Ignoring the stock price of a company, what are the underlying trends that tell us a business is past the growth phase? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. Having said that, after a brief look, Lubelski Wegiel Bogdanka (WSE:LWB) we aren't filled with optimism, but let's investigate further.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Lubelski Wegiel Bogdanka:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.021 = zł84m ÷ (zł4.4b - zł434m) (Based on the trailing twelve months to September 2020).

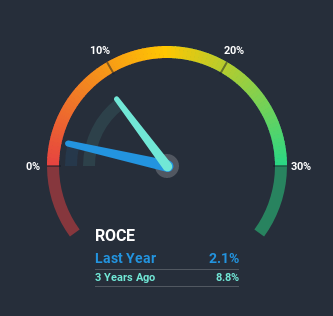

Therefore, Lubelski Wegiel Bogdanka has an ROCE of 2.1%. Ultimately, that's a low return and it under-performs the Oil and Gas industry average of 6.7%.

Check out our latest analysis for Lubelski Wegiel Bogdanka

Above you can see how the current ROCE for Lubelski Wegiel Bogdanka compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

What Does the ROCE Trend For Lubelski Wegiel Bogdanka Tell Us?

In terms of Lubelski Wegiel Bogdanka's historical ROCE movements, the trend doesn't inspire confidence. To be more specific, the ROCE was 8.3% five years ago, but since then it has dropped noticeably. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. So because these trends aren't typically conducive to creating a multi-bagger, we wouldn't hold our breath on Lubelski Wegiel Bogdanka becoming one if things continue as they have.

What We Can Learn From Lubelski Wegiel Bogdanka's ROCE

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. It should come as no surprise then that the stock has fallen 38% over the last five years, so it looks like investors are recognizing these changes. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

On a final note, we've found 2 warning signs for Lubelski Wegiel Bogdanka that we think you should be aware of.

While Lubelski Wegiel Bogdanka may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you decide to trade Lubelski Wegiel Bogdanka, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:LWB

Lubelski Wegiel Bogdanka

Engages in the hard coal mining business in Poland.

Flawless balance sheet and good value.