- Poland

- /

- Healthcare Services

- /

- WSE:EMC

A Piece Of The Puzzle Missing From EMC Instytut Medyczny SA's (WSE:EMC) 50% Share Price Climb

EMC Instytut Medyczny SA (WSE:EMC) shareholders have had their patience rewarded with a 50% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 14% is also fairly reasonable.

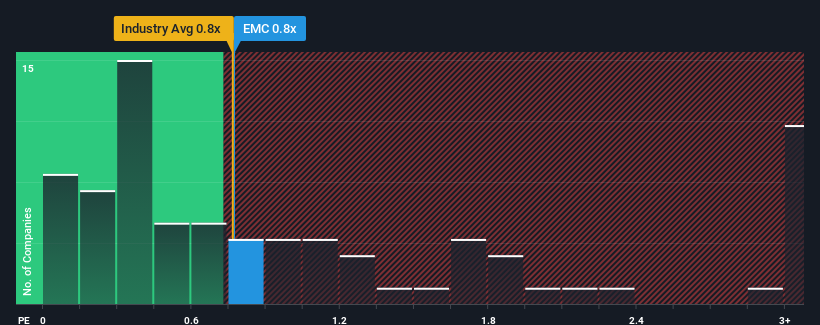

Even after such a large jump in price, given about half the companies operating in Poland's Healthcare industry have price-to-sales ratios (or "P/S") above 1.5x, you may still consider EMC Instytut Medyczny as an attractive investment with its 0.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for EMC Instytut Medyczny

What Does EMC Instytut Medyczny's P/S Mean For Shareholders?

EMC Instytut Medyczny has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on EMC Instytut Medyczny's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

EMC Instytut Medyczny's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 19%. The latest three year period has also seen an excellent 56% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 7.2% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that EMC Instytut Medyczny's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From EMC Instytut Medyczny's P/S?

The latest share price surge wasn't enough to lift EMC Instytut Medyczny's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Upon analysing the past data, we see it is unexpected that EMC Instytut Medyczny is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. Amidst challenging industry conditions, perhaps a key concern is whether the company can sustain its superior revenue growth trajectory. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with EMC Instytut Medyczny, and understanding should be part of your investment process.

If you're unsure about the strength of EMC Instytut Medyczny's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if EMC Instytut Medyczny might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:EMC

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives