99 billion.

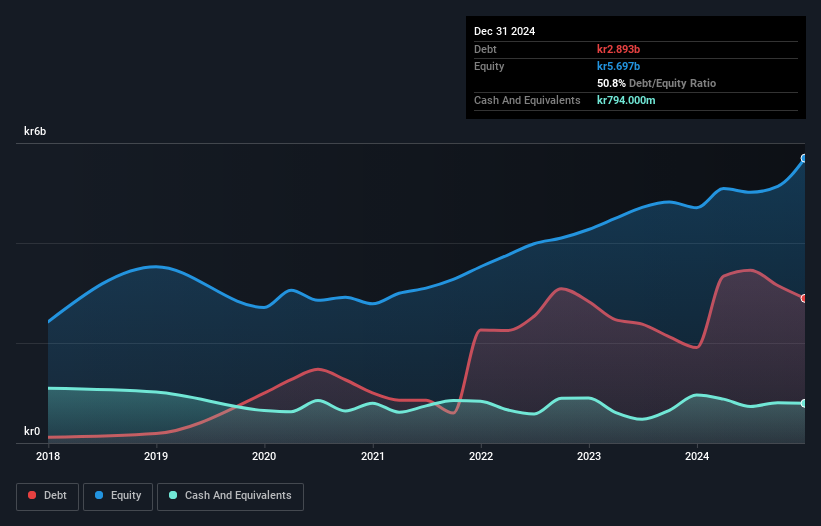

Electrolux Professional has been making waves with strategic shifts and innovative product launches. Over the past year, earnings grew by 3.6%, surpassing the Machinery industry average of 3.4%. The company's debt-to-equity ratio increased from 36.8% to 50.8% over five years, yet its interest payments are comfortably covered at a rate of 10 times EBIT. Trading at a significant discount to estimated fair value, Electrolux is introducing fully electric steamers aimed at reducing energy consumption and carbon emissions—a move that aligns with its sustainable growth strategy while targeting future revenue expansion through R&D investments and new products in late 2024 and beyond.

NEUCA (WSE:NEU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NEUCA S.A. is involved in the wholesale distribution of pharmaceuticals in Poland, with a market capitalization of PLN3.12 billion.

Operations: NEUCA generates revenue primarily through its wholesale distribution of pharmaceuticals in Poland. The company has a market capitalization of PLN3.12 billion.

NEUCA, a promising player in the European market, showcases high-quality earnings with a net debt to equity ratio of 29.1%, reflecting a solid financial position. The company's recent performance saw sales climb to PLN 12.61 billion from PLN 11.81 billion, while net income rose to PLN 154.24 million from PLN 146.27 million last year, indicating steady growth momentum. With basic earnings per share increasing to PLN 34.54 and trading at nearly 60% below its estimated fair value, NEUCA appears undervalued and poised for potential upside as it continues outpacing industry growth rates with robust future projections of earnings expansion at over 26% annually.

- Dive into the specifics of NEUCA here with our thorough health report.

Assess NEUCA's past performance with our detailed historical performance reports.

Next Steps

- Access the full spectrum of 356 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade cBrain, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives